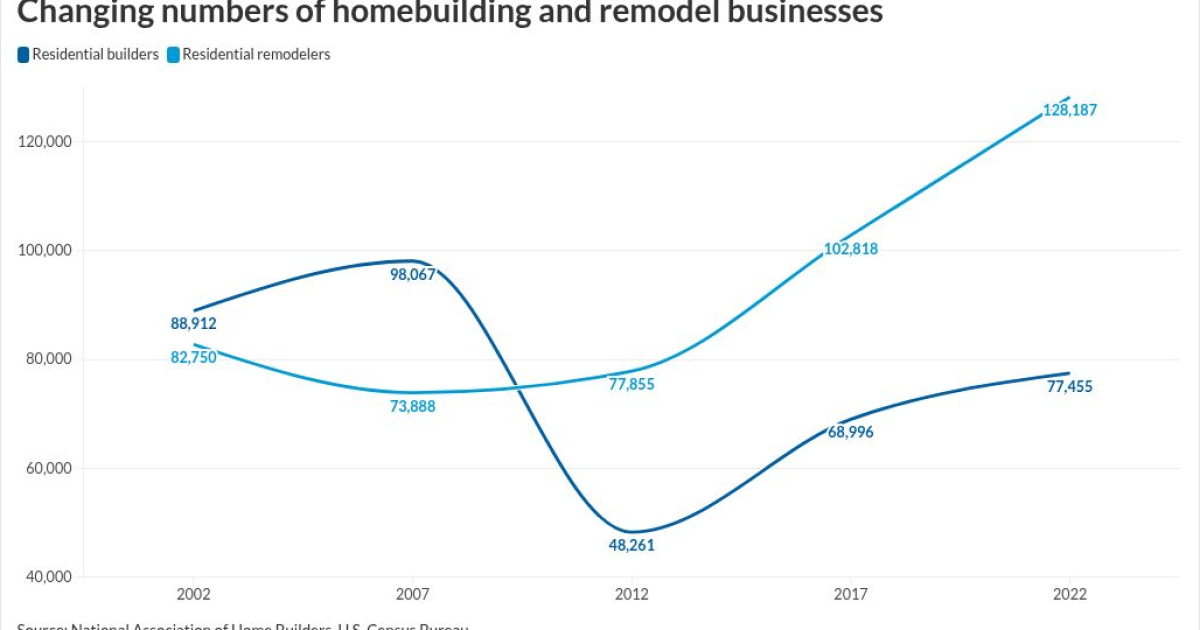

The number of residential remodeling businesses hit a record-high earlier this decade, with the pace of their growth more than doubling that of builders.

Total remodeling enterprises came in at 128,187 at the close of 2022, according to

Business census data is tracked in five-year intervals, and the pace of remodeling company growth surged 24.6% from 2017. The rate exceeded the 12.3% pace of single- and multifamily homebuilders.

The remodeling segment made up approximately 62% of all home construction establishments by the end of 2022, with builders accounting for 38%. The last time homebuilders predominated was 2007, at the beginning of the Great Financial Crisis, when they comprised 57% of the market.

In the subsequent 15 years, the number of remodeling companies has since grown by 73.4%, while the number of builders shrank by 21%.

What the data may mean for home finance

With a post-GFC pullback in building acknowledged as

While many may choose to remodel rather than relocate due to the limited supply of available properties in their chosen communities, demand for renovation work is also being driven by older homeowners, who

The most recent business census data period also came to a close just as the mortgage lock-in effect took hold in 2022. After a sudden spike that year, 30-year rates currently stand almost

In the latest Harvard Joint Center for Housing Studies' indicator for remodeling activity, researchers see spending on owner-occupied home renovation and repair climbing up 2.4% early this year, and easing to 1.9% in the third quarter.

"Upward trends in both remodeling permit activity and single-family home sales suggest that demand for home improvement will remain stable in the coming year," Rachel Bogardus Drew, director of the Remodeling Futures Program at the center, said recently in a press release.

"Despite the modest pace, total homeowner remodeling spending is expected to reach $524 billion in early 2026, a new record high," she said.

Changes in homeowner behavior and sentiment helped to bring a noticeable

At the same time, though, MBA also noted that the share of home equity loans used for renovations had fallen between 2022 and 2024 from approximately 66% to 46%.