The ever-growing amount of equity seniors hold in their current homes is likely contributing to another phenomenon, as more owners are passing their property onto their heirs, who are keeping it as a place to live.

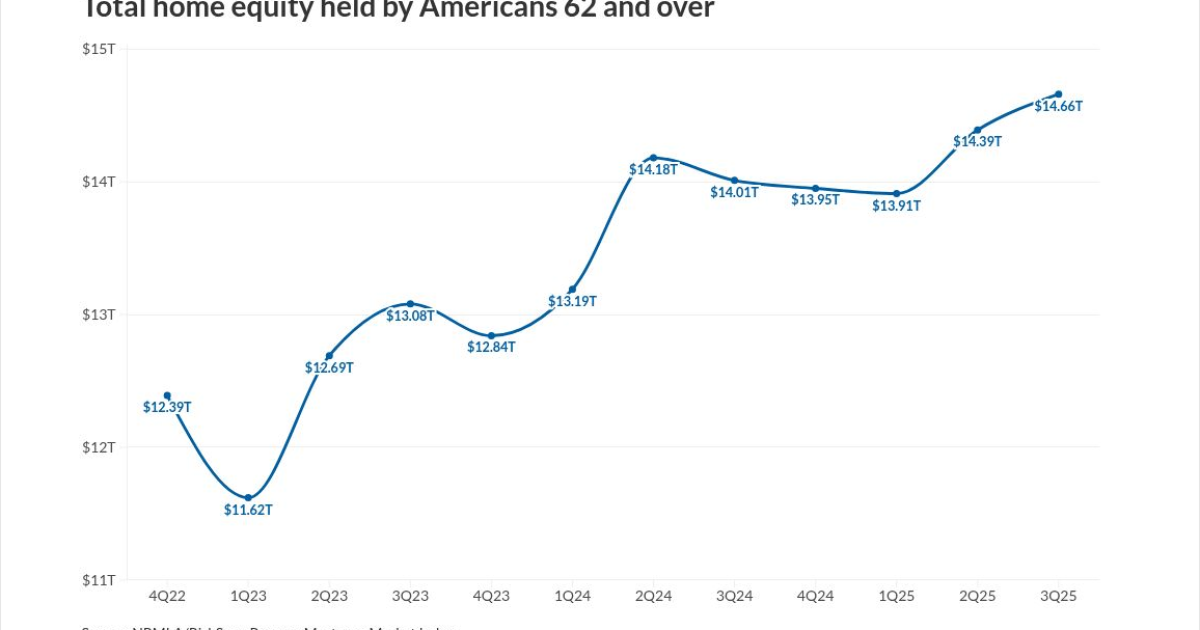

Americans 62 and older as a group now hold $14.66 trillion of total equity as of the end of the third quarter of 2025, the National Reverse Mortgage Lenders Association said. This compared with

Senior home equity growing again

This is the second consecutive period that collective equity has increased, following three quarters of decline following its last peak in the second quarter of 2024.

The NRMLA/Riskspan Reverse Mortgage Market Index reached an all-time high as of Sept. 30, 2025, at 511.99, compared with 502.47 three months prior and

This quarter-to-quarter change was driven by an estimated 2% rise in home values, which added approximately $295.4 billion in equity. But it was partially offset by a 1% increase in mortgage debt held by seniors, to $22.8 billion.

The latest report "underscores the extraordinary level of housing wealth held by older Americans," said Steve Irwin, president of NRMLA, in a press release.

Irwin says this equity is an underutilized tool for retirement planning and financial security.

Growing number of properties being inherited

But what if that equity is being used to pass on wealth?

Last year, inherited homes reached a record 7% of all U.S. property transfers, a study from Cotality found.

If this trend continued, the much-ballyhooed "silver tsunami," is more likely to be a soft, rolling wave.

The possibility of an overwhelming amount of homes hitting the market in a 20-year period was raised in

But in 2024, a Leaf Homes/Morning Consult study found that almost three quarters of baby boomers, 73%,

Cotality said its own examination of the data confirms this hypothesis. Aging in place is delaying when the property enters the for sale market.

Property transfers from inheritances set record

Looking at its own property database, a record 340,000 homes were transferred through inheritance in the 12 months ending in August 2025, Cotality found.

While some of those inherited homes do find their way onto the for sale market, others are being kept within the family.

This is not necessarily something new. The issue of tangled titles/heirs property comes when a family

In California, the tax system rewards families keeping homes, easing the transfer to heirs. Nearly 60,000 properties were inherited in 2025 in the state, accounting for 18% of all property transfers.

This is more than twice the number of new homes sold in the state, Cotality claimed.

In California, property tax increases over 2% per year are prohibited, regardless of the change in the market value of the home. This is inherited by children and grandchildren on the first $1 million of the inherited real estate's value if the property is used as a primary residence and continuously lived in.

"Aging in place slows the natural cycle of downsizing, moving in with family, and ultimately passing homes to the next generation," the Cotality report said. "This delays the long-predicted wave of housing supply from arriving on the open market, and in many cases, those homes will skip the open market entirely."

As a result, policy makers cannot count on "demographic destiny" to increase the supply of homes for sale.

"While inheritance can be a lifeline for some families coping with historically high housing costs, those waiting on inheritances to rebalance supply and demand are likely to be left out in the cold," the report said. "If America wants supply,