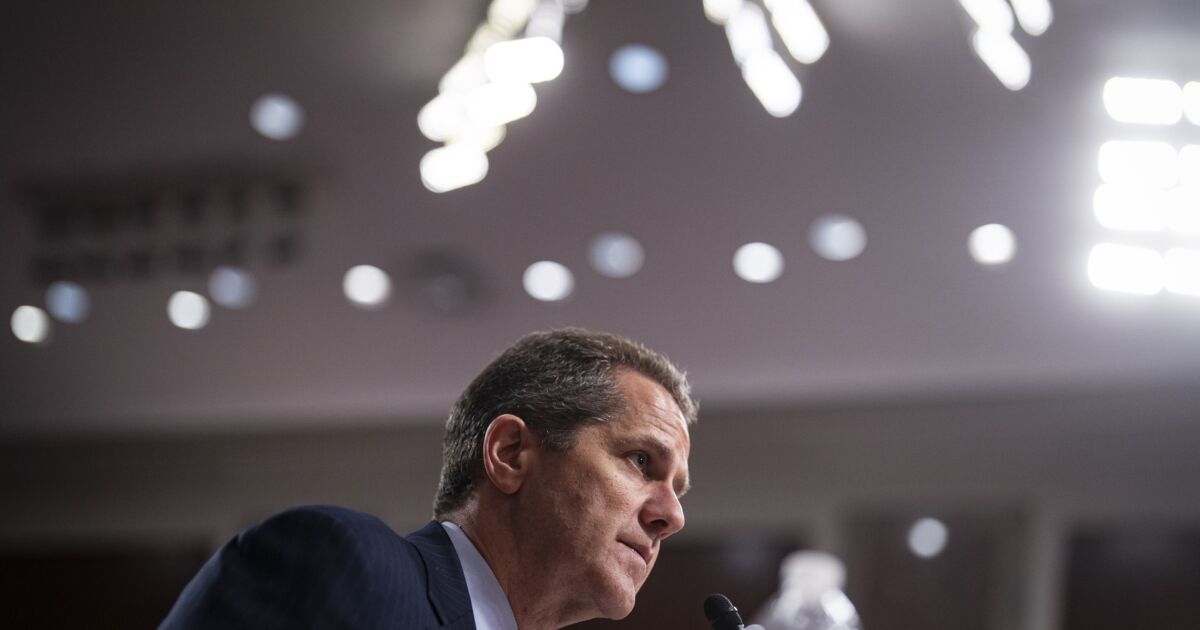

Federal Reserve Vice Chair for Supervision Michael Barr said Friday that the recent overhaul of the implementing regulations of the Community Reinvestment Act will prove well considered and durable, and will ultimately "stand the test of time."

Speaking at an event at the National Press Club sponsored by the National Housing Conference, Barr acknowledged that there were objections to the final rule from banks and community groups. However, there was enough flexibility baked into the regulation that the finished product will likely not require another rulemaking for some time nor be subject to reconsideration under a new presidential administration, he said.

"Not everybody loves every piece of it — any rule involves compromise, involves adjustment," Barr said. "But I think the rule is going to be a really durable rule. I think that the rule that we have put in place will last many, many years. It's designed to be flexible. It's designed to be able to adjust as the financial services sector adjusts. It's a balanced rule. It's a reasonable rule. We heard lots of feedback in the comment process. We took that feedback on board. There are lots of changes between the initial proposal and the final rule, and I think that it's an approach that is going to really stand the test of time."

Barr also acknowledged that the CRA revamp does not explicitly account for the racial background of potential borrowers as some community advocates had sought, but he said that the law exists in tandem with, and takes into account, other fair-lending laws in a way that is meant to penalize banks for discriminatory behavior. He also said the provisions making loans originated by special-purpose credit programs like community development financial institutions and minority depository institutions automatically CRA-eligible will go a long way toward spurring development in underserved communities.

"Special-purpose credit programs, I think, are really essential ways that banks have developed strategies to help make sure that they're serving their entire community, including minority communities," Barr said. "And so we strongly encourage banks to set up special-purpose credit programs — I think they're really good and valuable ways for banks to serve their entire community. And they are permissible — they're encouraged, under the Equal Credit Opportunity Act."

The Community Reinvestment Act was enacted in 1977 and requires banks to extend credit, investments and services to all communities within its service area — not just the most affluent and therefore profitable communities. But the CRA's definition of service area has traditionally been linked to a bank's branch network, even as more banking services are performed digitally. Banks and community groups have long agreed that various aspects of the CRA implementation rules are out of date.

Former Comptroller of the Currency Joseph Otting made CRA reform the centerpiece of his tenure during the Trump administration but faced opposition from community advocacy organizations and fellow regulators. The Fed, OCC and Federal Deposit Insurance Corp. issued a revised CRA implementation rule in May 2022 that initially met with positive feedback from banks and community organizations; banks later cooled on the measure.

One of the central criticisms from banks about the prior iteration of the CRA — and one that was central to Otting's version of CRA reform — was the lack of certainty about whether a prospective loan or development would qualify for CRA credit. Barr said that the inclusion of a list of representative cases and projects that qualify for CRA credit is a major innovation, and the agencies are going to work through the implementation period to develop online applications that will make eligibility that much more transparent.

"I do think it's important for banks to have that kind of certainty. As you said, CRA officers need to know that this deal is going to count, and it's also important for communities to be able to come to a bank and say, 'I've got a deal, it's a qualifying CRA deal, I need your help.' And so that kind of clarity is really important," Barr said. "We're going to be developing tools, online tools for banks, online tools for communities, online tools for us as regulators, and we want to make sure those tools are effective and that they work and that they're giving banks and communities what they need in order to do their jobs in order to be effective."

Barr added that the inclusion of a retail-lending assessment for banks that may take mobile deposits from an area without having a physical branch is another critical innovation in the CRA rule that corrects for a significant blind spot in the preexisting regulation. Banks will also be able to get community development credit nationwide, so they can undertake bona fide CRA-eligible projects where they might do the most good, not just in the places where they have physical presences.

"That's designed to make sure that we don't have banking deserts on community development activities," Barr said. "So you can really see the opportunity for banks to serve the whole country with their community development engaged."

The final rule will be fully implemented on Jan. 1, 2026.