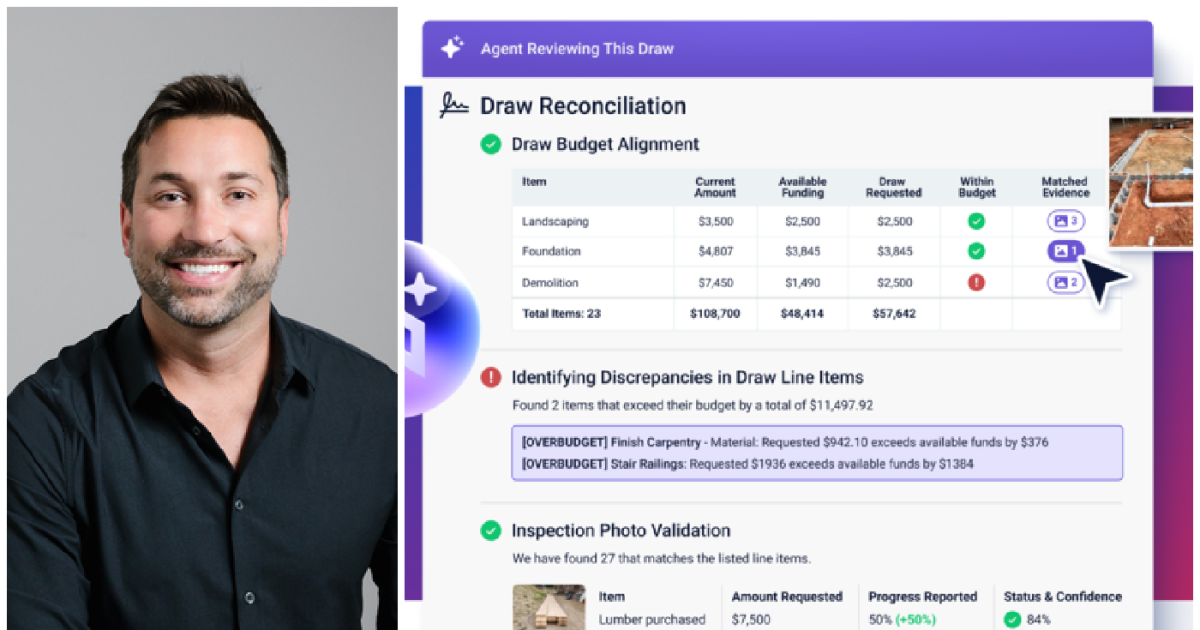

Agentic AI is moving from hype to real use cases in financial services, and Built is staking its claim in the space. The construction finance tech firm on Tuesday launched Draw Agent, an AI tool designed to speed and simplify construction loan draw reviews, one of the most time-intensive workflows in the lending process.

"AI promises have long outpaced outcomes for the more complex aspects of real estate finance," said Chase Gilbert, cofounder and CEO of Built, in a press release. "With Draw Agent, we've given lenders the ability to move beyond simple task automation or document parsing to true workflow intelligence when managing construction loans — where policies are enforced consistently, risks are surfaced proactively, and funds move faster so projects stay on track."

The announcement comes a week after Wells Fargo

This is the first in a series of specialized agents Built will launch in the coming year. The company plans to release agents steadily every quarter, looking to streamline onboarding, deal evaluation, portfolio management and other administrative tasks, Gilbert told National Mortgage News.

Built started with draw loans because of the critical mass and complex workflow associated. If the company could succeed with one of the most difficult processes in real estate finance, it would win the trust of its customers.

"When they see it, they can't unsee it. ... It is better, faster and cheaper," Gilbert said. "We're so confident, we just want people to try it, no strings attached. ... If we can build trust with financial institutions on a very complex workflow, then we want to earn the right for them to trust us to solve other problems."

Draw Agent promises to speed up the payment process, to improve risk management and to increase efficiency by moving from manual review to AI. The tool has shown up to 95% time-on-task improvement, with reviews completed in as few as three minutes, up to 60% acceleration in draw turn time from borrower request to funding and a 400% increase in risks detected versus human-led reviews, the company said.

"Draw Agent has fundamentally changed the rhythm of construction lending for us," said Randy Stewart, executive vice president of Enterprise Mortgage Lending at Zions Bancorporation, in the release. "What once took hours of manual review now happens in minutes with greater consistency, transparency, and control. It is not just faster; it is smarter, freeing our teams to focus on higher value decisions while the agent enforces every policy with precision."

Draw Agent is powered by the MightyBot Agentic AI Platform, which allows lenders to choose their ideal level, such as audit mode, which reviews and recommends actions for human approval, assist mode, which handles routine steps but staff still make final decisions, and automate mode, which fully executes when policies are met.

"People could dip their toe in the water, and as they get comfortable, allow AI to do more for them," Gilbert said.

Every decision the tool makes is informed by the complete context of the project, including the loan agreement, construction plans and budget and inspection photos and reports. The agent has a level of understanding and context that no human is capable of, Gilbert said.

"With Draw Agent, Built has demonstrated that end-to-end autonomy with rigorous controls isn't just possible — it's here, live in production, and already delivering measurable results," the company wrote in the release.