Institutional investors modestly expanded their share of single-family home purchases in December, complicating President Donald Trump's

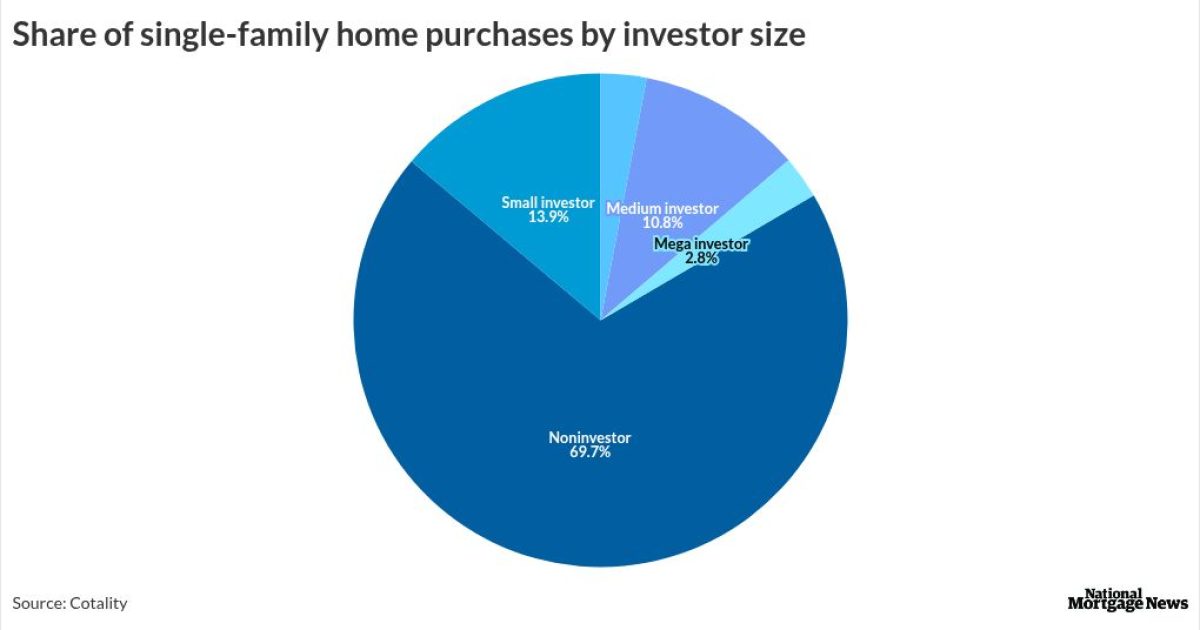

Large investors, those that own between 100-999 properties, accounted for 3% of all single family-home purchases and mega investors, 1,000 or more properties, totaled a 2.8% share in December, up from 2.5% and 2.3% respectively at the same time last year, according to Cotality's latest update on investor activity in the housing market.

Overall, investors made up 30.3% of purchases, the same level as the year prior. Small investors, with less than 10 properties, saw their share decline to 13.9% from 15.2%, while medium investors, between 10-99 properties, grew their share to 10.8% from 10.5%.

"Fewer first-time homebuyers mean more people are staying in the rental market, and investors are responding to that demand," said Thom Malone, principal economist at Cotality, in a press release. "The current landscape differs significantly from the pandemic-era surge, which was fueled by rapid price appreciation. Now, while real estate is no longer the 'hottest' asset, strong rental demand and the ability to secure acquisitions below list price are keeping investors engaged even as traditional buyers retreat."

While affordability hit its

Looking to make homes more affordable, Trump called for a ban on institutional investors from purchasing single-family homes early this year.

"People live in homes, not corporations," he said in a social media post.

If the ban forbids a single investor from owning more than 1% of the market, there will be relatively no impact. But if a 1,000-home cap is placed on investors, for example, then the industry would see a halt of equity going into it, which isn't much as is, said Jake Keating, cofounder and partner at Backyard Ventures and former head of investments and strategy at Promise Homes.

"This is a lot of political posturing," he said. "Trump ... and the administration is really focused on the lack of affordability throughout the country in various sectors of the economy, and housing is obviously one of them where there's been this very easy narrative about the big, bad institutional [single-family residential] investor, when in reality they only own ... 3%-5% of that market."

Investor market share is expected to remain constant in the near future, with a projected seasonal dip toward 25% as owner-occupied activity typically grows in the summer. The long-term outlook relies on interest rates, as a dip could decrease investor share, but as is, owner-occupied demand is unlikely to rebound much, the release said.