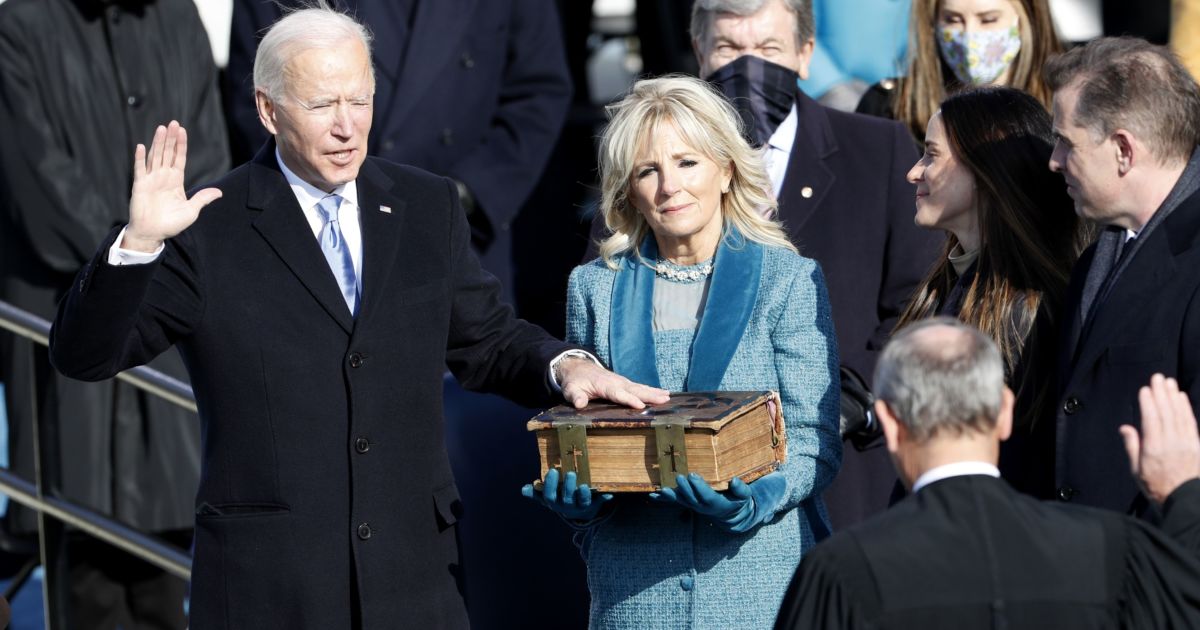

WASHINGTON — Joe Biden, who was sworn in as president Wednesday, faces an array of difficult decisions on financial policy, including what kind of fiscal stimulus is needed to jumpstart an economy ravaged by the coronavirus pandemic.

Although Biden has a number of executive orders planned and nominees awaiting confirmation in the Senate, his administration is not expected to move quickly to overturn some of the financial deregulation the banking industry has enjoyed during the four years of the Trump administration.

Instead, he is expected to focus on the COVID-19 pandemic, with an ambitious stimulus package that includes aid to small businesses.

But in the not-too-distant future the administration faces personnel and policy decisions concerning the housing finance system, the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau.

Here are the major financial policy issues Biden will have to address at the beginning of his term: