Late-year interest rates drove mortgage prepayment speeds back upward in December, as homeowners sought to capitalize through refinances, according to Intercontinental Exchange.

Prepayments increased to a 0.91% share of current liens, surging almost 10% from November's pace, ICE Mortgage Technology's monthly First Look report said. December's rate was up by more than 59% year over year, as homeowners responded to gradual, but mostly consistent,

"December's numbers show that lower interest rates drove refinance activity and prepayments to near multiyear highs," said Andy Walden, ICE's head of mortgage and housing market research, in a press release.

Prepayments accelerated back up to approach

ICE'S data points to continued growth of refinance opportunities if interest rates manage to sustain their downward momentum. At current levels, the pool of borrowers who could save at least 75 basis points

Borrowers accordingly took advantage throughout December providing a pipeline of refinance applications that

Delinquencies and foreclosures by the numbers

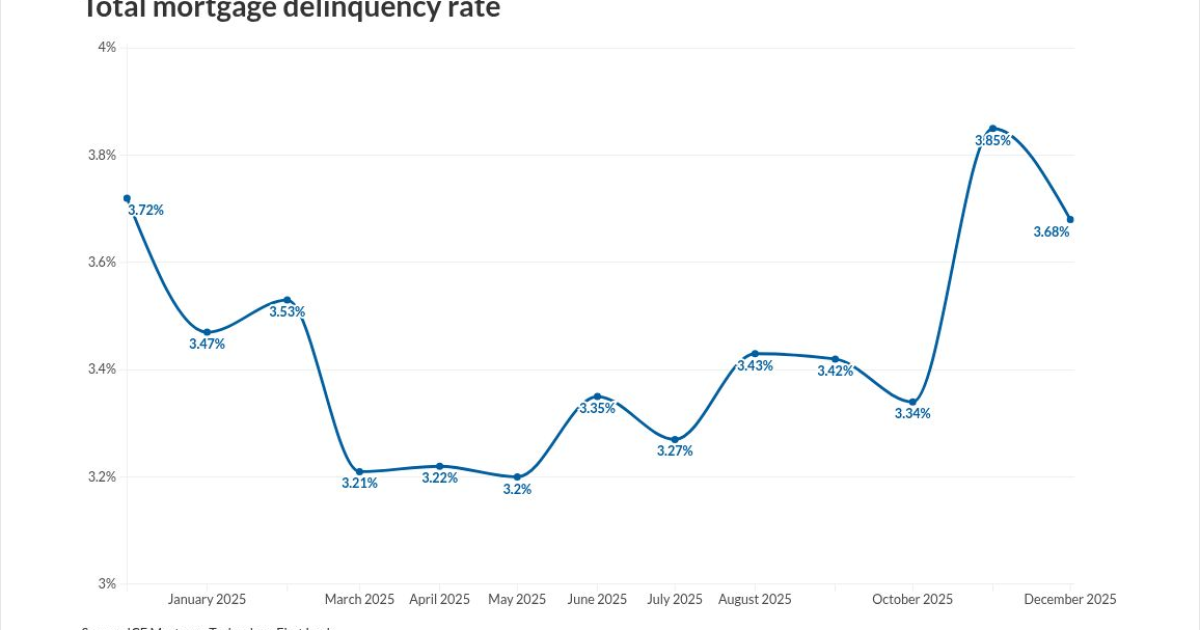

While some homeowners are able to benefit from recent economic trends, delinquencies and foreclosure numbers, in contrast, sent mixed messages about today's mortgage borrowers, with current market conditions appearing to pose ongoing financial obstacles for certain segments.

"There was a divergence in delinquency trends, with early-stage delinquencies improving and late-stage delinquencies continuing to rise," Walden said.

Early-stage delinquent mortgages equaled 2.03 million, dropping from 2.11 million in November but representing a marginal increase from 2.02 million a year earlier, according to the report.

On the other end, though, loans past due by 90 days or more surged to finish December at a two-year high of 560,000, rising from 530,000 in November and 541,000 one year prior.

The overall delinquency rate, consisting of loans past due by 30 days or more but not yet in foreclosure, pulled back to 3.68%, falling from both prior month and year levels by 4.2% and 0.93%.

Foreclosure activity also increased with a notable spike coming from Federal Housing Administration and Department of Veterans Affairs-backed loans, Walden added.

The current volume of loans in active foreclosure status reached its highest level in almost three years, as a 59% year-over year jump in FHA foreclosures pushed up numbers. Earlier in 2025, weakness in the FHA borrower segment was a primary factor behind delinquency activity even as the housing market showed overall resiliency,

While activity is still muted when compared to historical standards, foreclosure starts, inventory and sales all picked up in December both monthly and year over year.

Starts numbered 40,000, up by almost 54% from November and 27.8% in December 2024. Foreclosure sales totaled 7,100, representing increases of 6.7% from the prior month and 40.8% a year earlier.

Pre-sale foreclosure inventory increased to 239,000 units, climbing up from 226,000 and 192,000 on a month-over-month and yearly basis.

States with the highest rate of vulnerable homeowners were clustered in the Southeast, as Mississippi posted the greatest share of 90-plus-day delinquencies at 2.41%. It was followed by Louisiana and Alabama at 2.26% and 1.82%, respectively.

On the other hand, states seeing the greatest rise in their rates of noncurrent mortgages were spread throughout the country. Maryland, which was among the states most