The busiest week for purchases in almost two months was offset by a slower pace of refinancing, leading to a week-over-week decrease in mortgage activity in the last full week of August.

The Mortgage Bankers Association Market Composite Index, a weekly measure of loan applications based on surveys of MBA members, dipped 2.4% on a seasonally adjusted basis for the weekly period ending August 27, while the unadjusted index decreased 3% from the prior week’s levels. The week’s seasonally adjusted loan volume was 4.7% below numbers recorded in the same period last year.

The composite index came in lower for the week, despite an uptick in purchase applications, with the Purchase Index inching up 1% on a seasonally adjusted basis. The unadjusted purchase volume dropped by 2% from one week earlier and was 16% lower than the same week a year ago. Although the increase was small, it signaled a turnaround from the pace a month ago when the index dropped to its lowest point in over a year.

“Even with a slight increase, purchase activity hit its highest level since early July, as applications for conventional and government loans increased,” Joel Kan, MBA’s associate vice president of economic and industry forecasting, said in a press statement.

Refinances declined, though, pulling the composite index downward. The Refinance Index posted a 4% decrease week-over-week, but was up 2% from volumes seen during the same week a year ago.

”Despite low rates, refinance applications declined, with some borrowers still waiting for rates to drop even lower,” Kan said. “Recent uncertainty around the economy and pandemic have kept rates low over the past month, which is why the Refinance Index has oscillated around these levels.”

Refinances also accounted for a smaller share of overall activity — reflecting both its slowing pace and recent renewed interest in purchases — coming at 66.8%, down from 67.8% a week earlier.

The share of adjustable-rate mortgages climbed to 3.2% of total volume, up from 3.1% the previous week.

Average loan sizes increaseWhile volumes dropped, the average dollar amount of new mortgage applications grew on a weekly basis for both purchases and refinances. Average purchase size climbed 1% to its highest mark in five weeks, up to $396,500 from $392,400, while the mean refinance amount expanded to $305,800 from $304,600 the prior week, a 0.4% gain. Among applications overall, average size increased 0.8% to $335,900 from $333,300.

Higher average purchase amounts indicate that home-buying activity continues to be dominated by higher price tiers of the market, according to Kan. The latest numbers from the Federal Housing Finance Agency show a 17.4% spike in home prices between the first and second quarters this year. In June, prices were up 18.8% compared to a year ago.

“Both measures set new records, as housing demand continued to outpace the inventory of homes for sale,” Kan said.

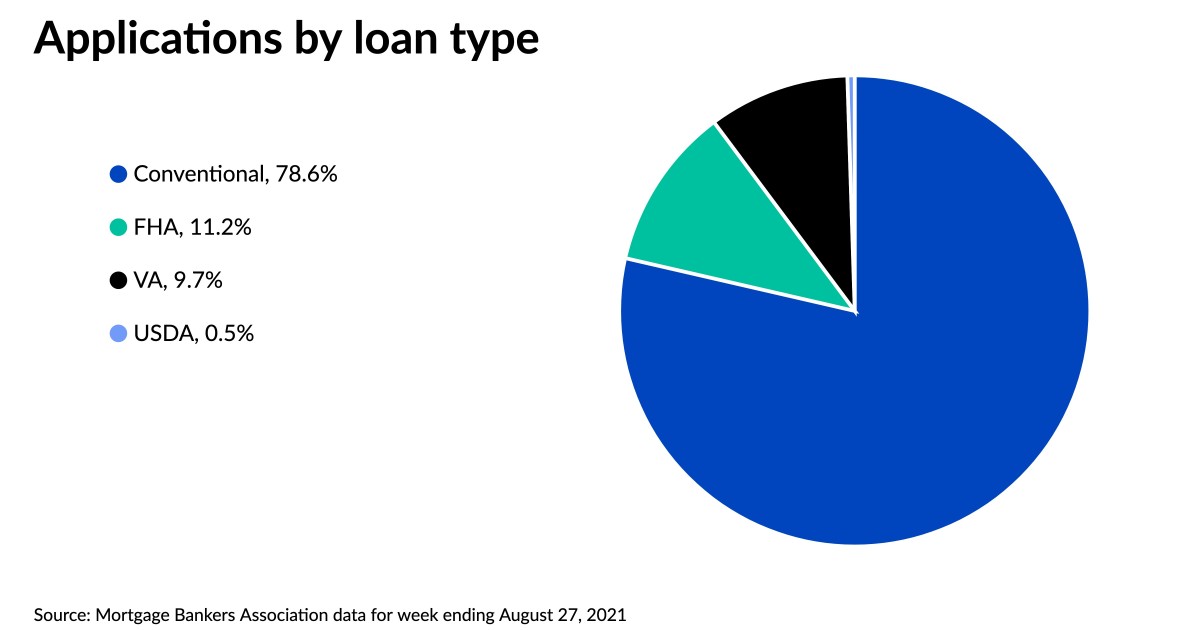

The share of applications taken through government-sponsored agencies in recent weeks, though, provide some hope that more affordable homes are slowly becoming available. The share of loans backed by the Federal Housing Administration continued to grow, accounting for 11.2% of overall volume, up from 11% the previous week. Veterans Administration-backed applications dropped from the prior reporting period, though, falling to 9.7% from 10%. The share of mortgages taken through the U.S. Department of Agriculture’s programs edged higher to 0.5% from 0.4% a week earlier.

Interest rates show little changeAs the pandemic and its economic impact remained in the headlines, interest rates saw little movement in either direction.

- The average contract interest rate of 30-year fixed-rate mortgages with conforming loan balances of $548,250 or less remained at 3.03% on a week-over-week basis.

- The average contract interest rate of 30-year fixed-rate jumbo loans with balances greater than $548,250 also was unchanged, staying at 3.13%.

- The average contract interest rate of FHA-backed 30-year mortgages edged down a single basis point to 3.09% from 3.1% a week prior.

- The average contract interest rate of 15-year fixed-rate mortgages climbed to 2.39%, up one basis point from 2.38% a week earlier.

- The average contract interest rate for 5/1 adjustable-rate mortgages climbed 12 basis points to 2.8%, compared to the previous week’s 2.68%.