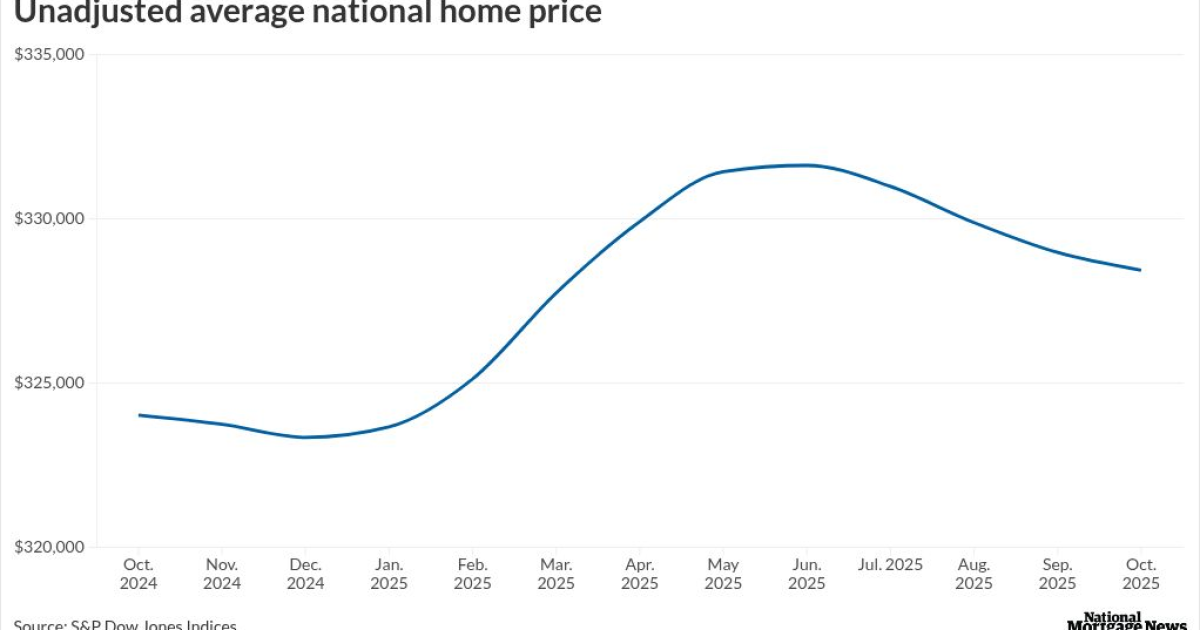

National home-price growth is slowing as 2025 comes to an end, while economists anticipate

The Federal Housing Finance Agency's index increased 0.4% in October on a seasonally-adjusted monthly basis and 1.7% from a year ago. Prices jumped 1.3% monthly and 1.4% annually on an unadjusted basis in October, according to the S&P Cotality Case-Shiller's national index.

"October's data show the housing market settling into a much slower gear, with the National Composite Index up only about 1.4% year over year – among the weakest performances since mid-2023," said Nicholas Godec, head of fixed income tradables and commodities at S&P Dow Jones Indices, in a press release Tuesday.

October's annual gain is just slightly above September's 1.3% and far below the 5.1% average home price increase recorded in 2024, he said. Home prices decreased by 0.1% from August to September as well, according to the FHFA.

"National home prices also continue to lag consumer inflation," Godec said, noting that October's provisional Consumer Price Index during the government shutdown at the time was around 3.1%. This outpaced inflation-adjusted housing values over the past year.

First American also expects income growth to exceed house-price appreciation next year,

Regional home-price growth

For the nine census divisions the FHFA tracks, home-price changes ranged from -0.4% in the East South Central division to 1% in the West South Central division on a seasonally-adjusted monthly basis. The annual changes ranged from -0.7% in the West South Central division to 5.3% in the Middle Atlantic division, the FHFA report found.

Among major metro areas, Chicago led all with a 5.8% annual price gain, followed by New York at 5.0% and Cleveland at 4.1%. Home prices fell 4.2% year over year in Tampa, marking its 12th consecutive month of annual declines, while Phoenix, Dallas and Miami also experienced decreases of at least 1%, Godec said.

"It's a stark reversal from the pandemic boom, as the markets that were once 'pandemic darlings' are now seeing the sharpest corrections while more traditional metros continue to post modest gains," he said.

On a monthly basis, 16 of the 20 cities tracked saw home prices drop in October from September. Only Phoenix, Miami and San Francisco managed monthly increases.

"This broad stagnation suggests that