The majority of mortgage lenders plan to expand or hold current staff levels in 2021, even in the face of declining origination activity, two recent reports found.

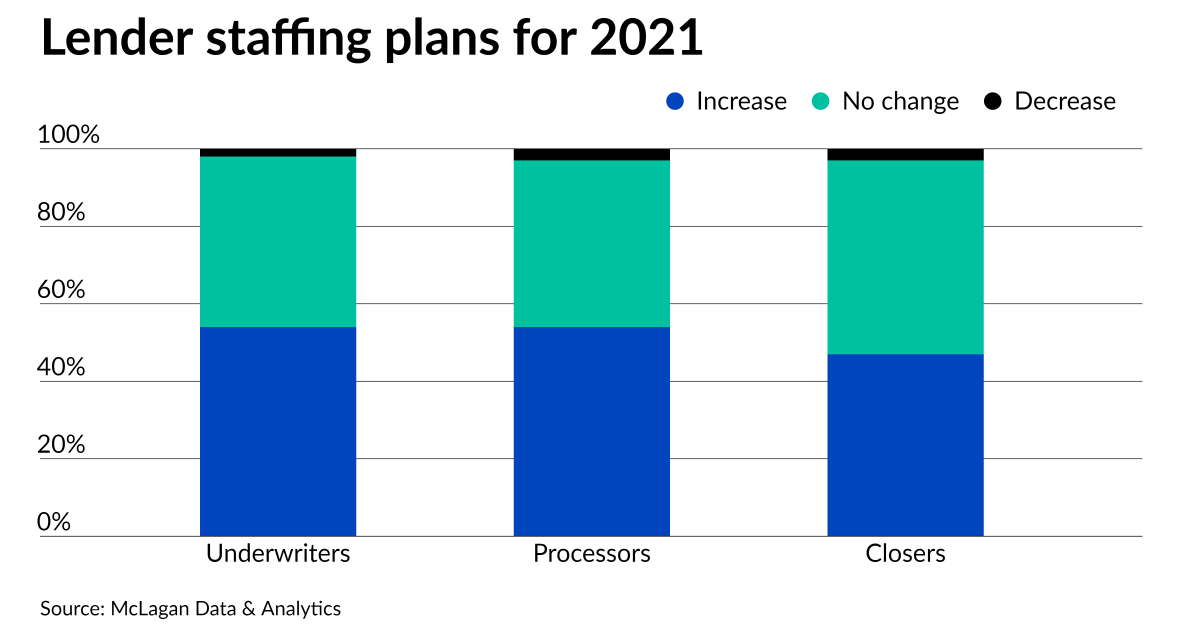

About 54% of both underwriters and processors said they will increase their 2021 headcounts and 47% of loan closers will do the same, according to McLagan Data & Analytics. Concurrently, only 2% of underwriters and 3% of both processors and closers expect staffing cuts over the remainder of the year, despite recent cuts to annual volume forecasts. Even with reduced activity ahead, firms are staffing up to work through the high volume from the first half of the year.

“You hear about how it's 23% cash buyers [right now], but mortgage financing will be needed, the 30-year mortgage rate will be here,” Marina Walsh, the Mortgage Banker Association’s VP of industry analysis, said at the MBA’s 2021 single-family research and economics showcase this week. “We're not going the way of the Betamax or the Palm Pilot, mortgage is here to stay. It just changes.”

The latest data from the Bureau of Labor Statistics reported mortgage banker and broker jobs climbed to 386,800 in April from 378,300 in March, and grew every month for the past 12. First quarter numbers from business intelligence software provider LBA Ware showed annual and quarterly spikes in mortgage hiring as well.

Loan officer turnover declined to 21% in 2020 — the lowest level since at least 2003 — while they churned out 7.6 loans per month, the highest average since 9.4 in 2003, according to a study from the MBA and Stratmor. Periods of high volume, especially refinancing, drive lower turnover because in addition to not having time to job hunt, LO commissions rise with their productivity, Walsh explained.

“These loan officers were doing very well financially,” Walsh said. “Why move to another firm, have to potentially learn a new loan origination system and waste a few weeks of time just getting set up and acclimated?”

Reduced turnover should continue as work-from-home flexibilities born out of the pandemic help employee satisfaction — a boon to lenders’ bottom lines. Less change means less onboarding and sustained production.

“Turnover is a cost. And so lenders need to make an environment that encourages people to stay,” said Rob Northway, McLagan partner and global head of consumer banking. “That's not just paying more, that's creating a culture that is really attractive to the employee base.”