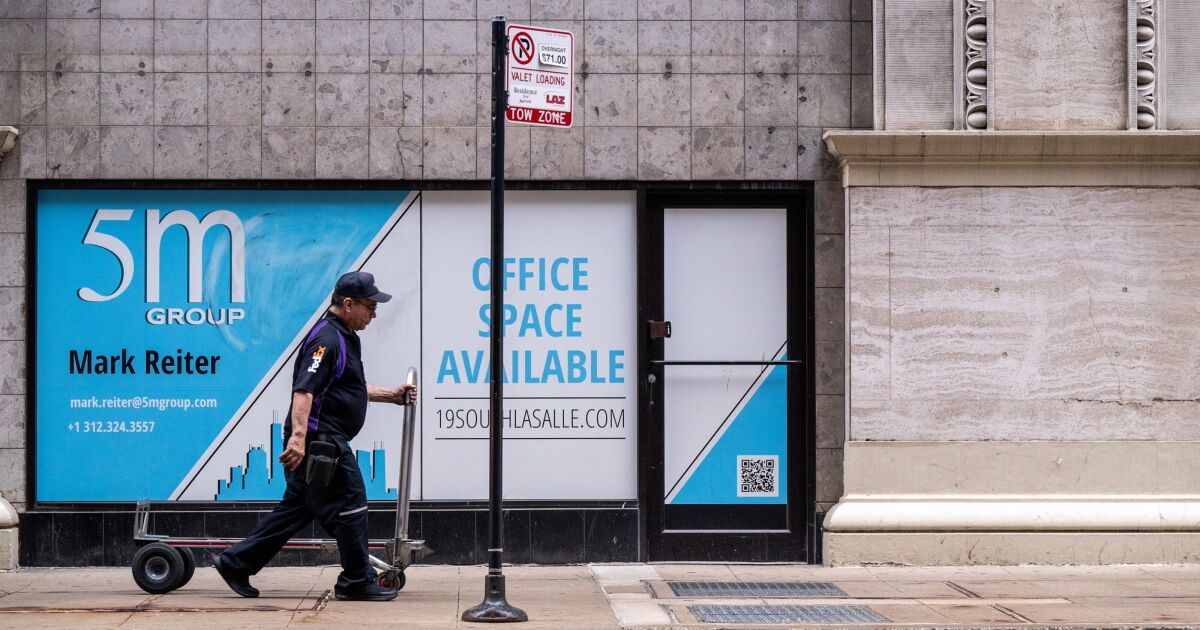

Loans backed by office buildings are currently drawing major scrutiny, as the rise of remote work has led to higher vacancy rates and sparked fears that some lenders will face big losses in the coming years.

Much of the focus has been on smaller regional banks, which tend to have greater exposure to the commercial real estate sector than their larger counterparts.

At banks with between $10 billion and $100 billion of assets, commercial real estate loans accounted for 33.2% of total loans at the end of the first quarter, compared with 12.8% at bigger banks, according to a recent analysis by S&P Global Ratings.

So far, losses on office loans remain low. The repricing of office properties is expected to play out over several years, and many property owners are still paying relatively low interest rates that they secured before the Federal Reserve started hiking rates last year.

As the rates that borrowers pay rise, S&P expects more charge-offs.

"If you were paying a low-rate fixed loan, and it moves to a much higher rate variable-rate loan, it's going to be more challenging to make payments," said Stuart Plesser, an analyst at S&P.

But Plesser also said that commercial real estate loans have better underwriting than they did in 2008 — the last time that the sector faced the prospect of a large downturn. Today, loan-to-value ratios, which measure the cushion that lenders have against falling property values, are typically in the 50%-65% range, according to S&P.

"Prices would have to come down significantly to bleed into charge-offs," Plesser said. "Not saying it won't happen, but there's more cushion."

S&P identified banks with more than $10 billion of assets, but less than $100 billion, that have notable exposures to office loans. The list includes Cullen/Frost Bankers, Columbia Banking System, Synovus Financial, Valley National Bancorp and Associated Banc-Corp.

Executives at all of those banks have spoken publicly in recent months about their institutions' exposure to office loans. They have pointed to factors that offer protection, including the geographic advantages of their portfolios and the types of buildings that serve as collateral.

Analysts at JPMorgan Chase recently expressed a similar viewpoint, saying that they think concerns about regional banks' exposure to commercial real estate are "overblown."

What follows is a look at the situation facing five regional banks that have significant exposure to office loans.