The total number of people with mortgage payments on hold due to coronavirus-related hardships has fallen after two weeks of gains, suggesting the long-term downward trajectory in forbearance activity is resuming.

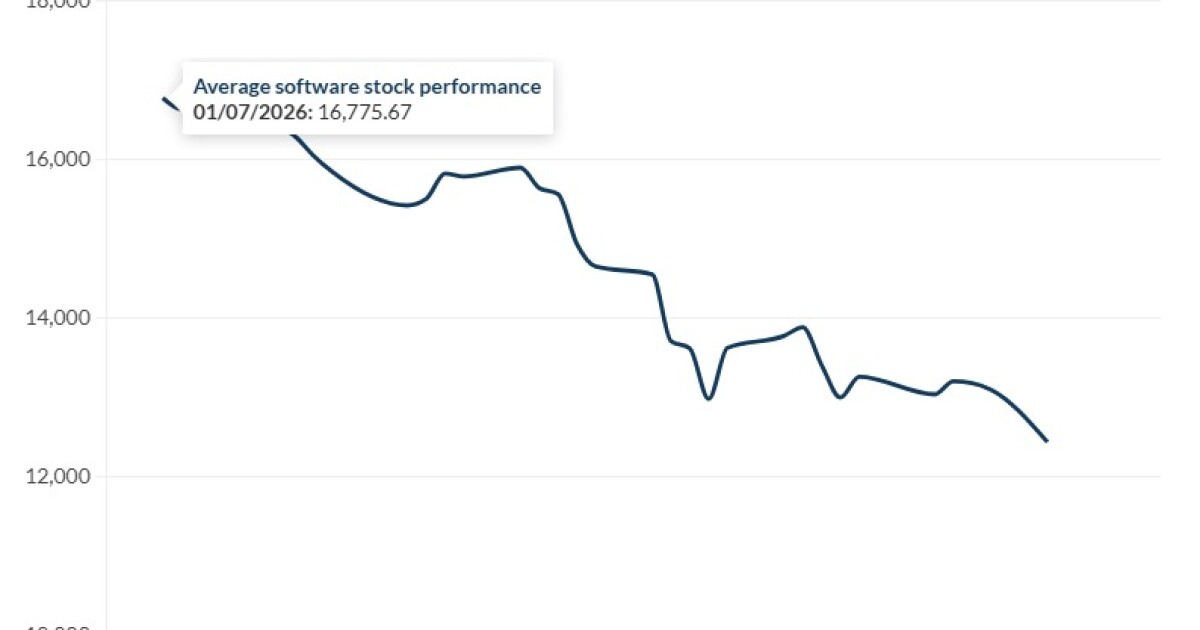

Mortgages in forbearance totaled 790,000 during the seven-day period ended Feb. 1, down from 835,000 the previous week, according to Black Knight’s analysis of its McDash Flash data set.

“In a positive sign, plan start volumes for both new starts and restarts edged lower after climbing in recent weeks,” Andy Walden, vice president of market research, wrote in a Feb. 7 blog post containing the company’s most recent weekly data.

The drop follows a decline in infection rates associated with the omicron variant and the typical mid-month processing lull's end.

Overall, more than 90% of all borrowers with forbearance plans have exited them, but those departures have been decelerating in line with the likelihood that anyone who is still suspending payments has a long-term loss of income and they may need a modification of their loan terms to cure.

Although the percentage of people remaining in forbearance is low, it could take some time to unwind the hundreds of thousands of forbearance plans and any delinquencies from the pandemic that are still outstanding. To get a sense of the pace the forbearance exits within that group are moving at, consider that 50,000 plans were up for review in January, and a little under one-third of these likely expired, according to Black Knight.

In total, the count when it comes to residential mortgage borrowers who had serious delinquencies but weren’t in foreclosure as of December was 946,000, according to Black Knight’s separate monthly loan-performance report. That number is still double pre-pandemic levels, but is more comparable with long-term averages in this category.

While foreclosures have gradually restarted and some aspects of them have picked up a little as long-term pandemic-related bans have been phased out, activity remained relatively low through December, Black Knight found.

While far less than 1% of single-family home loans (0.24%) were in active foreclosure during December, expiring forbearance could boost that number. December’s completed foreclosure sales, which often involve vacant properties with fewer regulatory restrictions than occupied ones, were around twice as high as they were a year earlier but one-third of pre-pandemic levels.

What could hold foreclosure levels low, so long as it’s sustained, is the record amount of home equity built up in properties over the past year. When equity levels are higher, mortgage servicers and borrowers are more likely to come to an agreement in which the latter is willing to satisfy their debt and generate additional cash by agreeing to sell their home through arrangements that don’t involve having to go through a more lengthy foreclosure process.

The amount of equity borrowers can tap beyond the ideal 20% lenders would like them to keep in their homes rose by a record $2.6 billion to nearly $10 trillion in 2021, according to Black Knight’s Feb. 7 Mortgage Monitor report. That reduces the loan-to-value ratio for the market to an extremely low 45%.

“The aggregate total of $9.9 trillion represents an astounding 35% annual growth rate which works out to an increase of $2.6 trillion in tappable equity in a single year,” Ben Graboske, president of Black Knight data and analytics, said in a press release. “That’s $185,000 available to the average mortgage holder before hitting a maximum combined loan-to-value ratio of 80%.”