Housing is on the ballot this November.

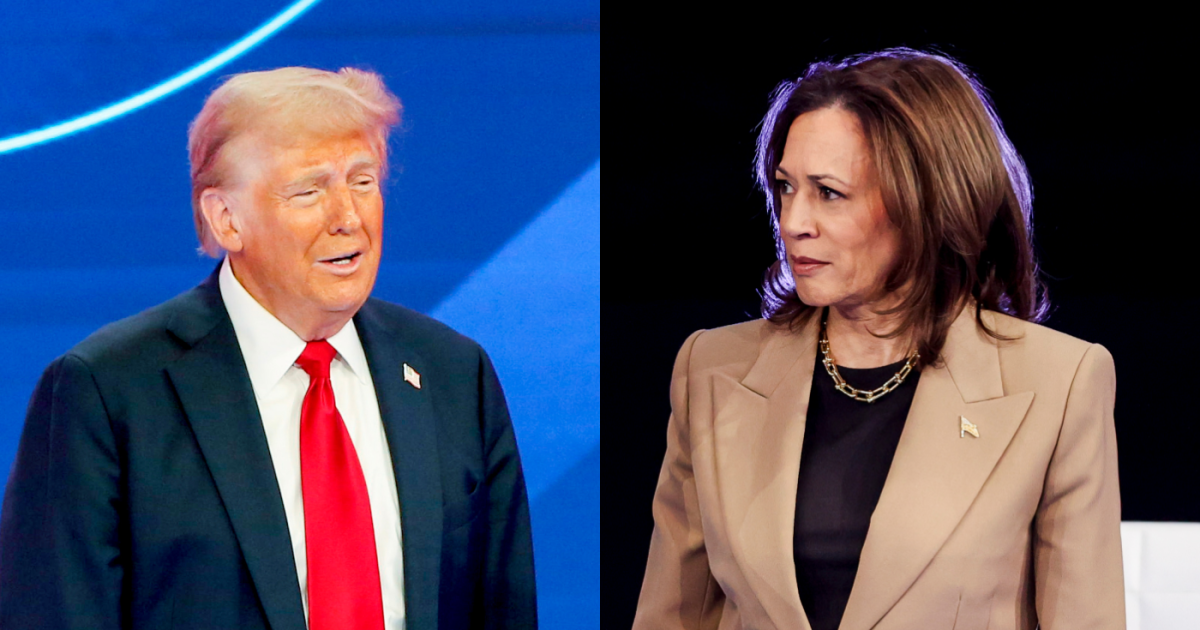

Presidential hopefuls Kamala Harris and Donald Trump have offered to voters

"The unfortunate reality is we've got a crisis, so that's why it's being discussed," said

Vice President Harris, who replaced President Joe Biden on the Democratic ticket this summer, is proposing an

Contributions from mortgage professionals and industry political action committees this cycle lean Republican, aligning with historical norms. Mortgage players however are spending far less on politics this cycle compared to their activity during the 2020 presidential race and

The stakes are high, and lenders are refraining from public comment amid a particularly tight and tense presidential race. Despite widespread policy implications, industry analysts still have mixed feelings on the impact November's results will have on housing finance.

"I think the punchline is, when it comes to housing finance, we don't really feel like that will be a top priority for either candidate," said Eric Hagen, managing director and mortgage and specialty finance analyst at BTIG.

National Mortgage News broke down the playing field, analyzing each candidate's housing history and policy proposals, where mortgage dollars are flowing, and the lingering concerns experts have around the election.

The state of housing Mortgage rates

Prospective home buyers want to ride out the storm. Over a third of consumers in a lender poll this summer said they'll wait to buy a home

The Harris housing pitch

The vice president is no stranger to the mortgage business,

She also faced criticism in that arena, when her office opted

Harris this summer tapped Minnesota Governor Tim Walz

The Dem presidential hopeful has pushed

The other major Harris pitch is

Some industry experts are pleased with Harris' focus but view the plans with skepticism. Moody's Analytics Chief Economist Mark Zandi estimated a $125 billion price tag for new Harris homes.

"It could be realized, but there needs to be a lot of coordination and alignment incentives," said Jung Choi, a principal research associate with the Urban Institute's Housing Finance Policy Center.

Killmer said the MBA has received outreach from Capitol Hill voices who want to beef up Harris' proposals.

"This is a marathon, not a sprint, so I don't think anybody should be counting on immediate relief," he said. "It took us years to get into this supply deficit for all the reasons that's happened, and it'll take long-time, consistent, incremental efforts to get us out of it."

Experts also caution that the downpayment assistance plan could exacerbate inflation of home prices. The

"It could end up putting upward pressure on home prices that are targeted as a part of the program," said Bose George, managing director at KBW.

The Trump approachThe Trump administration rolled back Obama-era regulation including

The Department of Housing and Urban Development under secretary Ben Carson was also accused of failing to enforce HUD's fair housing laws. And despite many pleas inside and outside of his administration to do so, Trump

The former president in July tapped Ohio Senator J.D. Vance as his VP running mate. Vance has

Trump hasn't commented on GSE reform, but his former associates said exiting conservatorship

Experts agree that an exit would be a difficult process. Privatization would also dampen the administration's control over the GSEs via the FHFA, Hagen noted. Killmer said the mortgage industry in any scenario wants to understand the rules around GSEs and minimize disruption to the housing ecosystem.

"The capital markets implications of doing this are profound, and the cost that could be passed along, either due to volatility with that transition, or safeguards that are put in place, could increase costs," he said.

The GOP ticket has called for more executive influence

Trump in September also echoed Vance's stance on immigration, calling on barring undocumented immigrants from obtaining home loans. The boisterous candidate has also threatened mass deportation of immigrants.

A meaningful immigration reduction could hit the nation's home builders, George said. A Trump administration also probably couldn't ban non-federally funded programs such as

"We don't know how many properties can be freed up if (immigrants are) evicted," said Choi. "Many are likely to live in lower-income, lower-priced rental units. What kind of housing would that open up?"

Fewer industry contributionsMortgage bankers and brokers, individually and via PACs, have contributed $8,304,964 during the 2023-24 election cycle, according to Federal Election Commission data analyzed by Opensecrets. Although that sum is only current as of the end of August, and only counts contributions of $200 or more, that spending is a little more than half of what the industry gave in the prior two cycles.

"It may be less about the industry support of politics and more about, they just

Since January 2023, mortgage professionals and PACs contributed $3,345,717 to Democrats and $4,564,262 to Republicans, for a 42% to 57% split, according to the data. The industry has leaned Republican since 1998, outside of the 2008 election, according to historical figures.

Individuals from the combined affiliates of Rock Holdings lead mortgage lenders through August 31 with $1,648,078 in contributions, according to Opensecrets. Rock Holdings PAC meanwhile has raised over $1.2 million this cycle and spent $1.3 million, with contributions again slightly in favor of GOP candidates. Money from both the PAC and Rock Holdings employees this season trails totals from the 2022 ($4.1 million combined) and 2020 ($3.3 million combined) election cycles.

The MBA's MORPAC spent $1,799,896 through the end of August. MORPAC has contributed $352,500 to Democrats this cycle and $425,000 to Republicans, according to Opensecrets. It also has $879,447 cash on hand as of August 31. Its spending so far is a little over half of the amount MORPAC contributed in 2022.

"I can assure you our level of political intensity through our direct lobbying and our grassroots outreach is as strong as ever," said Killmer, who's also treasurer of MORPAC. "The receipts and disbursements are down a bit, but that's to be expected."

Following the moneyMortgage bankers and brokers this cycle have given more money to Harris, with $473,143 in contributions through August, than to Trump, with $316,803. The remaining mortgage contributions flow to a familiar roster of senators and U.S. representatives on their respective financial committees.

Sherrod Brown, a Democratic senator from Ohio and chairman of the U.S. Senate Committee on Banking, Housing and Urban Affairs, has received $127,906 so far from the industry. Jon Tester, a Democratic senator from Montana also on the committee, has received the next most contributions at $94,999 – both lawmakers are in close races this fall.

Republican French Hill of Arkansas, the vice-chairman of the House Financial Services Committee, is the top GOP mortgage contribution recipient on Capitol Hill with $69,200 through August. Fellow committee member Andy Barr, a GOP representative from Kentucky, is the next-highest GOP mortgage recipient with $64,000 in contributions this cycle.

Individuals from Fannie Mae and Freddie Mac have overwhelmingly given to Democrats, with contributions totalling so far $250,108 and $113,793, respectively. Veterans United Home Loans employees are among the industry's most politically active, giving 62% of their total $188,030 in funds to Republicans. CrossCountry Mortgage individuals have contributed $149,480 through August, $83,808 of those dollars to the GOP.

The Association of Independent Mortgage Experts PAC is boosting its profile, contributing $108,000 this cycle, 54% of that to Republicans. It retained $195,167 cash on hand as of August 31. The National Association of Mortgage Brokers PAC has revived its longtime political activities, spending $95,800 this election season. That's the most that PAC has spent since 2018.

The Title Insurance PAC has spent about $1 million this cycle, and its contributions lean slightly Republican, according to Opensecrets. That spending approaches TIPAC's activities in 2020, but trails its 2022 efforts when it spent over $1.3 million on the midterms.

Mortgage players are also spending far less on lobbying this year, with just $6.7 million in 2024. Through August, that appears on pace to come well below the sums the industry spent in every year since 1998, according to Opensecrets. In the wake of major financial legislation passed last decade, housing finance stakeholders still surpassed $10 million in lobbying spend annually.

Only the MBA ($1.8 million) and the Council of Federal Home Loan Banks ($1.2 million) have spent over a million dollars on lobbying this election cycle. Pennymac is the top lender among industry lobbying leaders, spending $290,000 by the end of August.

Lasting implicationsFew names have been floated as potential housing leaders under either administration. Calabria has said he'd serve in his FHFA role again, if asked. Speculation has revolved around a Trump Treasury secretary;

"If (Paulson) were to happen, we feel like the odds for exiting conservatorship get much higher," said Hagen of BTIG. "And we would expect to see activity in the stocks."

There's also the

Congressional races will also determine a critical battle over the Tax Cuts and Jobs Act, a Trump-era achievement set to expire in 2025. Aside from a bevy of provisions at stake that could impact housing finance, presidential candidates are also weighing corporate tax changes. Trump has pitched lowering the corporate tax rate from 21% to 15%, while Harris wants to raise the rate, which isn't an expiring TCJA provision, to 28%.

Analysts concluded a pro-business Trump presidency would be slightly more favorable to the mortgage industry, but each candidate presents pros and cons.

"As lenders, we tend to be as bipartisan as possible," said VanFossen. "We respect our employees' individual views, and we respect the system as a whole. Elections have consequences, and no matter which way it'll go, there will be benefits and there could be potential downfalls."