Mortgage originations do appear to be falling slightly on average as the refinance boom has gotten long in the tooth, but bank earnings reported Friday suggested that, overall, they’ve been surprisingly resilient, according to a Keefe, Bruyette & Woods report.

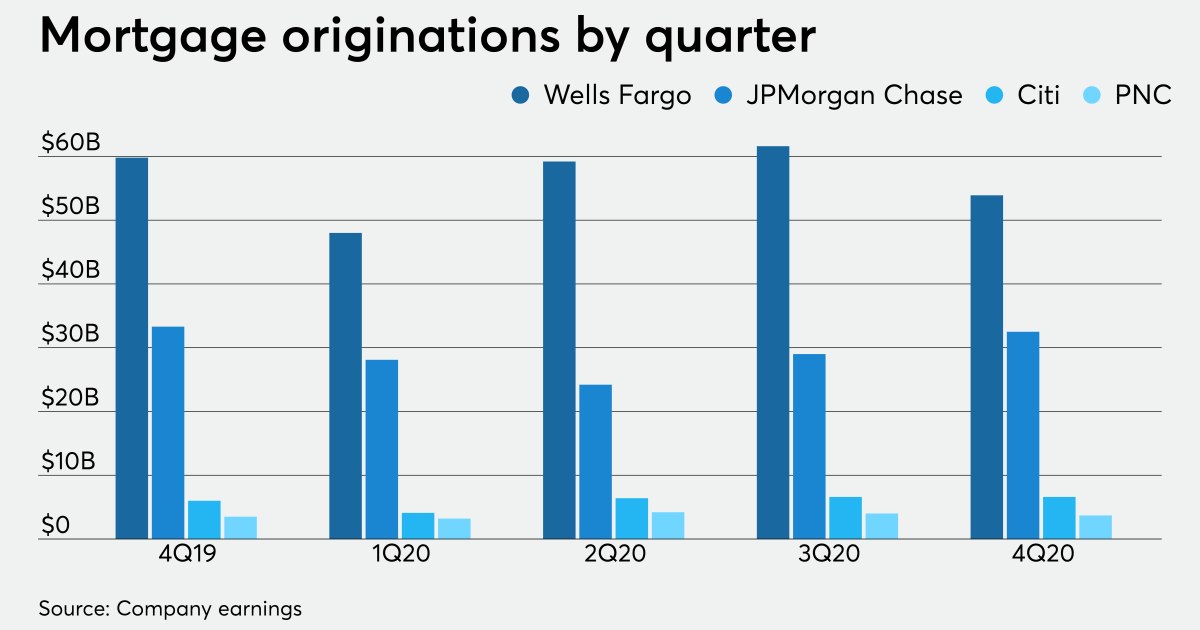

“Mortgage banking results came in generally better than expected at several large banks,” Bose George, Thomas McJoynt-Griffith and Michael Smith, analysts at Keefe, Bruyette & Woods, said in the report.Earlier Fannie Mae and the Mortgage Bankers Association forecasts predicted that fourth-quarter origination volumes would fall 7% on a consecutive-quarter basis, but early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank on average show they were down just 3% when purchased loans were excluded, according to KBW.

In addition, analysts were surprised to see marks on mortgage servicing rights rose on average by 9% given that rates remained at or near record lows during the quarter, which was expected to maintain some pressure on valuations.

“MSR pricing could be improving as market risks (for example, in terms of forbearances) have declined,” the KBW analysts said.

Gain-on-sale margins for originations on average were in line with analysts’ expectations that they will continue to undergo slight compression.

However, within these metrics, there was naturally some variation by company. What follows are some details related to how each fared in 4Q20 that illustrate broader challenges and opportunities that are emerging in the mortgage business.