New Residential's $1.67 billion cash purchase of Caliber Home Loans from Lone Star Funds likely takes not just one potential initial public offering off of the table, but two.

Caliber's IPO was put on hold in October 2020 right before it was to be priced. The last action the company took was to update its registration statement in January.

Meanwhile, New Residential Chairman, CEO and President Michael Nierenberg, who felt investors were not properly valuing the company, had discussed taking its originations and servicing business, NewRez into a separate publicly-traded entity. The real estate investment trust went as far as filing a confidential registration statement last year.

But Nierenberg said in a conference call this week that there is "no rush" to take NewRez public, primarily because the parent company is already publicly traded, which differentiates it from the other nonbanks that recently launched IPOs or merged with SPACs.

"As we look forward, whether we spin it out, make it public [or] keep it as part of NRZ, we're going to do what we think is best for our shareholders and make sure that we are extremely well equitized," Nierenberg said. "And I think that we don't have the answer right now."

The transaction will create a mortgage originator that on a pro forma basis produced $142 billion in loan volume last year, with $80 billion from Caliber and $62 billion from NewRez.

"We view the deal terms positively considering ... it significantly ramps New Residential's origination capabilities, which we see helping potentially enhance the risk management of the mortgage servicing rights portfolio," Eric Hagen of BTIG said in a research note.

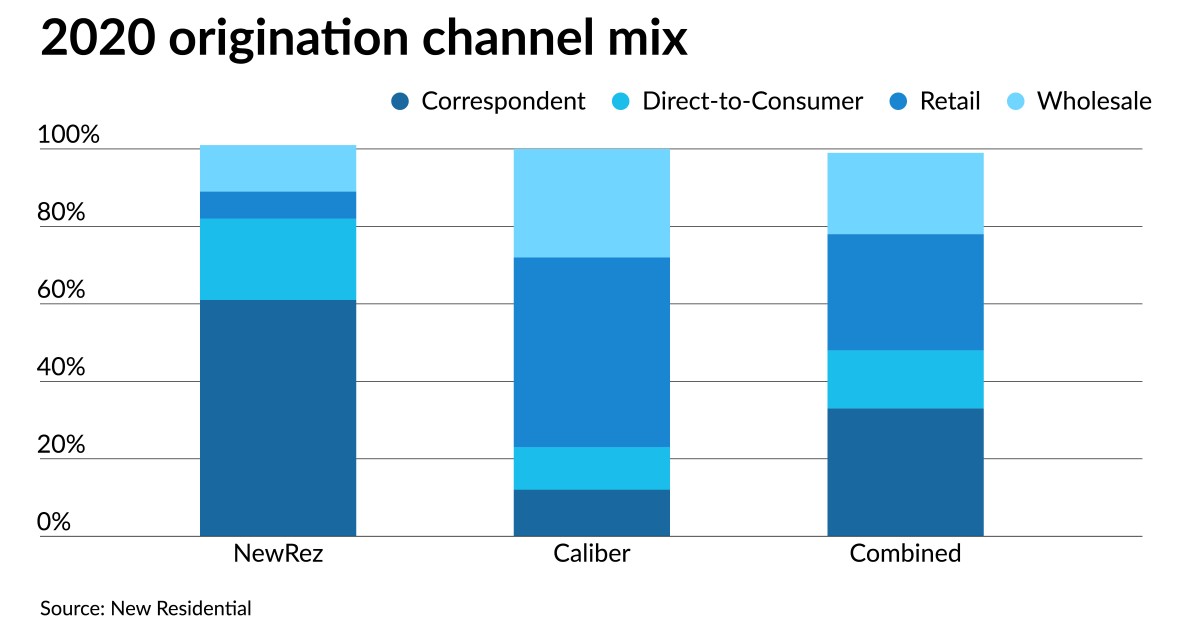

The deal will help to move NewRez' origination mix away from the heavy concentration of correspondent loan purchases (61% of 2020's total production) to a more even split between retail (30%) and correspondent (33%).

On the servicing side, New Residential handled $435 billion at year end, while Caliber's portfolio was at $141 billion.

The deal will be funded using $675 million in cash and liquidity already on hand at New Residential, plus $500 million of excess liquidity on Caliber's balance sheet.

New Residential also announced Wednesday that it is going to sell 45 million of its own shares (plus an underwriters' option for an additional 6.75 million shares) in a public offering to help pay for the transaction. Closing of the Caliber acquisition is expected sometime in the third quarter of this year.

New Residential's stock opened trading Wednesday morning at $10.55 per share, down $0.38 from Tuesday's close.

Nierenberg praised Caliber's portfolio retention success, another area that he was seeking to improve at NewRez.

He pointed to Caliber's 54% recapture rate on refinances in 2020 (down from 58% in 2019), calling this "one of the things that [Caliber CEO] Sanjeev [Das] and his team have done extremely well. And if you think about the scale and the size of our operating business and our customer base and our MSR portfolio, this should be a huge benefit for our overall combined company."

Caliber's retail channel recapture rate for purchase loans was 57% last year.

"The high retention rates give us more cash flow, so it extends the cash flow and obviously gives you higher yield; it protects the MSR asset, and improves our net origination margins," Nierenberg said. "I think the high level of recapture rates really helps with customer satisfaction and that's something that we really want to strive to continue to get better at."

The deal also creates opportunities for New Residential to grow its jumbo and non-qualified mortgage origination lines, Nierenberg said.

New Residential also disclosed preliminary first quarter results during the call. The company is expecting to report net earnings between $275.2 million and $300.9 million. For the same quarter in 2020, the company lost $1.6 billion as it took a big hit on the value of its mortgage investment portfolio.