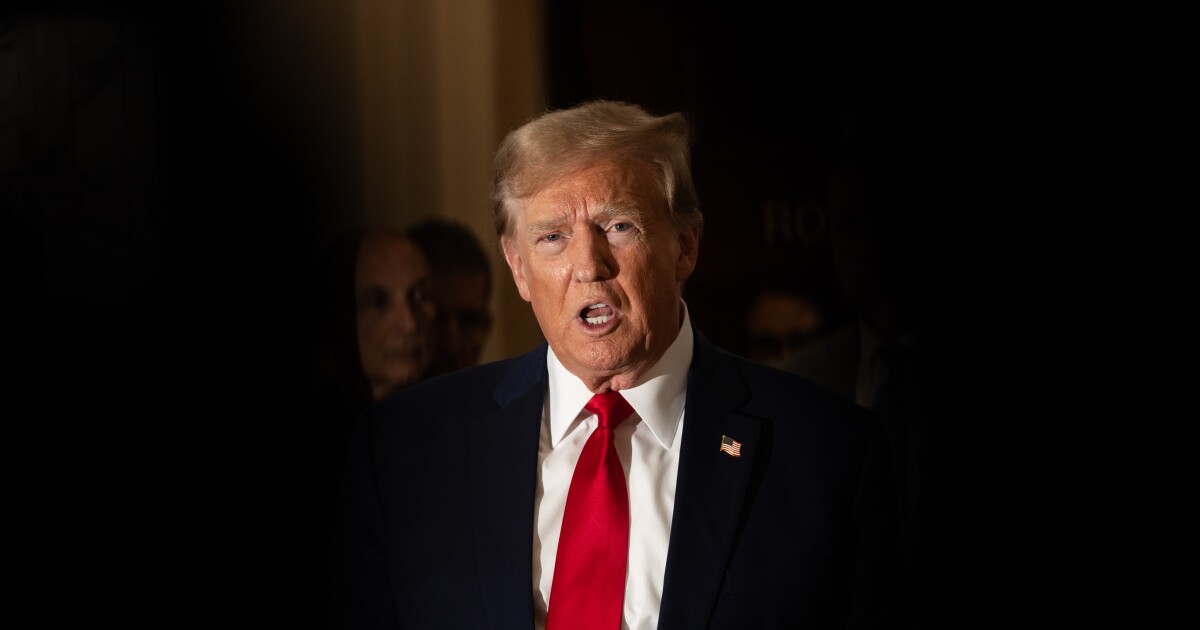

Donald Trump appears likely to recapture the White House following a tight race which, as of 4 a.m. Wednesday morning, awarded him 267 of the necessary 270 electoral votes needed for victory, according to the Associated Press.

Key swing states Pennsylvania, Wisconsin and Michigan appeared likely to go to Trump. The Republican party won a Senate majority in part by flipping seats previously held by Democrats in Ohio and West Virginia. Control of the House of Representatives remains undetermined, with 100 races yet to be decided.

While both parties' 2024 presidential campaigns made few specific prescriptions in the way of financial policy, the results will have a huge impact on the direction of the economy and regulation for the next four years.

"Like most presidents, neither Harris nor Trump have very strong views on financial regulation that we're aware of," Ian Katz, managing director at Capital Alpha, told American Banker earlier this week. "That means most policy will depend on who exactly the regulators are."

A Donald Trump win could mean some of the same financial regulatory policies his administration enacted in his first term, but alongside a highly protectionist ideology that would mean high tariffs and deportations that could unsettle employment figures in the country.

Sen. Sherrod Brown, D-Ohio, lost his bid for reelection in the U.S. Senate. This means that the top Democratic spot on the committee — almost certainly ranking member rather than chair at this point — is up for grabs.

Sen. Jack Reed, D-R.I., is the most senior Democratic member of the committee after Brown, but is largely expected to remain the top Democrat on Senate Armed Services.

That leaves Sens. Jon Tester, D-Mont., — who is himself in an uphill battle for reelection this cycle — Mark Warner, D-Va., and Elizabeth Warren, D-Mass.

Both Tester and Warner are relatively moderate on banking issues. Both contributed heavily to the 2018 tailoring law on bank regulations. Should Tester be defeated and Warner not want the spot, Warren would be next in line for Democratic leadership of the committee, setting up an intense clash with Wall Street and banking interests.

Rep. Adam Schiff, D-Calif., won the Senate seat in California vacated by fellow Democrat Sen. Dianne Feinstein. Schiff is one of the House's most staunch Democratic crypto allies, and will likely take up a seat on the Senate Banking Committee that's been long held by a California lawmaker.

Sen. Elizabeth Warren, D-Mass., will return to the Senate, where she's expected to continue to be a strong progressive voice on personal finance issues.

"We beat the big banks on Wall Street and cracked down on overdraft and junk fees," Warren said at her victory speech Tuesday evening. "I led the charge to create the Consumer Financial Protection Bureau — go CFPB — and now, with a cop on the beat, big banks have been forced to return more than $20 billion directly to consumers they cheated."

Stalwart Republicans on finance issues in the House soared easily to victory on Tuesday. Reps. French Hill of Arkansas and Andy Barr of Kentucky each had their races called relatively early in the evening. Both are contenders for the top Republican spot on the House Financial Services Committee with the retirement of Rep. Patrick McHenry, R-N.C.

Going into the election, the

Trump had little to say about housing in general, but observers expect his administration to work on ending the government-sponsored enterprise conservatorships.

"While the likelihood of GSE privatization remains a low probability outcome, we continue to expect GSE shares to outperform meaningfully in the event of a Trump victory in the November 5 presidential election," Bose George, an analyst with Keefe, Bruyette & Woods, said in an Oct. 31 report after Fannie Mae and Freddie Mac both reported third quarter earnings.

Eric Hagen, an analyst at BTIG, commented on the future of the GSEs in his Nov. 5 mortgage finance roundup report.

"In a Trump victory, we still see better near-term upside for the preferred stock, which have collectively built [approximately] $25 billion of capital from retained earnings over the last year," Hagen wrote. "We're marginally more constructive on the opportunity for credit risk transfer transactions to proliferate in a Trump administration given the potential read-thru it creates for accelerating a release from conservatorship, although it could depend on the leadership development at Treasury and FHFA."

The end to all of the uncertainty of the election process is likely to benefit consumers — especially those who had been

Mortgage rates have

The FOMC is meeting on Wednesday and Thursday with

"While the U.S. election is undeniably a critical event, the potential for economic stimulus through lower borrowing costs is winning the attention of investors," Nigel Green, CEO of U.K.-based financial advisory firm deVere Group, said in a statement. "The focus remains on the Fed's likely intervention to shield the economy from further weakening."

— Kyle Campbell, Catherine Leffert, Carter Pape, Ebrima Santos Sanneh, Polo Rocha, Kevin Wack and John Heltman contributed to this report.