A mortgage loan originator has settled a coordination action brought by 21 states which permanently bars him from working in the industry in 19 of those.

Patrick Terrance Donlon, worked for Trusted American Mortgage, disputed the findings but settled the "regulatory concerns without the time, expense, and uncertainty of contesting the findings in separate administrative actions or other legal proceedings brought by the State Mortgage Regulators in the Participating States," stated a copy of the agreement posted on the California Department of Financial Protection & Innovation website.

Trusted American is a mortgage brokerage headquartered in Centennial, Colorado. Donlon's Nationwide Multistate Licensing System page said he is the company's CEO.

He stood accused of having another person take required loan officer licensing education on his behalf and taking the credit for himself, violating the SAFE Act. The full name of the federal law is the Secure and Fair Enforcement of Mortgage Licensing Act, which

The allegations raised against Donlon

Earlier in 2025, the Conference of State Bank Supervisors received information which alleged Donlon had another person take 22 pre-licensing and three continuing education courses in 2024 and the following year, the filing said.

CSBS, along with the American Association of Residential Mortgage Regulators,

Donlon was licensed in 19 states, plus active applications to be approved as an originator in two more states and the agreement bars him from practicing in almost all of them permanently. All 21 states involved participated in the settlement, a CSBS press release said.

Which states participated in the settlement

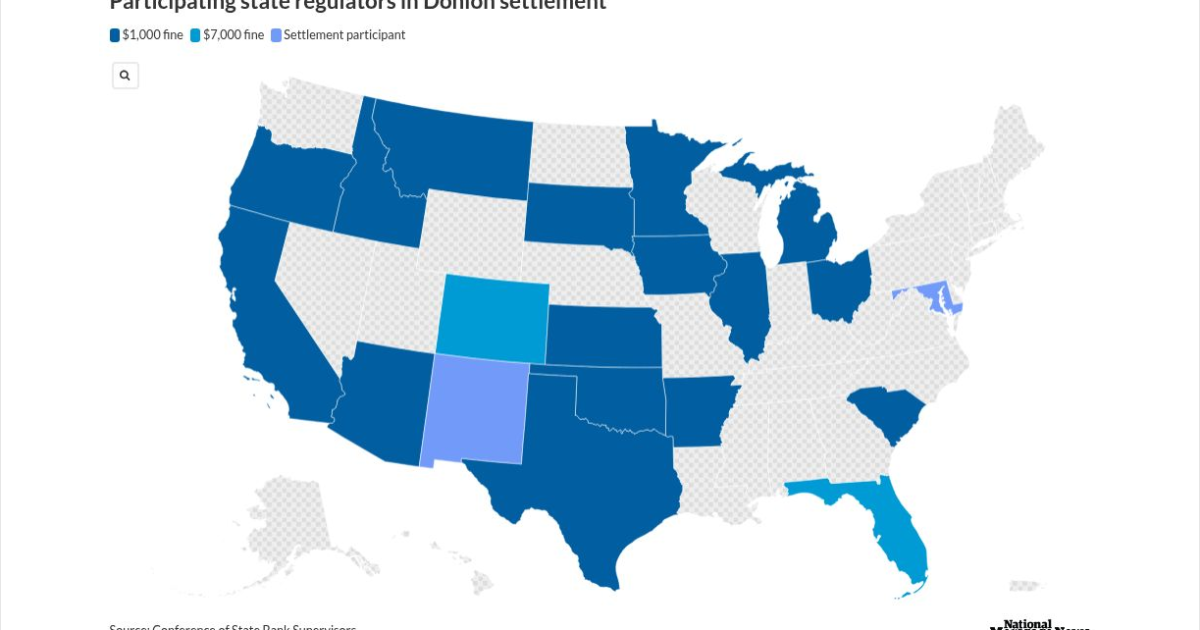

The settlement was led by regulators in Arkansas, Colorado, Florida, Iowa, Kansas and Texas. Other participants are: Arizona, California, Idaho, Illinois, Maryland, Michigan, Minnesota, Montana, New Mexico, Ohio, Oklahoma, Oregon, South Carolina and South Dakota.

The only states where Donlon can apply for reinstatement are Colorado and Florida, where he may reapply for a license in two years if he pays all administrative penalties and completes additional education requirements.

Those are also the states which will receive the most proceeds from Donlon's $31,000 fine with $7,000 each. All the remaining states will get $1,000, except for Maryland and New Mexico, the two where Donlon's licensing application was pending.

In addition to the above penalties, Donlon cannot serve as a qualified individual or control person of any financial services entity registered with NMLS for two years. He also was removed from those roles at Trusted American Mortgage.

The Illinois Department of Financial and Professional Regulation put out its own press release about the settlement.

"We require that licensed professionals complete their continuing education to ensure our licensees have the highest levels of competence and ethics," said IDFPR Division of Banking Acting Director Susana Soriano. "With this action, the residential real estate market in Illinois has been protected and consumers can continue to expect the highest levels of professional service from their licensed mortgage loan originators."

This was not the first time a CSBS-coordinated education fraud enforcement action was undertaken. In January 2022,