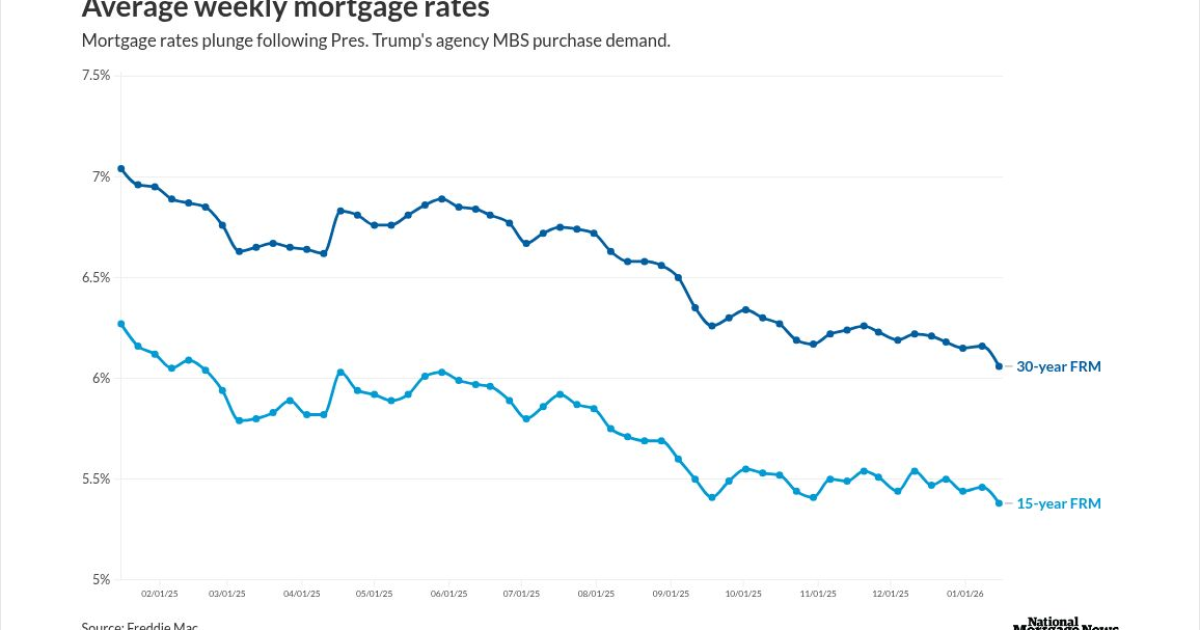

Mortgage rates fell to their lowest levels in more than three years after Pres. Trump ordered a $200 billion purchase of agency mortgage-backed securities, Freddie Mac said.

Spreads were already tightening as Freddie Mac and Fannie Mae have increased the size of their respective retained portfolios in recent months. The announcement further narrowed the gap in anticipation.

It was a year ago at this time that the 30-year fixed rate mortgage

For Jan. 15, the product was at 6.06%, the Freddie Mac Primary Mortgage Market Survey said,

The 15-year FRM averaged 5.38%, versus Jan. 8 when it was at 5.46% and a year ago, it was 6.27%.

The effects of this week's mortgage rate movements

"The impacts are noticeable, as weekly purchase applications and refinance activity have jumped, underscoring the benefits for both buyers and current owners," said Sam Khater, Freddie Mac chief economist, in a press release. "It's clear that housing activity is improving and poised for a solid spring sales season."

The 30-year fixed rate mortgage reportedly dipped below 6% in

Its helped position the housing market for a stronger spring season, said Samir Dedhia, CEO of One Real Mortgage, after the Freddie Mac announcement.

"While this sparked optimism, it also raised questions: Is this the beginning of a sustained effort to support housing, or just a one-time market catalyst?" Dedhia asked. "That uncertainty is part of what's keeping rates volatile in the short term."

Knowing a guaranteed purchaser for MBS is in the market allows mortgage lenders to lower rates, added Kate Wood, Nerdwallet's lending expert in a statement prior to the Freddie Mac release.

"That's what happened this week, leading the average rate to dip below 6% for the first time since 2022," Wood said. "Lenders' exuberance may prove short-lived, but it's already been enough to cause a spike in refinance volume."

Mortgage rate movements this week

Optimal Blue tracking data put the 30-year conforming mortgage at 5.999% on Monday, but it rose to 6.027% the following day before dropping back to 6.02%.

Federal Housing Administration pricing has dipped above and below the 6% level while Veterans Affairs products consistently under this mark since early September. Lender Price data posted on the National Mortgage News website had the conforming 30-year FRM at 6.07% on Thursday morning, down 3 basis points on the day. For the same time seven days ago, the tracker was 25 basis points higher at 6.32%.

Meanwhile, the 10-year Treasury yield as of 11 a.m. Thursday morning was at 4.16%, up 2 basis points on the day, following Wednesday's dip to 4.14% from 4.17% the prior day.

On Monday, the yield was at 4.19% as investors digested the news that the Department of Justice issued grand jury subpoenas to Federal Reserve Chair Jerome Powell and the central bank.The Mortgage Bankers Association, whose survey period ended Jan. 9,

"The continued decline in mortgage rates fueled a sharp increase in borrower demand during the first week of 2026," MBA President and CEO Bob Broeksmit said in a Thursday statement. "With mortgage rates much lower than a year ago and edging closer to 6%, MBA expects strong interest from homeowners seeking a refinance and would-be buyers stepping off the sidelines."

While the

"Affordability remains a challenge, especially for first-time buyers," Ostrowski said in a commentary. "A recent dip in mortgage rates might help some buyers get into the market, but home prices remain stuck at record highs."