Slow on the uptake, tech-anxious, one may even say vanilla. The long-standing reputation of a lagging mortgage industry is no secret.

Recent years, however, have seen this stereotype begin to unravel. The sector is increasingly embracing new technologies, improving its operational agility, and growing more responsive to volatile customer and market dynamics.

2020 has made such capabilities mission-critical for lenders hoping to continue to trade successfully and responsibly. Huge changes in risk appetites, a rapidly growing gig economy and a cross-sector greening agenda have transformed consumer demand and requirements, outmoding traditional credit decisioning techniques in the process.

These cultural shifts have arguably mainstreamed once niche and underserved markets: freelancers, the environmentally conscious, the financially vulnerable – the number of whom continues to grow as the pandemic’s hostile economic conditions persist.

Do specialist lenders in mortgage services offer a solution for these “non-conforming” cohorts? And if so, in this apparent new era of variable employment and environmentalism, when does specialist become standard?

Panellists on EQ’s recent webinar suggested that faced with the growing complexity of cases, customisation is king for lenders. That is, tailoring products, services and underwriting processes will be key to truly answering this new spectrum of needs.

A flexible approach to financing

Ryan Davies, Hodge

Considering credit events in isolation is quickly becoming unsustainable in today’s economic climate. The prevailing level of financial anxiety should encourage lenders to “differentiate between a temporary financial blip and a longer-term issue, predicting too how this customer position will adapt over time,” argued Ryan Davies, managing director of mortgages at Hodge.

Simon Healy, chief operating officer at Ashman Finance, echoed the sentiment that great customer outcomes derive from understanding borrowers’ needs at a granular level. “Even in the same sector, businesses look fundamentally different to one another. Variations in structure, revenue streams and ownership models all bear on product design and business need. The better we appreciate these minutiae and properly assess credentials, the more we can apply granular product features that better service that sector’s bespoke needs. Let’s not pretend that a generic mortgage can do all that.”

Simon Healy, Ashman Finance

As a rule, incumbent big players pursue lower risk mortgages, Ryan expanded. “Hyper-cautious, they look at scenarios in a vacuum, paying no heed to the nuanced detail of each case.” Such risk-averse, black and white decisioning is untenable today, he suggested. “Lenders must gain the capability to operate in a grey space.”

It is large lenders’ lack of specialism and risk appetite that prevents the customer-lender relationship progressing from the transactional to a partnership built on genuine understanding. Providers who evolve and calibrate their proposition, going “above and beyond an exchange,” will unlock customer loyalty said Simon Healy: “partnerships, not transactions, drive housing tenure.”

Open banking opening doors?

What the big banks do have, however, is data. And data, as KPMG Partner Simon Walker reminded us, is central to understanding the customer.

In his eyes, the “crux of the limitation” for lenders is that to meet the regulator’s expectations, they must find a way to demonstrate customer affordability and adequately evidence a customer’s financial position.

Mark Webster, EQ Credit Services

Open banking promises to level the playing field, hopes EQ Credit Services Mortgage Account Director Mark Webster – even if it hasn’t yet been realised to the fullest extent.

“Open banking in the underwriting process would challenge large banks’ walled garden of data, giving greater opportunities to fledgling organisations. The more data you have about a customer set, the more rounded your understanding of their position and the easier to justify lending.”

By upsetting the ONS model of affordability, open banking increases the lending opportunity for those with unconventional spending or working patterns. “Take contractors,” Ryan explained. “Extended periods of downtime may spur contractors to take a payment holiday, but they know that their income is more accountable when they return to work.”

The flexibility and optionality of specialist lenders’ products combined with open banking is an area of innovation Mark believes is likely to become mainstream: “since Covid-19, many customers will be thinking differently in terms of how to utilise money; they’ll expect more out of last year’s experience. Flexibility with mortgage payments – most people’s biggest outgoing – will be crucial, which is why we must look at the whole process. Tech for speed in the origination space only matters so much if what happens after is arduous.”

Does this mean tracking should continue through the life of a mortgage? From a regulatory point of view, Simon Walker explained how that would “impose an obligation to take action when lenders identify a change in customer behaviour” – an “interesting moral and commercial question,” he argued; in Ryan’s view, “a valuable opportunity from an arrears and forbearance perspective.”

(Ever)Green mortgages?

Richard Carter, EQ Credit Service

Just as open banking encourages a departure from a transaction mentality, lenders would do well to take a “more long-term commercial view of green mortgages,” argued Richard Carter, managing director of EQ Credit Services. That is, taking in the impact of sustainable investments on a property across the lifecycle of a mortgage.

“These investments not only make for greater affordability via cheaper utility bills, but increase the value of the underlying asset over time,” he said. Building that incremental value into the underwriting decision will be “the ticket to green mortgages shirking their reputation as a bit quirky,” added Mark.

Incentivising sustainability is another way of sharing value with customers over time, commented Simon Healy. “Constantly progressing your proposition is the best incentive to retain customers, and this includes evolving the offer if the property improves itself.”

Specialist as standard?

“Generally, unless you’re an individual working 9-5 with a great credit score,” Ryan concluded, “you’re underserved by traditional lenders.” Customising lending products, whether for green mortgages, the self-employed or the “newly vulnerable”, will be cardinal to answering the cultural shifts that are making these once marginal markets the norm.

2020 may have just been the catalyst that sees, in Mark’s words, “specialist become mainstream”.

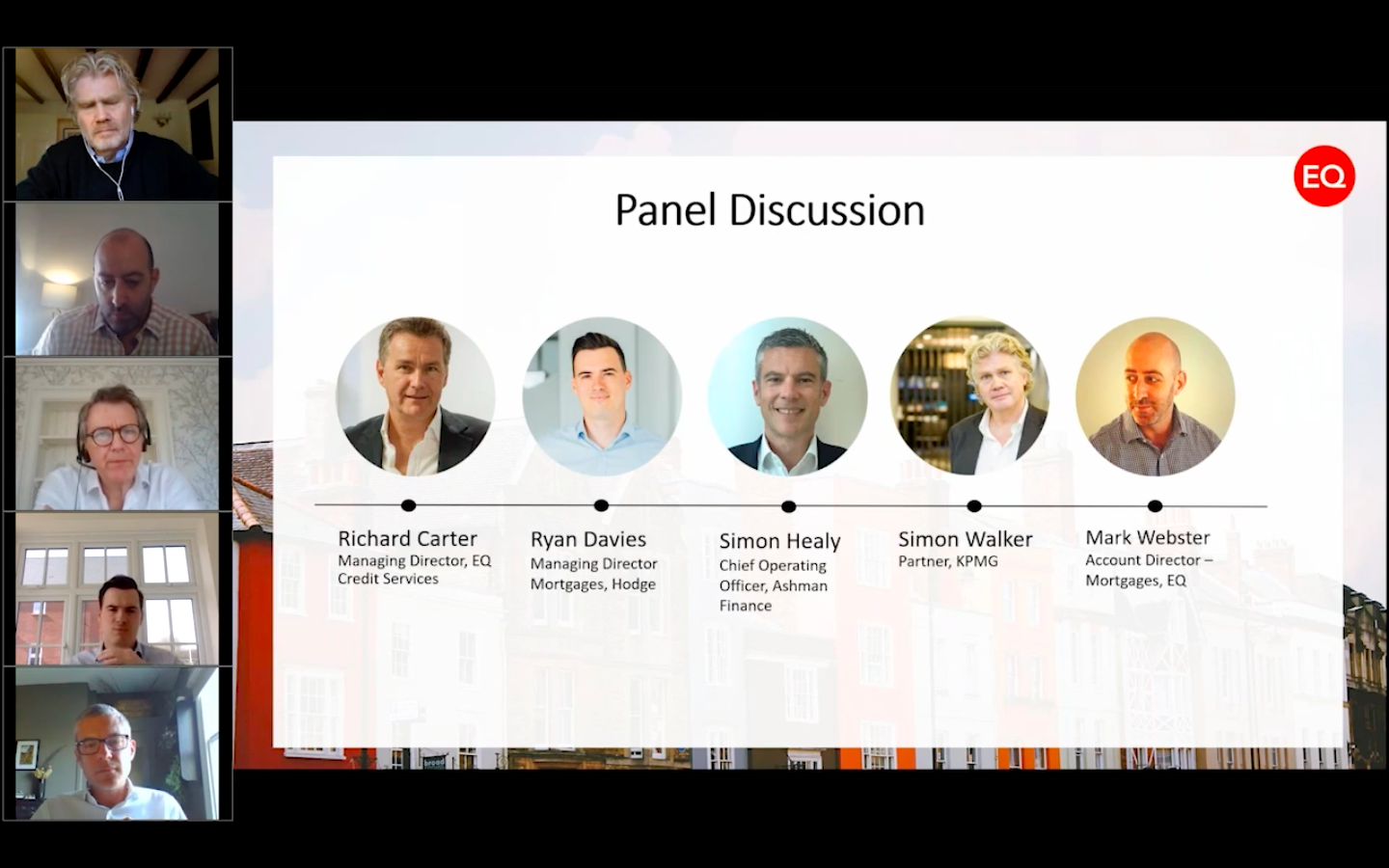

Hosted by EQ Credit Services, ‘The changing landscape of specialist lending’ webinar took place on 30th March in association with Mortgage Finance Gazette.

Panel:

- Richard Carter, managing director, EQ Credit Services

- Mark Webster, mortgage account director, EQ Credit Services

- Ryan Davies, managing director of mortgages, Hodge

- Simon Walker, partner, KPMG

- Simon Healy, chief operating officer, Ashman Finance

Watch the recorded webinar here.