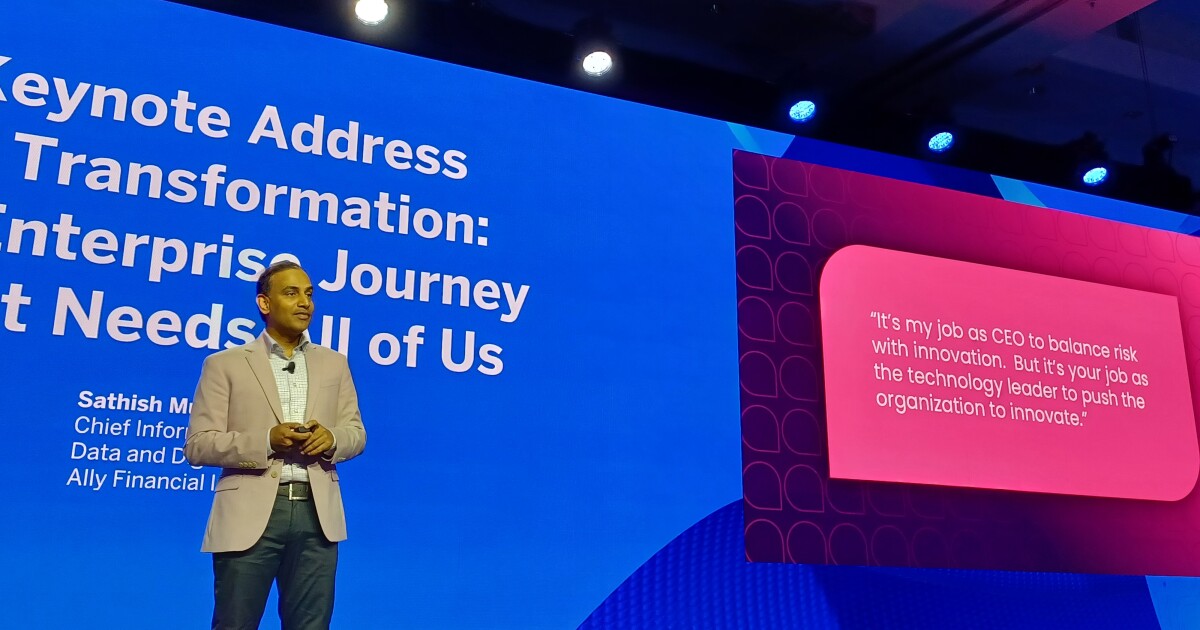

"His answer was, 'It's my job as CEO to balance risk with innovation. But it's your job as the technology leader to push the organization to innovate,'" said Muthukrishnan, the chief information, data and digital officer at the $193 billion-asset Ally, in his keynote address at American Banker's Digital Banking conference on Monday. "That hit me hard."

His quest for buy-in didn't end there. Muthukrishnan, who was named

"I realized it was important to showcase the value of the technology, but more importantly, to eliminate fear and show how we are protecting it and how we are protected from it," he said.

Many banks are using a similar strategy by proactively training their leaders, helping employees get comfortable with the technology and crowdsourcing use cases, said Nageswar Cherukupalli, who heads banking and capital markets at Cognizant, which helps companies modernize their technology.

"While Sathish of Ally was ahead of the game, when it comes to implementation and adoption, every other bank is approaching it in the same fashion," he said.

In his keynote address, Muthukrishnan laid out the steps he took.

He solicited ideas from employees familiar with the problems that generative AI could solve, including those outside of technology. His conversations with the control groups at Ally clarified that he must demonstrate how he was

Muthukrishnan also oversaw the completion of Ally.ai,

These measures "built comfort with the C-levels," said Muthukrishan. "In one of the board meetings, [our] chief risk officer said 'the strategic risk of not using generative AI is greater than the operational risk of using it.'"

Then he had to prove its promise

One way he did this was by showing, not telling, use cases that save employees time and energy. That included transcribing and summarizing calls to the contact center, getting a head start on marketing and web content, recapping earnings reports and conference call transcripts from Ally's peers and creating reports for Ally's audit teams.

He also oversaw the composition of an official AI playbook to explain how generative AI and traditional machine learning would be used, and organized "AI Days" every four to six weeks. Any employee could attend these four-hour blocks to hear from external speakers about advancements in generative AI and internal speakers about progress within Ally. The majority of the 1,200 to 1,300 participants each time are from outside the technology group.

The AI playbook "is a great initiative that other banks can learn from," said Cherukupalli. He also recommends that companies provide innovation sandboxes to their employees and gamify their training for using generative AI.

Now Ally has more than 450 use cases in its pipeline, "and most are coming from outside of the technology team," said Muthukrishnan.

Then Ally has to prioritize which of these use cases to focus on.

"You have to think like a business leader and focus on what use case will generate the most money and drive productivity," he said. "For decades, technology has been a cost vacuum or a support beam. I want technology to be a value creator and revenue generator."