The mortgage industry has invested a huge amount of time and money to create products for tapping the vast amount of

Another important change in the world of CES has been

"For second liens, which include home equity lines of credit and closed-end second liens," Kroll Bond Rating Agency reports, "issuance is projected to reach $21 billion in 2025 (up 42% YoY), extending the momentum from 2024 as homeowners continue to tap equity amid limited refinance incentives."

A number of issuers have come to the securitization market in the past several years, including JPMorgan, Rocket Mortgage, Verus, Crosscountry and Bravo. More, warehouse lenders and repo counterparties are accepting pools of CES liens for financing, further helping the economics of a product that is basically a loss leader. If the industry does $21 billion in CES liens in 2025, that is a rounding error in a market

"With close to $35 trillion of homeowner equity in residential real estate and many homeowners locked into low-rate first mortgages, HELOCs and home equity loans have become the product of choice for many homeowners," said Marina Walsh, CMB, MBA's Vice President of Industry Analysis

Walsh noted that the

But Walsh added: "While there are additional opportunities in this space for lenders, there are also challenges. For example, just 50 percent of home equity applications are closing, and turn times are averaging 39 days. Automated valuations and decisioning, integrations with mortgage platforms, and accessible self-service options are a few ways lenders intend to increase efficiency and reduce costs."

The statistics provided by Walsh suggest that CES liens are very expensive products given the small loan size. The low close rates and long turn times are not encouraging, but the CES liens do help to fill the mortgage pipeline. Yet it needs to be said that independent mortgage banks are

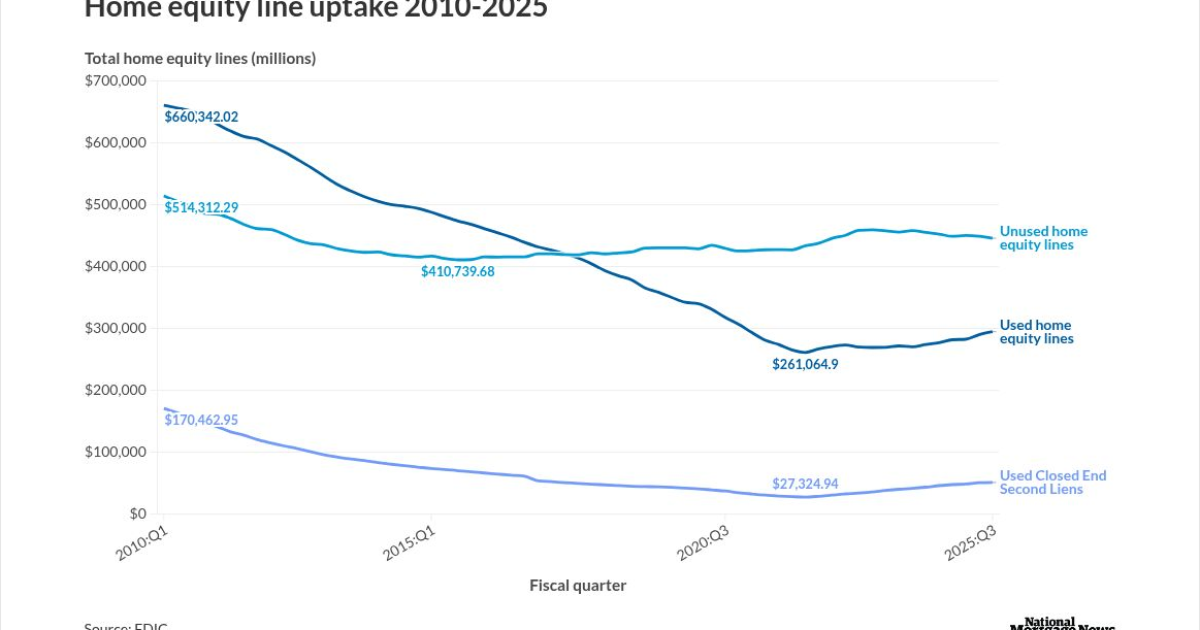

Traditionally commercial banks have been the primary provides of home equity loans in the form of revolving credit lines or "HELOCs" secured by a second lien. These are essentially revolving credit lines with a subordinated security interest in the house, usually behind a closed end first lien mortgage. The rate of utilization of bank HELOCs vs available credit is at a 35-year low, according to data from the FDIC. Total HELOCs owned by banks were just below $300 billion as of Q3 2025.

As you can see in the chart, both CES liens and

One big reason for the slow growth of home equity products is regulation. The Dodd-Frank law closed loopholes that previously made risky second mortgages profitable.

Cautious lender and borrower behavior is another factor behind the low growth of home equity products. Many homeowners remain wary due to the painful lessons of the housing crisis, where many borrowers ended up "underwater" (owing more than their home was worth). Also, second liens made loan modifications difficult and sometimes forced people out of their homes.

Another issue is sticker shock, with many consumers looking for lower interest rates on CES liens and HELOCs, but the second position for these products means that they have higher risk and this higher coupon rates. Bank Rate notes that rates on home equity products are not as favorable as primary mortgages or even refinance rates, generally running a couple of percentage points higher.

One firm that is

FOA just announced the

In August 2025, FOA announced that it repaid $85 million of higher cost working capital facilities and entered into an agreement to

Despite the exit by Blackstone, institutional investors and private equity investors collectively own a large percentage of the company's stock. Clearly a number of investors and financial institutions remain bullish on home equity products such as reverse mortgages, yet the attractive demographics and other positive factors have not served as a catalyst for strong market growth across the industry overall.

Lenders from Chase to SoFi Technologies to