Rural markets across the board saw a significant spike in property values during the pandemic housing boom, but some communities benefited more thanks to their locations and the rise of remote work.

Between March 2020 and March 2023,

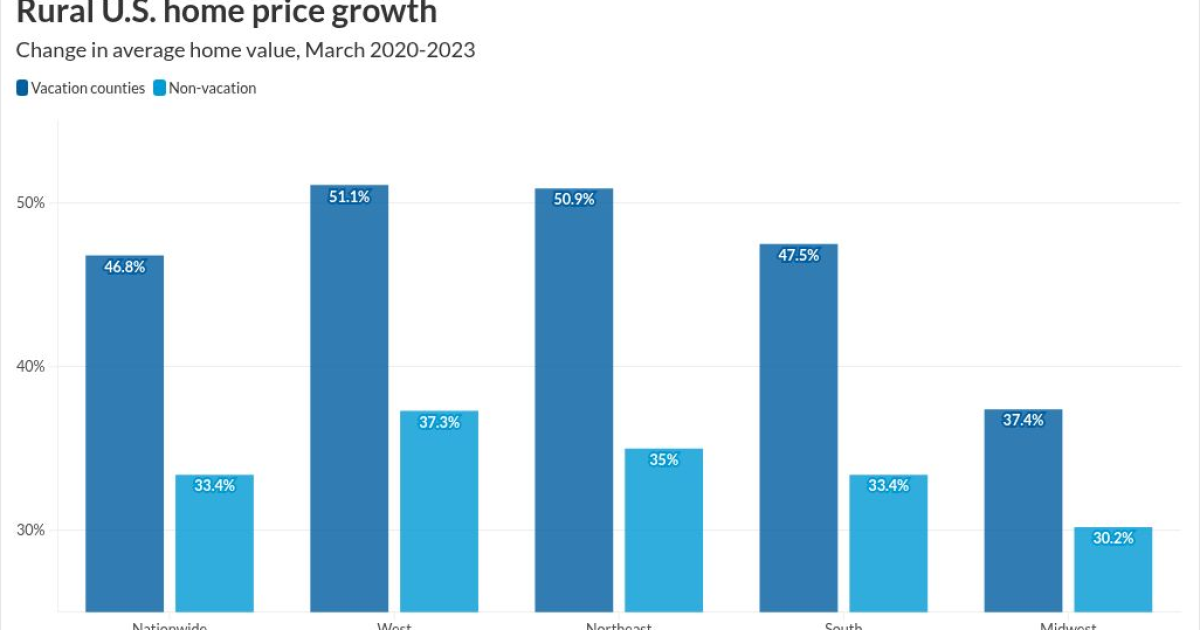

In areas with high percentages of seasonal second homes and vacation properties, the surge was even more pronounced at 46.8%, rising from 17.4% from 2016 to 2019, a new working paper by Harvard JCHS' Alexander Hermann and Peyton Whitney finds. Alongside the appeal of nearby natural attractions, such as lakes and mountains, the communities also offer robust infrastructure aimed at supporting traffic flows brought by the tourism industry.

The latter figure even exceeded the national pace of acceleration during the same three-year pandemic period as reported by

While price growth appeared across rural areas, Harvard's research models noted the particular role that the stark spike in vacation-area residents had in rising home values, with newcomers taking advantage of then-new work policies.

"The substantial growth in home prices has been driven in large part by an influx of people to rural areas. The proliferation of remote work during the pandemic allowed workers to move further from their place of employment," researchers wrote.

Defined broadly as communities located outside of metropolitan areas, rural markets reversed downward

How markets performed regionally

The boost in rural home values was evident across all parts of the U.S., with the West and Northeast experiencing the largest growth of 40.7% and 40.5%, respectively. The rural South and Midwest saw hefty increases as well at 35.5% and 31.4%.

By comparison, during the three years before the arrival of Covid, housing costs increased more modestly between 13.6% and 20.9% across each of the four regions.

The same type of widespread appreciation appeared in vacation counties, where more than one-fifth of housing stock is occupied only seasonally. The counties made up 14% of communities analyzed by the Harvard research group and are especially prevalent by the Great Lakes, in mountain communities and near beach towns on East and West Coasts.

In the three year pandemic period, home prices in vacation counties jumped up 51.1% out West and 50.9 in the Northeast. Property values in vacation counties in the South accelerated 47.5%, while the Midwest saw 37.4% growth.

While homeowners in vacation areas continue to profit from the financial benefits of the early-decade trends, rising home values present mixed fortunes to their communities, many of which rely on seasonal low-wage service employees.

Vacation counties run a risk of not having enough affordable properties available to sufficiently house tourism workers needed to serve them, and the need may make a case for public policy initiatives, the working paper pointed out.

At the same time, increasing inventory in rural areas remains a

"If domestic migration trends persist and more people continue to flow into rural areas, the need to produce both market-rate housing and more affordable housing types, such as manufactured homes, at scale in rural places will only become more pressing," the researchers said.