Mortgage originations for

This is an early downbeat sign for the independent mortgage banking community, a report from Keefe, Bruyette & Woods indicates.

Chase is the first large bank to report earnings in the current cycle and is one of the largest depository originators.

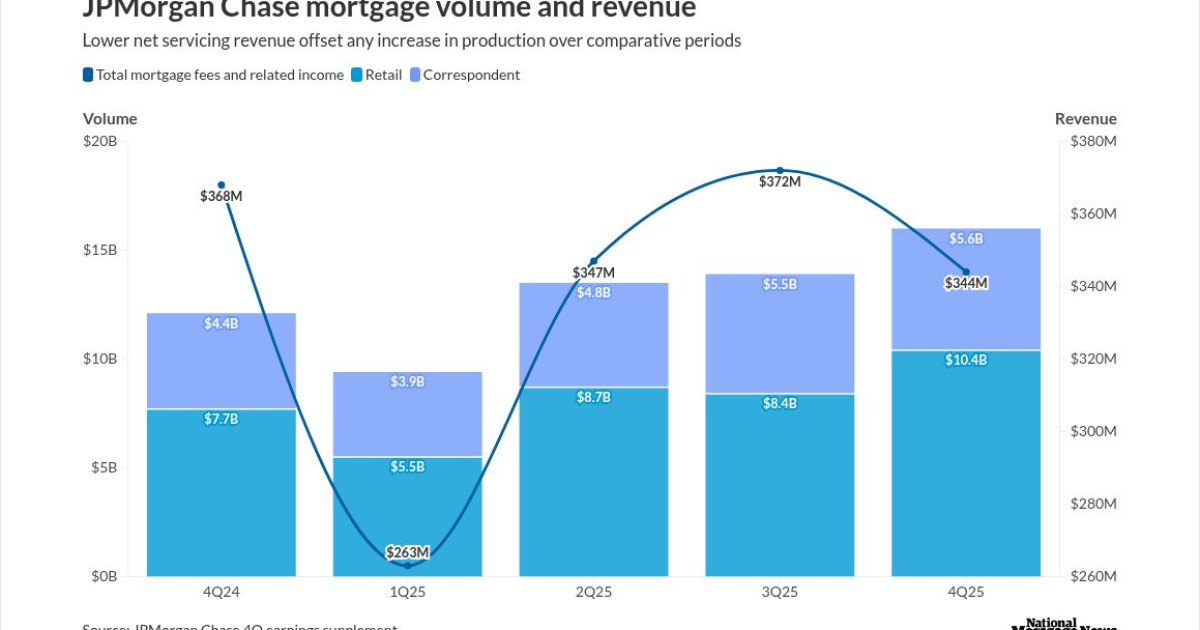

In the fourth quarter, Chase's Home Lending unit did $16 billion in production, of which $10.4 billion was in the retail channel and $5.6 billion was correspondent.

This compared with $13.9 billion

Full year originations of $52.8 billion were 29% above the $40.8 billion of 2024 volume.

How has JPM done historically compared to nonbank lenders

But the three largest IMBs all dwarfed Chase's mortgage volume in the third quarter —

Volume still rose 16% versus the third quarter at Chase, and by 32% compared with one year prior.

This is above the Mortgage Bankers Association's

What drove JPM's mortgage results in the quarter

The 24% rise in retail volume at Chase shifted its business mix to 65% from the channel, compared with 60% three months prior. Retail typically generates higher margins than correspondent volume; Chase does not have a wholesale operation.

But Chase's gain-on-sale margins fell by 6 basis points quarter-to-quarter to 118 basis points, even with the market share shift.

"We think the slightly lower GOS margin at

For the fourth quarter of 2024, a higher retail mix (to 64% from 57% in the third quarter of that year) pushed GOS up 19 basis points to 154 basis points for the period.

Mortgage fees and related income at Chase totaled $344 million. This included $188 million of production revenue and $156 million of net servicing revenue.

While origination revenues were higher than the comparative periods, servicing was lower, resulting in lower total mortgage income.

In the third quarter, Chase had $173 million of production revenue and $199 million of net servicing revenue ($372 million total), while in the fourth quarter of 2024, it had $186 million and $182 million respectively ($368 million).

The quarter-to-quarter drop off was 8%, while versus the year ago period, it was down 7%.

For all of 2025, it posted total mortgage fees and related income of $1.32 billion ($622 million originations and $704 million servicing). During 2024, its $1.38 billion of total mortgage income was $627 million originations and $751 million servicing.

How did servicing perform for JPM

George estimated Chase's mortgage servicing rights valuations ticked up by about 1 basis point to 1.38%, better than expected given the fourth quarter's decline in interest rates.

It ended the quarter with $661.9 billion in mortgage servicing rights, versus $663.6 billion on Sept. 30 and $648 billion on Dec. 31, 2024.

"Net/net, we would characterize the quarter as roughly in line with higher volumes, modestly lower GOS margins, and fairly flat MSR valuations," George said.