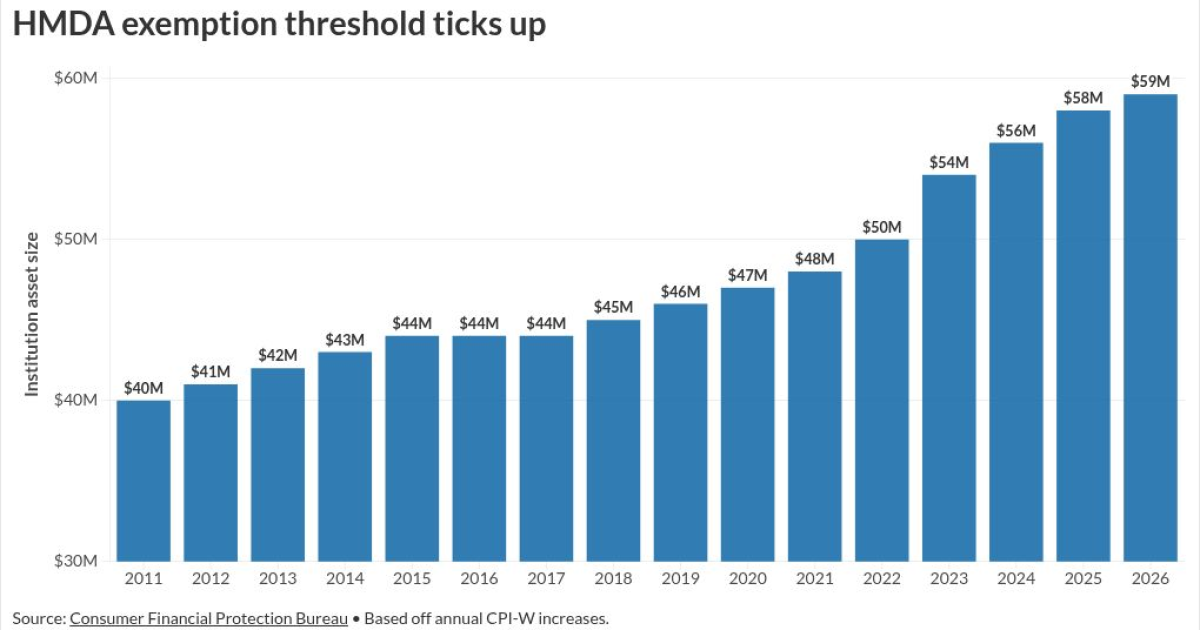

Lenders with less than $59 million in assets last year won't have to share their home loan data with the government.

The Consumer Financial Protection Bureau on Wednesday raised its Home Mortgage Disclosure Act reporting exemption threshold by $1 million over the prior year, the smallest annual increase since 2023. The regulator, which is still issuing limited mortgage oversight during its quasi-shutdown, based its adjustment on an inflation index.

Nearly 5,000 financial institutions reported HMDA data last year, slightly less than the number of originators who reported for 2023. Although there were questions of

While the Trump Administration has made several efforts to shutter the regulator altogether, a federal judge has so far

The HMDA reporting exemption has risen in all but one year since it was created in 2011, when it began at $40 million. The exemption typically rises $1 million annually, but rose $6 million in 2023 to $54 million, and by $2 million in each of the past two years.

The increases are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers, which rose 2.5% in the 12 months ending last November.

CFPB also raises mortgage escrow threshold

The bureau this week also raised two asset thresholds in which lenders may be exempt from mandatory escrow requirements for higher-priced mortgage loans. Those loans are any mortgage with specifically higher annual percentage rates than the CFPB's average prime offer rate.

The general exemption threshold for lenders was raised slightly to $2.785 billion, while the exemption for insured banks and credit unions ticked up to $12.485 million this year. In December the regulator also raised the bar for

The CFPB sets a threshold for HPMLs as loans with APORs 1.5 percentage points higher than the CFPB's own measure, or 2.5 percentage points higher for jumbo loans and 3.5 percentage points greater for subordinate loans.

The