Bill Pulte, a key housing regulator, is poised to do something about high costs associated with credit metrics as two key legislators steer him away from one related move his predecessor considered.

"Still not happy with FICO. We should be making some decisions on all related items in next 1-3 weeks," Pulte said in

The statement suggests Pulte, who is the conservator and regulator of influential loan buyers Fannie Mae and Freddie Mac as well as a board member for both entities, is looking for a way to adjust their requirements to promote efficiencies

Why some legislators don't want to reduce number of credit reports used

Score provider FICO has said in the past that

Some legislators also have recently shown

Eight legislators sent a letter to Pulte Friday calling for him to preserve the requirement that lenders merge three credit reports when they submit loans to the enterprises rather than introducing an option to use two, which his predecessor Sandra Thompson said was "expected to reduce costs."

Thompson had said research showed this could be done "without introducing additional risk to the enterprises," but the eight Republican legislators' letter took issue with this assertion.

"Under the previous administration, the agency has failed to solicit feedback and has disregarded requests to pursue such a significant change through a formal rulemaking process," the legislators said.

Reps. Scott Fitzgerald, R-Wis.; Mike Flood, R-Neb.; Bill Huizenga, R-Mich.; Dan Mueser, R-Pa.; Barry Loudermilk, R-Ga.; Young Kim, R-Calif.; Troy Downing, R-Mont.; and Tim Moore, R-N.C., signed the letter.

Why it could matter in an exit from conservatorship

The three-report requirement is particularly important given the interest President Trump recently showed in

"Maintaining the tri-merge framework will help to ensure that both Fannie and Freddie's balance sheets are sound and the housing market is secure, paving the way for smooth and lasting transition from conservatorship," the congressmen said.

Studies of whether a two-report option would be risky are mixed. A Standard & Poor's study found

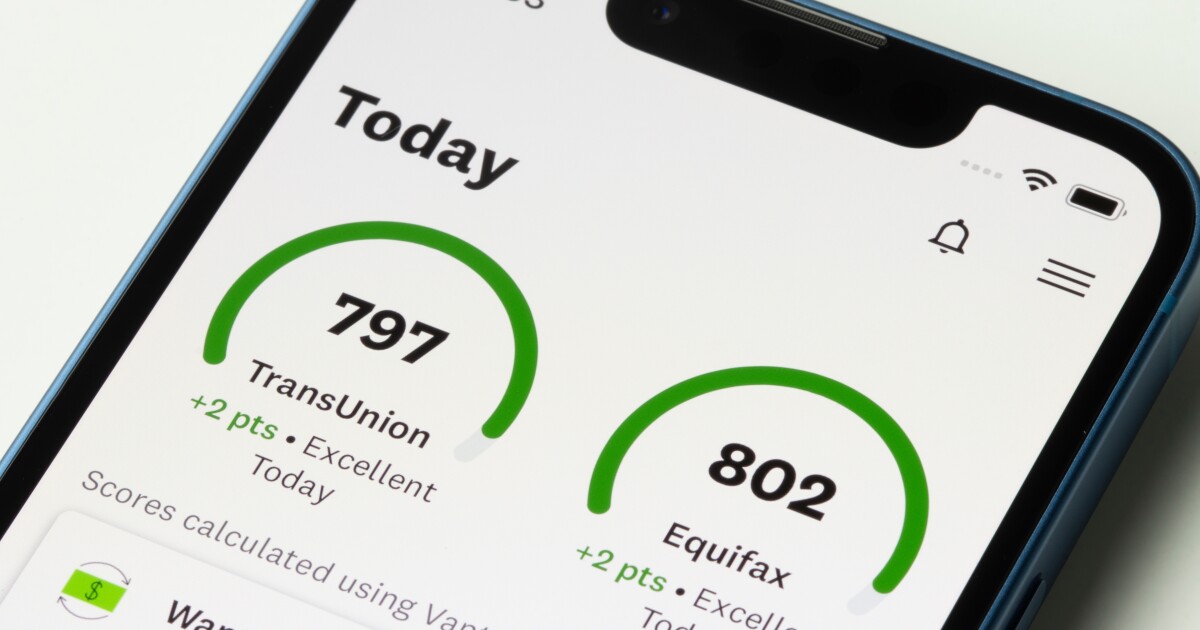

"The tri-merge credit report reflects the most accurate picture of a consumer's creditworthiness and is an essential driver of safety and soundness in the mortgage ecosystem," Transunion said in a statement released Monday.

Dan Smith, president and CEO of the Consumer Data Industry Association said in a separate statement on the value of the tri-merge that it plays a role in lowering mortgage rates and "ultimately consumer credit reports represent a very small portion of overall closing costs."