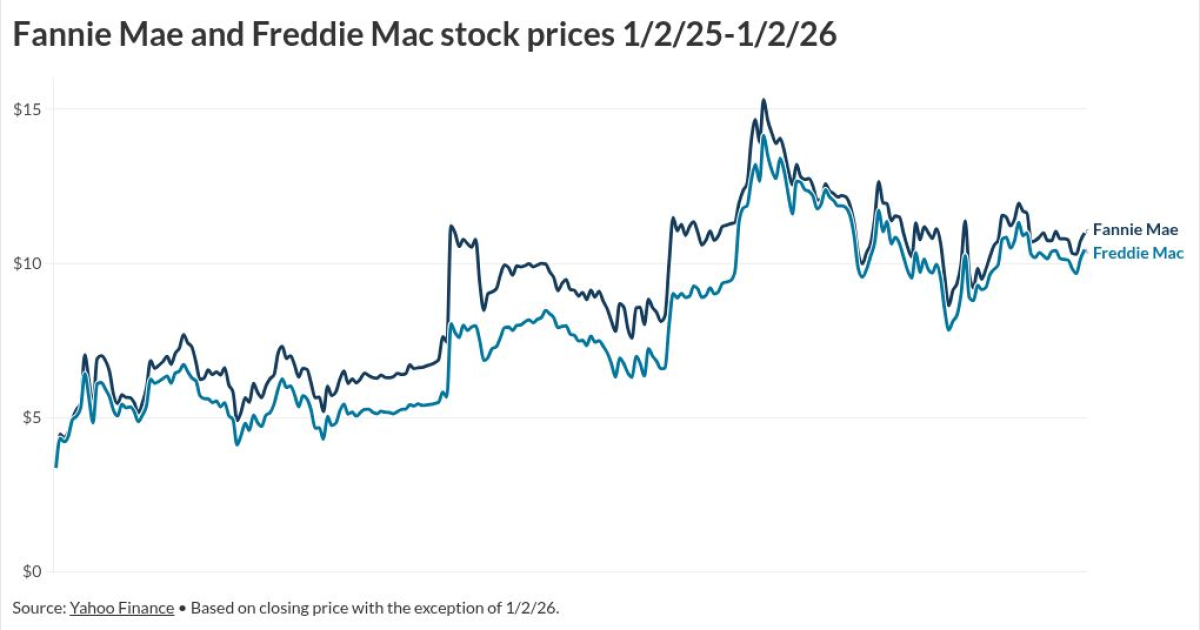

The will to explore a new move that will put the government-sponsored enterprises on a path to be recapitalized and released from conservatorship exists; the question now is how, when and if.

All that could depend on whether the Trump administration is willing to make investor concessions and offer new shares, according to Henry Coffey, an analyst at Wedbush Securities and the author of a recent report on paths he foresees Fannie Mae possibly taking.

Federal Housing Finance Agency Director Bill Pulte has said he's considering an offering for 5% of Fannie and Freddie's shares in the near term. But he also has stressed

A definitive move toward recap and release could happen as soon as fiscal year 2026 or take until 2033 if the administration decides to move forward with one, according to Wedbush.

A step away from conservatorship could occur in the near term, Bill Ackman, billionaire founder and CEO of investment firm Pershing Square Capital Management and a legacy GSE investor, recently reaffirmed in revisiting his

"It remains our best idea for 2026," Ackman said in an X social media post.

Building capital without issuing new stock

One path away from conservatorship, which the report labels option A, would be to not issue any additional shares but instead retain earnings in order to amass required equity, according to Coffey, who came out of retirement to cover Fannie's stock. He also now covers Freddie Mac's stock.

At that point, the Treasury could begin getting a 10% dividend associated with the carrying value of the senior preferred, which is the stock tied in with the agreements struck between Fannie Mae, Freddie Mac and the government when the GSEs were forced into conservatorship.

"It's going to take eight years to retain and generate the kind of equity capital they need to meet the requirements that the FHFA has already outlined, and the idea that they could operate with less is interesting. But frankly, I would call it dangerous," Coffey said in a recent interview.

"I don't think that's the acceptable path," he added later in the conversation. "I think the more likely path is that you convert some of the preferreds to common."

Two potential paths for senior preferred shares

The path for conversion that has gotten the most attention recently has been deeming the senior preferred shares paid, a move Ackman has favored in line with

The value of the senior preferred shares would be preserved in the conversion to common through a stock swap, the Wedbush report notes.

Deeming "results in no shares being issued on the senior preferred conversion, fewer overall shares being issued and a higher estimated stock price," Coffey wrote in the report, adding that the last point is "an important consideration." Wedbush refers to this as option C.

"We are leaning towards something akin to Option C in our own thinking," the report states, noting that if policymakers do want to meet the goal of staging a 5% offering in the near future and building up more than $28 billion in equity that's needed, "they will need to give up something."

Options B or C could lead to a definitive move away from conservatorship as soon as the 2026 fiscal year, according to the report, which also notes that other paths may be possible.

What could happen next

Given the importance of capital, the next step policymakers should take is to explain how they foresee Fannie and Freddie building it to sufficient levels, Coffey said.

"It all boils down to step one: clarify the capital plan. Tell people where they're going to end up," Coffey said.

"The stars are aligned in the right direction, and if they want to move forward, this is the way to move forward," he added. "There'll be lawsuits, there'll be politicians, there'll be everything. But eventually, if they want to see mortgage risk move back to the private sector where it belongs, and if they want to see a vibrant Fannie Mae and Freddie Mac, then they're going to have to just work through all this."