Weekly mortgage application volume shrank for the first time this year with purchases and refinances both slowing, according to the Mortgage Bankers Association.

The MBA's Market Composite Index, a measure of weekly loan applications based on surveys of association members, decreased a seasonally adjusted 9% for the period ending Jan 27 after accelerating by 7% and 28% earlier in the month. Compared to the same week last year, activity came in 62% lower.

"Overall application activity declined last week despite lower rates, which is an indication of the still volatile time of the year for housing activity," said Joel Kan, MBA's vice president and deputy chief economist, in a press release.

The seasonally adjusted Purchase Index fell 10% week over week and still sat 41% below levels of a year ago. But various reports tracking year-end activity, including new-home and pending sales, also showed 2022 closing out with an uptick

Although winter is typically the slowest time of year for home buying, "purchase activity is expected to pick up as the spring home buying season gets underway, bolstered by lower rates and moderating home-price growth," according to Kan.

"Both trends will help some buyers regain purchasing power," he said.

The Refinance Index dropped 7% from the previous week, and with current interest rates still far above early 2022 readings, volumes were 80% lower on an annual basis. The share of refinances relative to total applications also declined to 31.2% from 31.9% one week prior.

With borrowers locked into low interest rates having little incentive to refinance, they were more likely to turn to home equity loans last year, which saw a steep increase, according to new research from TransUnion.

Meanwhile, adjustable-rate mortgages took a larger share of activity in the MBA survey in spite of decreasing rates, rising to 6.7% of total volume from 6.5%, the first weekly uptick this year.

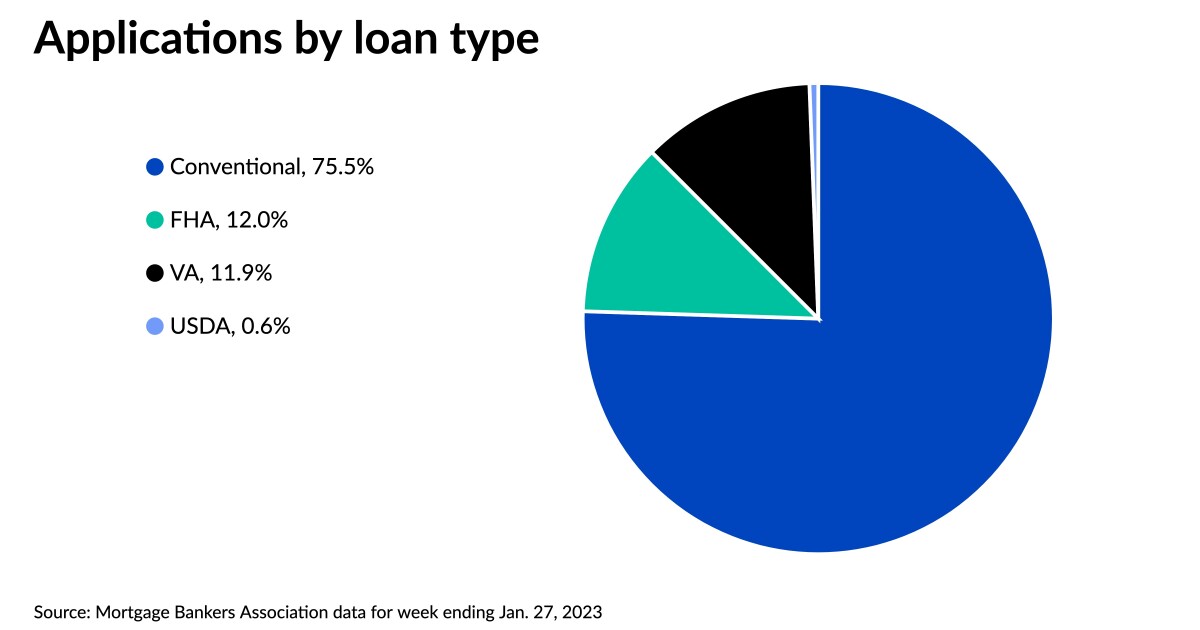

MBA's seasonally adjusted Government Index contracted last week by a larger margin than overall activity, contributing to a smaller percentage of federally backed applications. Federal Housing Administration-backed loans accounted for 12% of total volume, edging upward from 11.9% seven days earlier. But the share of loans guaranteed by the Department of Veterans Affairs shrank by more than one percentage point to 11.9%, compared to 13% the previous week, while U.S. Department of Agriculture-sponsored applications took the same 0.6% slice.

Average loan amounts recorded on applications remained relatively flat overall, with purchase sizes up refinances down both by less than half of 1%. The average purchase size climbed up 0.4% to $416,800 from $415,000 week over week, while mean refinance amounts inched downward 0.1% to $269,000 from $269,300. The average size across all new loan applications for the week came in at $370,700, up by 0.6% from 368,500 a week earlier.Loan-application sizes have gradually increased in early 2022 at the same time interest rates slide in the other direction. "Mortgage rates declined for the fourth straight week and have now fallen almost 40 basis points over the past month," Kan said.

"The spread between mortgage rates and the 10-year Treasury has been abnormally wide since early 2022. Further narrowing of that spread is expected to put downward pressure on mortgage rates in the coming months," Kan added.

The contract interest rate of the 30-year fixed mortgage with conforming balances of $726,200 or less averaged 6.19%, down 1 basis point from 6.2% seven days earlier. Points decreased to 0.65 from 0.69 for 80% loan-to-value ratio loans.

The average rate for 30-year fixed jumbo mortgages exceeding the conforming amount saw the only weekly increase, climbing to 5.99% from 5.92%. Points increased to 0.48 from 0.41.

The FHA-backed 30-year fixed contract rate averaged 6.18%, falling 4 basis points from 6.22 a week earlier. Points decreased to 0.99 from 1.1 for 80% LTV mortgages.

The average contract rate of the 15-year fixed mortgage took a similar drop to 5.5% from 5.54% week over week, with points increasing to 0.73 from 0.51.

Meanwhile the contract interest rate of 5/1 ARMs averaged 5.38% compared to 5.44% a week earlier. Points saw no change, remaining at 0.83.