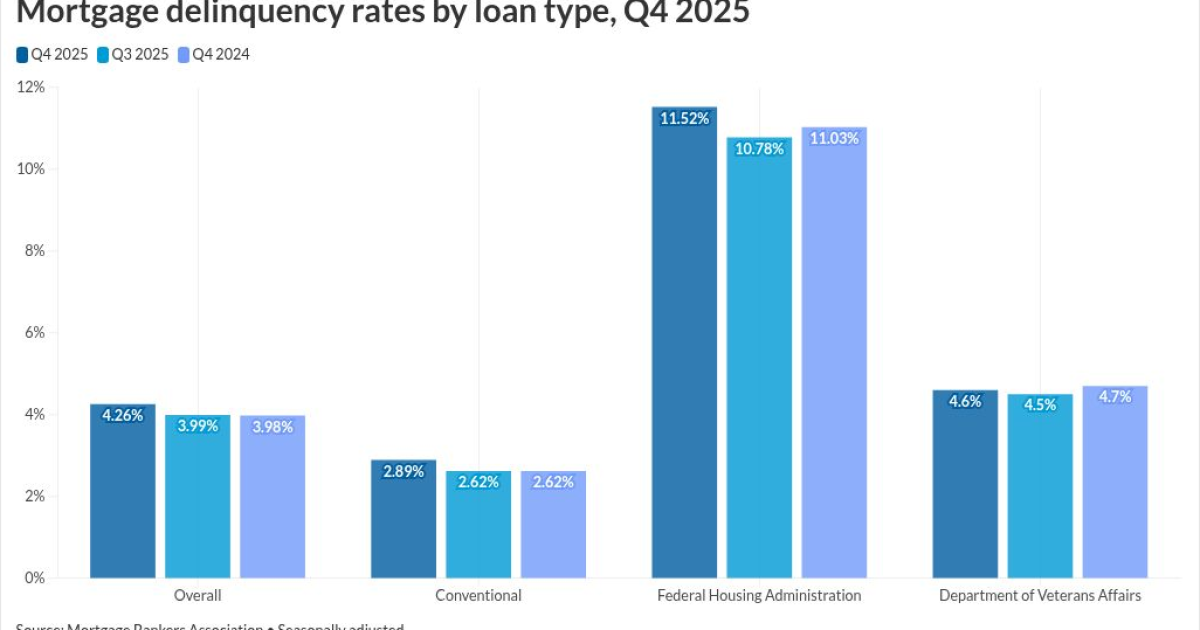

Mortgage delinquency rates increased in the most recent quarter, with Federal Housing Administration-backed distress spiking to multiyear highs, according to the latest industry report.

Delinquencies increased to 4.26% in the fourth quarter on a seasonally adjusted basis,

Driving the increase were distressed FHA borrowers, whose delinquency rate hit 11.52%, the highest mark since mid 2021 and up 74 basis points from the third quarter. Compared to one year earlier, the latest number also rose 49 basis points.

"The fourth-quarter results may have been impacted by the expiration of pandemic-era, FHA relief options as well as disparities in the labor market — a key determinant of mortgage delinquency levels," said MBA vice president of industry analysis Marina Walsh in a press release.

Signs of labor weakness appeared toward the end of last year, with unemployment numbers up by over half a million on a yearly basis

"While earlier-stage FHA delinquencies remained relatively flat compared to the previous quarter, later-stage, 90-plus day delinquencies increased by 76 basis points. The FHA foreclosure inventory rate also grew to the highest level since the first quarter of 2020," Walsh pointed out.

MBA's data further illustrated that FHA loans originated in 2021 and 2022, when mortgage rates were at record lows, showed more strength compared to the vintages of the ensuing two years when geopolitical and economic conditions put a dent in home affordability.

Recent

Delinquency levels by loan type and stage

While the FHA segment saw the most noticeable uptick, the same trend showed up across the board.

- Conventional Fannie Mae- and Freddie Mac-backed borrowers recorded a delinquency rate of 2.89%, up a seasonally adjusted 27 basis points from both the previous quarter and year.

- Delinquencies on loans insured by the Department of Veterans Affairs increased 10 basis points to 4.6% from the third quarter but was down by the same margin from 12 months earlier

Mortgages 30 days past due fell 5 basis points to a share of 2.07%, but later-stage rates increased from the prior quarter. The 60-day rate increased 16 basis points to 0.92%. The 90-day delinquency rate also headed up 16 basis points to 1.27%.Mortgages in foreclosure at the end of the fourth quarter came in at a rate of 0.53%, rising 3 and 8 basis points from three months and one year prior.

Mississippi posted the greatest quarterly increase in the country, with its delinquency level surging 109 basis points. It was followed by Louisiana and Maryland at 89 and 87 basis points, respectively. Oklahoma and Indiana were next, both recording increases of 86 basis points.