The transition toward updated credit score models at Fannie Mae and Freddie Mac, while less dramatic than

Given that classic FICO and tri-merge credit reports sit at the center of many mortgage systems, it's worth looking at what's driving the push for change and how those shifts could affect the market. How will it affect origination, pricing, and borrower eligibility? We investigate below.

The momentum behind rent reporting

The director of Fannie Mae and Freddie Mac's oversight agency has emphasized the addition of rent reporting in particular.

The GSEs already have

Fannie can get digital rental information from bank accounts, credit reports or through a multifamily payments and rewards platform like Bilt's. However, the traditional credit system tends to be the main channel.

"I think more and more people are now leaning towards the credit bureaus just because they have such a high penetration in terms of usage," Lawless said.

Adding factors like rent to advanced scores could give certain borrowers a little more weight in the GSE mortgage purchase process, primarily if they lack credit history.

The share of rent records reported into the credit system has been low but TransUnion found in a study released earlier this year, that the numbers have been growing due in part to

"The population that's able to get their rent reported is growing really quickly," Lawless said, noting that Bilt is adding 50,000 records per month to this end.

The caveat: When rent reporting can lower a score

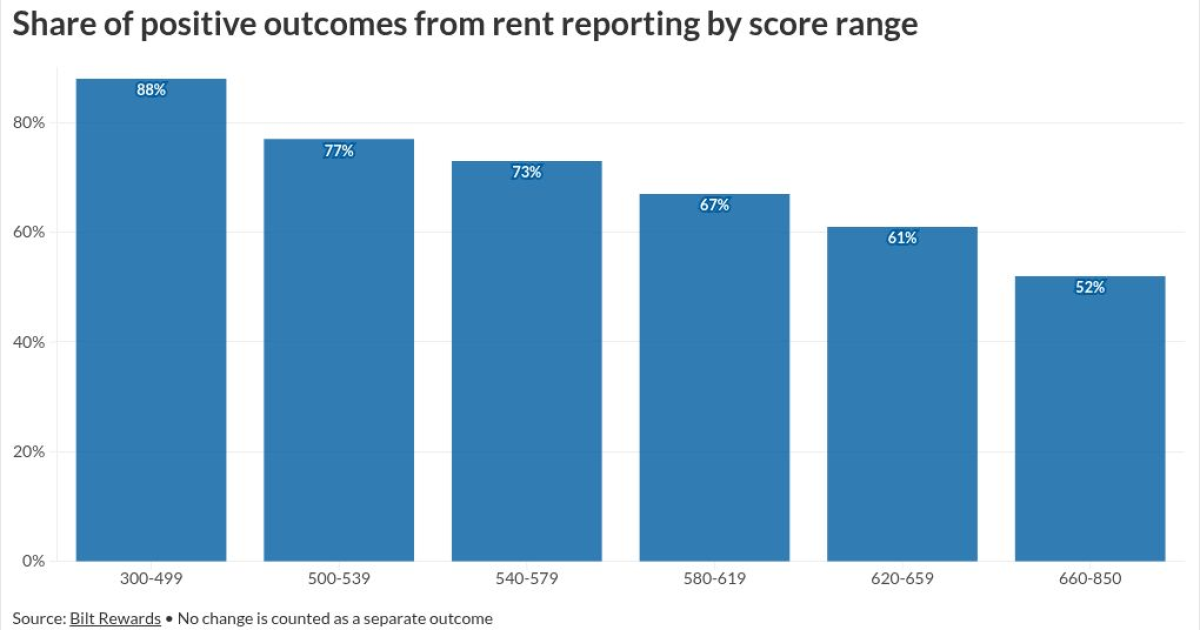

The GSEs, which have been working to facilitate rent reporting so that more of it can be incorporated into credit metrics, might want to be careful about how the information gets submitted because Bilt found rent reporting outcomes are primarily positive but can be adverse.

"For about 10% of our renters, we see their scores go down if we were to add a rental trade line to their credit report," Lawless said. "Those tend to be higher credit score borrowers with certain attributes in which adding a clean 12 months of history can hurt you."

When the average age of tradelines shortens, bureau credit-report information that score models digest can generate a mildly negative result in some cases, he said. Borrowers and lenders who work with them may want to be sure the way rent history gets added addresses this concern.

"We have now worked with all the bureaus to let us report any lease continuation as a singular tradeline," Lawless said. "So as long as you're in the same building, we can report it as one tradeline and not have to kind of create new tradelines every time you renew your lease."

How rent data can reduce LLPAs and MI premiums

Fannie Mae recently joined

The update does not change existing requirements for lenders to obtain credit scores for their records and assessments. "Though DU will no longer apply a minimum credit score requirement, lenders are still responsible for ensuring that credit scores for all borrowers are requested," the GSE noted in its selling guide.

Credit scores still play a role in pricing, but for borrowers who might not otherwise be able to establish a credit score or obtain a favorable rate due to their payment history, rental data could improve their score by around 10 points, in some rarer cases 20 or 40, Bilt found. The average is lower, ranging from 2 to 19 points.

So a focus on what increased rent reporting could mean seemed more practicable than just looking at it solely in advanced scores, which also incorporate new types of data beyond tenant payments.

If the number is in the 20-40 point range, it could reduce upfront loan-level price adjustments for the lender roughly 10 to 50 basis points or 0.5% under existing pricing mechanisms, which may not remain constant. Lenders may choose to pass that on to the borrower.

Private mortgage insurers who partner with the GSEs in absorbing some risks for borrowers with lower down payments also may reduce premiums that are pegged to credit metrics by almost 20 basis points with the addition of rent data, Lawless estimated.

Bilt came to its conclusions based on an examination of rent's impact on the FICO 9 score using a simulator which allowed for tradeline changes.

A meaningful number of people could improve their scores with the addition of rent data, but it may be less impactful for higher credit score borrowers if pricing grids remain consistent.

"If you're at a 740 and didn't count rent, now you have a 745 with that history, you were going to get approved anyway and it will have no impact on pricing; but some people will be moved over a bucket," Lawless said.

Some of the caveats around these estimates follow.

The head of Fannie and Freddie's oversight agency has considered proposals for changing the LLPAs so the interplay with rent reporting could change. Classic FICO underpins many aspects of GSE operations, and their pricing grids may need to be updated to allow for new scores.

Also, while the MIs published some pricing grids going back to years like 2018, their models more recently have been more complex and opaque. The estimate is based on calculations around a historical MGIC rate card.

Investors concerned the new scores' limited use in the mortgage market could offer a less favorable price for loans made based on them, although

"Will investors accept this change? Will they find it significant? How will they respond to this?" Chris Whalen, an author, analyst and investment banker, asked during a panel at an American Enterprise Institute meeting earlier this year, noting that the last housing crash was in 2008.

Lenders have chosen to utilize advanced scores for some loans sold to investors outside the GSE market, and in some cases FICO classic data also has been provided to give buyers comfort. However, this can add to credit reporting and scoring costs.

The rising cost of Classic FICO and the competitive landscape

As previously reported, at deadline the cost of the FICO classic credit model that's still broadly used was

FICO has blamed the increase, in part, on the bureaus. One of the bureaus, TransUnion, has described its pricing increases as

News of the price hike followed competitive moves like repositioning by FICO

Credit reporting and scoring costs are not high on a per unit basis and may be passed on to consumers that get loans. The high end of the range is over $100, and the total cost to originate is several thousand dollars.

That said, the industry has been experiencing higher fallout rates where people start applications but don't follow through, making expenses in this area more impactful.

Around 1.9 million of more than 5 million mortgage applications started in 2023 and 2024 did not result in originations, according to Amy Crews Cutts, president of AC Cutts and Associates LLC and a longtime industry economist who recently authored a white paper on mortgage credit.

"We're talking about $115 million to $240 million that lenders are spending on loans that don't finish," she said.

The single-pull conundrum: Competition vs. adverse selection risk

The Mortgage Bankers Association has been pushing for research into whether the GSEs could add to competition and lower costs by allowing alternatives to the tri-merge of all three credit bureaus' reports in which fewer could be used.

Lawless said he anticipates advanced scores could be objective indicators of performance and situations where lenders decide to use a single bureau's metric consistently. He shows concern about the idea of picking a different credit report provider or score for each loan.

"If you can pick a score on a per loan basis, what are you going to do? You pick the best one every time, and if you pick the best one every time, you're now biasing the data in a really terrible way," he said. "I don't think they'll do that."

Cutts, who has worked for the National Association of Credit Management and Equifax in the past, reported in her white paper that a single credit pull could put borrowers at a disadvantage even if it was consistent.

The report found that if a lender happened to pick a score from a single provider that turned out not to be optimal for a particular loan, then passed the cost through to the borrower, that person could end up paying as much as 0.625% more than they would otherwise.

Cutts also estimated that mortgage-backed securities investors could price less favorably based on a single pull because they'd see it as less reliable.

An average metric may be a way to address this concern, but this reduces opportunities to spur competition, among other things.

The conundrum is reflective of the broader tension in credit reform around finding reasons and ways to replace a working system for mortgage credit reporting and scoring with a more updated one without too much upheaval and cost.

"On one hand, you could say, 'Why do I fix a thing that's not broken?' On the other hand, you can say, 'Well, we have a lot more data about consumers that we want to incorporate, and we want to price mortgages as accurately as we can.' I think those are two different dynamics that we're trying to evaluate," Jonathan Glowacki, principal and consulting actuary at Milliman, said at the AEI conference.