Newly initiated foreclosure actions at banks have risen on a consecutive-quarter basis but the overall performance of financial institutions' home loans has remained resilient from a credit perspective.

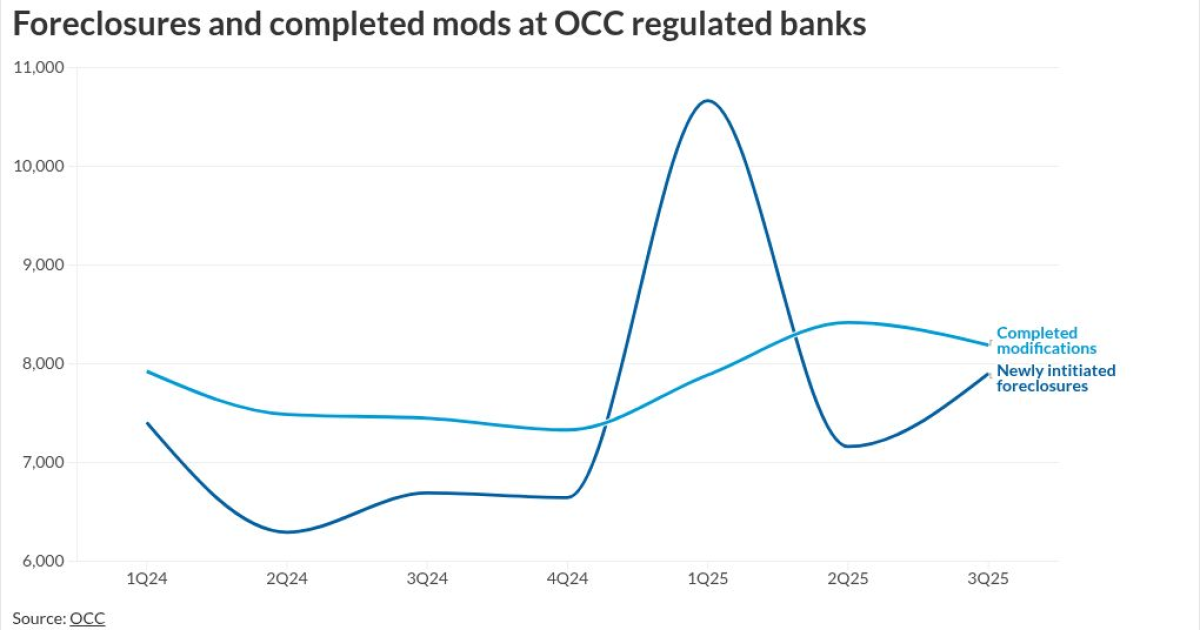

Foreclosure starts jumped to 7,903 from 7,163 the previous quarter and 7,450 a year earlier, according to the Office of the Comptroller of the Currency's latest Mortgage Metrics report.

The modest third-quarter uptick in foreclosures reported for banks that the Office of the Comptroller of the Currency regulates is in line with

Despite this,

The relative strength in mortgage credit is in line with some comments Wells Fargo CEO Charlie Scharf made earlier this month. While

"The consumer continues to spend," Scharf told attendees at the Goldman Sachs Financial Institutions Conference in New York.

Signals are mixed on how effectively banks are reengaging mortgage borrowers who have fallen behind on their payments.

Completed trial modifications, which allow for transitions into permanent ones, dropped to 8,190 from 8,419 in the second quarter. Mod completions aimed at bringing loan terms in line with consumers' changed financial circumstances were higher than a year ago, when they totaled 7,450.

Re-default rates were up from both the previous quarter and a year earlier, rising to 1,954 from 1,874 and 1,756, respectively.

The first-lien mortgages the OCC tracks for its Mortgage Metrics report make up around one-fifth of all outstanding residential debt of this type, or around 10.5 million loans with a total principal balance of $2.7 trillion.