Homeowners with a mortgage gained over 31% in equity on a year-over-year basis in the third quarter, providing them with a buffer against foreclosure as pandemic-related forbearances wind down, CoreLogic said.

Rising home values also drove the share of borrowers underwater on their mortgage to a 12-year low of 2.1%. Consequently, 70,000 properties moved back into positive equity during the period.

"Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they've also enabled many to continue building their wealth," Frank Martell, CoreLogic president and CEO, said in a press release. "This financial reserve will be especially helpful for homeowners looking to fund renovation projects."

CoreLogic estimated that 1.2 million borrowers had to exit forbearance by the end of September.

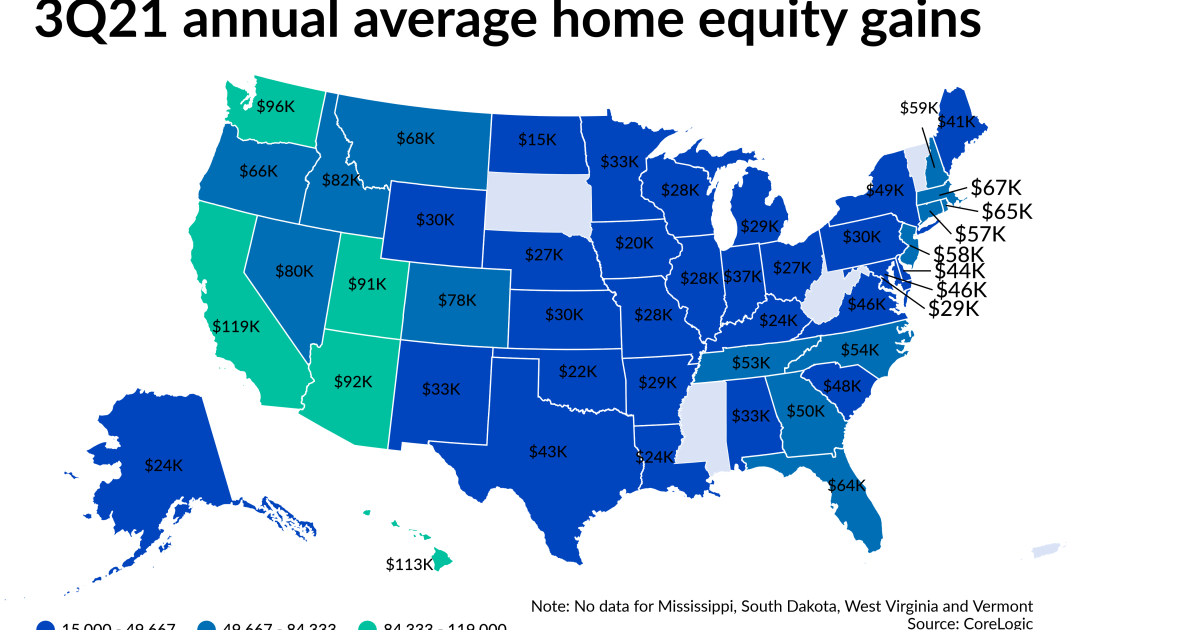

Approximately 63% of homeowners have a mortgage on their property. Compared with the third quarter of 2020, this group had a collective equity gain of over $3.2 trillion for an average of $56,700 per borrower.

At the end of the third quarter, 1.2 million underwater homes were underwater, a 5.7% drop from the second quarter, virtually unchanged on a unit basis, and a 28.9% decline from the third quarter of 2020, when 1.6 million homes were in a negative equity position.

On an aggregate basis, the value of properties in negative equity was approximately $276.2 billion at the end of the third quarter, up approximately $8.2 billion, or 3%, from $268 billion in the second quarter. But this was down year-over-year by approximately $8.3 billion, or 2.9%, from $284.5 billion.

If home prices were to rise by 5% from where they were at the end of the third quarter, an additional 45,000 homes would return to positive equity; but if they dropped by 5%, 191,000 more would be underwater.