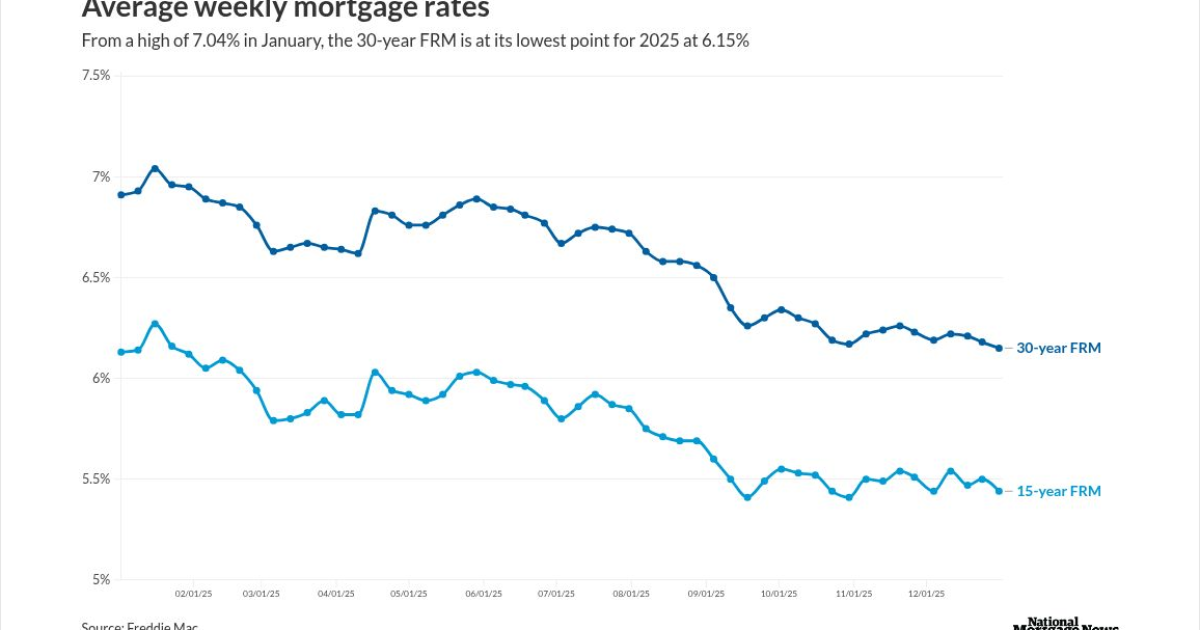

The 30-year fixed rate mortgage is ending 2025 at its lowest point for the year, but still in the same flat range it occupied since late October, according to Freddie Mac.

The rate for this mortgage averaged 6.15% on Dec. 31,

Meanwhile, the 15-year FRM averaged 5.44%, a decline of 6 basis points from Dec. 24 when it averaged 5.5%. But this is not the 2025 low for this product; the 15-year FRM was at 5.41% for Sept. 18 and Oct. 30. For the same week a year ago,

"After starting the year close to 7%, the average 30-year fixed-rate mortgage moved to its lowest level in 2025 this week, an encouraging sign for potential homebuyers heading into the new year," Sam Khater, Freddie Mac's chief economist, said in a press release.

Lender Price data on the National Mortgage News website put the 30-year at 6.34% at 11 a.m. Wednesday, a loss of 2 basis points from seven days prior. On Jan. 2, the 30-year as tracked by Lender Price was at 7.22%.

Over the week, the 10-year Treasury yield remained essentially flat, ending Christmas Eve at 4.14%. It closed unchanged on Dec. 26, fell to 4.12% on Dec. 29 and rose 1 basis point the next day. By 11 a.m. on Wednesday, it was back to 4.14%.

The year-low for the 10-year Treasury was 3.89% on April 7. While on several occasions, the yield did break under 4%, it was not sustained.

Data on the Optimal Blue website shows the low for the 30-year conforming rate was 6.12% on Oct. 28. Rates were subsequently in a range 6.25% or lower and on Dec. 30, the Optimal Blue tracker was at 6.14%.

Both Freddie Mac and Optimal Blue reported that the 30-year FRM was above 7% for a brief period last January.

The Federal Open Market Committee

The reduction will be for a total of 1 percentage point.

"Weak home prices are raising deflation concerns that the Fed needs to address," Navellier said. "Additionally, there is no reason for the Fed to remain restrictive when the U.S. economy is not creating many jobs, so in my opinion, the Fed has to cut key interest rates four more times in 2026 to move to a neutral rate, and more may be needed if deflationary pressures intensify."

Fannie Mae's