The fact that more recent home purchasers used cash rather than finance their transaction quantifies how competitive the market has been since the pandemic started.

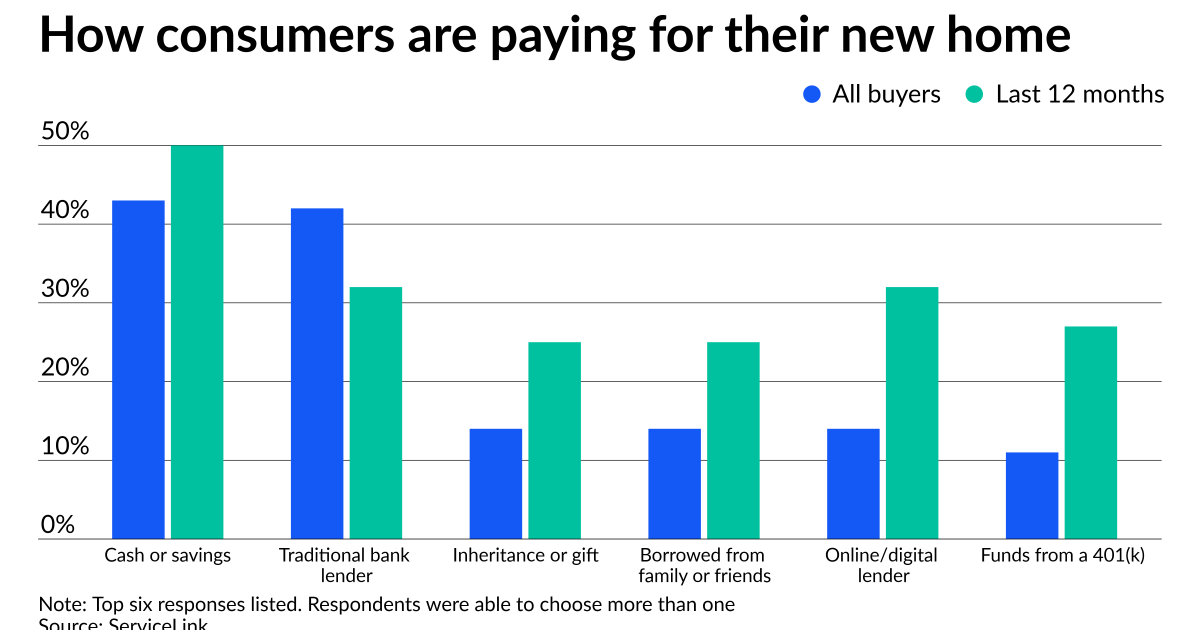

Approximately 43% of all respondents to a ServiceLink survey said they used cash on hand or savings to purchase their home, while 42% went to a traditional lender to finance it. That gap widens when the question was asked of those who purchased in the last year, to 50% using cash or savings, and 32% financing from a traditional lender.

Among all respondents, 14% said they went to a digital or online lender; that increased to 32% among those that bought in the last year.

Respondents were able to choose more than one option for this question.

In March, Redfin said a cash offer increased the likelihood of seller acceptance by 290%, according to an analysis of transactions made through its agents.

"The COVID-19 pandemic and market conditions forced the real estate industry to reassess how it serves today's homebuyer," Dave Steinmetz, president of origination services at ServiceLink, said in a press release. "With the evolution of technology to help streamline the process, it's not surprising that our data found consumers are turning to tech-enabled providers who can meet their needs through any phase of the process."

ServiceLink, which is a subsidiary of Fidelity National Financial, surveyed 1,000 homeowners that were interviewed by Market Cube between April 14 and April 19.

Among those who purchased a home last year, 27% said they borrowed against their 401(k) account for funds, compared with just 9% who bought a home in prior years. Baby boomers, a group closer to retirement age, were least likely to touch those accounts, at 1%, compared with Gen X (11%) and Gen Z/millennials (17%). Younger people may be more likely to dip into or even liquidate those funds to use for other purposes.

Borrower education efforts paid off for lenders, the survey found, with 73% of those that bought a house in the last year responding that they felt fully informed about the process. This was up from 59% of those who made their purchase prior to 2020.

But the survey did find a disparity between those that used an online lender versus those that used a traditional lender. A breakdown of the numbers shows a disparity between online lenders and traditional lenders. Nearly three-quarters, 72%, of online lender customers felt they were fully informed about the home buying process, but that was only true for 58% that used a traditional lender.

Meanwhile the survey found that only 30% of existing borrowers refinanced last year, with younger borrowers more likely to take advantage of the opportunity.

The youngest demographic had the highest share of refinancers as 45% were Gen Z/millennials, while 30% were in the Gen X group and just 6% of baby boomers.

When asked why they did not refinance, 40% of borrowers said they had a rate they were comfortable with, while 27% wanted rates to fall further. Another 18% said closing costs were too high, 13% called the process too time intensive to undertake and 7% said they did not know how to start the process.

These results matched a similar survey taken in late April by Zillow, which found that in the preceding 12 month period, just 22% of respondents refinanced their home (although it did find that 59% had done a refi at least once at some point while owning their current property).

When asked why they did not refinance, 37% reported that they were considering moving or paying off their mortgage soon, and 38% said fees were too high. About 29% of homeowners did not refinance because they didn't understand the process, Zillow said.

"In general refinancing a mortgage should be a bit less intense than a few weeks away at puppy boot camp," Jonathan Lee, Zillow Home Loans senior director, said in a press release. "A few hours of online shopping, talking to a mortgage professional and signing documents is a small price to pay for hundreds of dollars in potential savings per month, and goes a long way toward funding those dog training classes."

The ServiceLink survey had some good news for lenders: they are largely succeeding in keeping their existing customers. When considering refinancing, more than 43% first sought out their current lender, while only 28% looked at a new lender.