Mortgage activity picked up for the second week in a row, even as new applications refinances dropped to their lowest weekly level two years, according to the Mortgage Bankers Association.

The MBA’s Market Composite Index, a measure of loan volume based on a survey of association members, increased 2.3% on a seasonally adjusted basis for the weekly period ending Jan. 14. Compared to the same week of 2021, mortgage activity came in 37% lower.

The Refinance Index fell 3% week-over-week and sat 49% below its level from a year ago. Joel Kan, MBA’s associate vice president of economic and industry forecasting, attributed the recent decline in numbers to rising rates, with the 30-year mortgage jumping by more than 30 basis points in two weeks. Fewer government-backed refinances, in particular, contributed to the decline, he said.

The amount of purchases has been elevated since the start of the year, though, after cooling off to end 2021. The seasonally adjusted Purchase Index saw an 8% increase compared to the previous seven-day period, but was down 12.2% year-over-year. A higher number of conventional applications led to the weekly spike and also drove the average amount to a new high.

“The average loan size for a purchase application set a record at $418,500,” Kan said. “The continued rise in purchase loan application sizes is driven by high home-price appreciation and the lack of housing inventory on the market — especially for entry-level homes.” The average increased 4.2% from $401,700 the previous week.

“The slower growth in government purchase activity is also contributing to the larger loan balances and suggests that prospective first-time buyers are struggling to find homes to buy in their price range,” Kan added.

The decrease in government refinance applications, though, did not carry with it a similar outcome, as the mean size of refinance loans inched down 0.9% to $299,500 from $302,300 a week earlier. The average size of all loans for the week climbed 2.6% to $346,800 from 338,000 during the previous period.

The refinance share of applications also dropped, falling to 60.3% from 64.1% of new activity. Adjustable-rate mortgages jumped up to 3.8% of total volume, compared with 3.1% a week earlier.

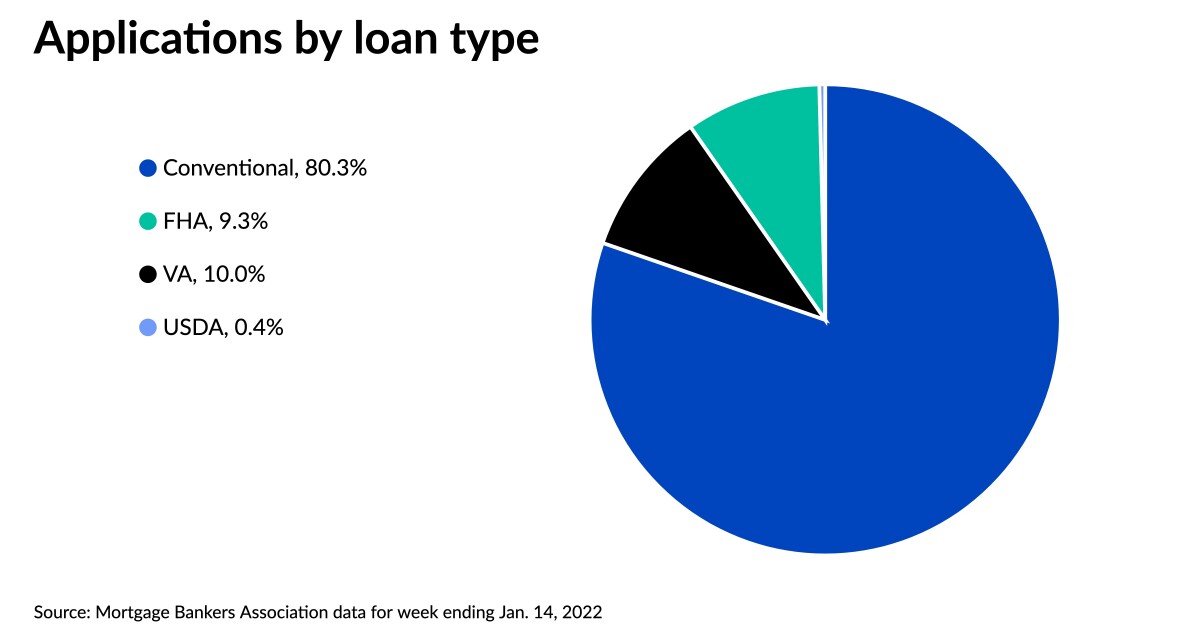

Reflective of the weekly changes in government loan numbers, the share of federally backed applications relative to overall activity fell as well. Federal Housing Administration-sponsored loans decreased to 9.3% of overall volume, down from 9.9% a week earlier. Veterans Affairs-backed mortgages accounted for 10% of new applications, compared to 11.4% the prior week, while the share of U.S. Department of Agriculture-sponsored loans remained at 0.4%.

Interest rates increased across the board, climbing to their highest since March 2020, according to Kan. The contract interest rate for 30-year fixed mortgages with conforming balances of $647,200 or less averaged 3.64%, up from 3.52% a week earlier.

The average contract rate for the 30-year jumbo fixed-rate mortgage for nonconforming balances also jumped 12 basis points to 3.54% from 3.42% the previous week.

Contract interest rates for 30-year fixed FHA-backed loans averaged 3.64%, compared to 3.5% seven days earlier.

The 15-year fixed-rate mortgage also climbed, averaging 2.95%, a 22-basis-point increase from 2.73% one week prior. The 5/1 adjustable rate average edged up 3.04%, compared to 3.03% in the previous weekly period.