The Federal Reserve's preferred inflation index inched toward the central bank's 2% target last month, but lingering uncertainty means interest rates are likely to remain unchanged next week.

Prices rose by 2.3% on an annualized basis in March, according to the Personal Consumption Expenditures report from the Bureau of Economic Analysis released Wednesday. Core PCE, which factors out food and energy prices, was up 2.6%.

The report was released 90 minutes later than its usual time. It is also the third straight month in which year-over-year PCE inflation has been 2.5% or lower. President Donald Trump has argued that this trendline has given the Fed space to reduce interest rates.

"Groceries have come down. It's all coming down. The only thing that hasn't come down — but hasn't gone up much — are interest rates," Trump said last week

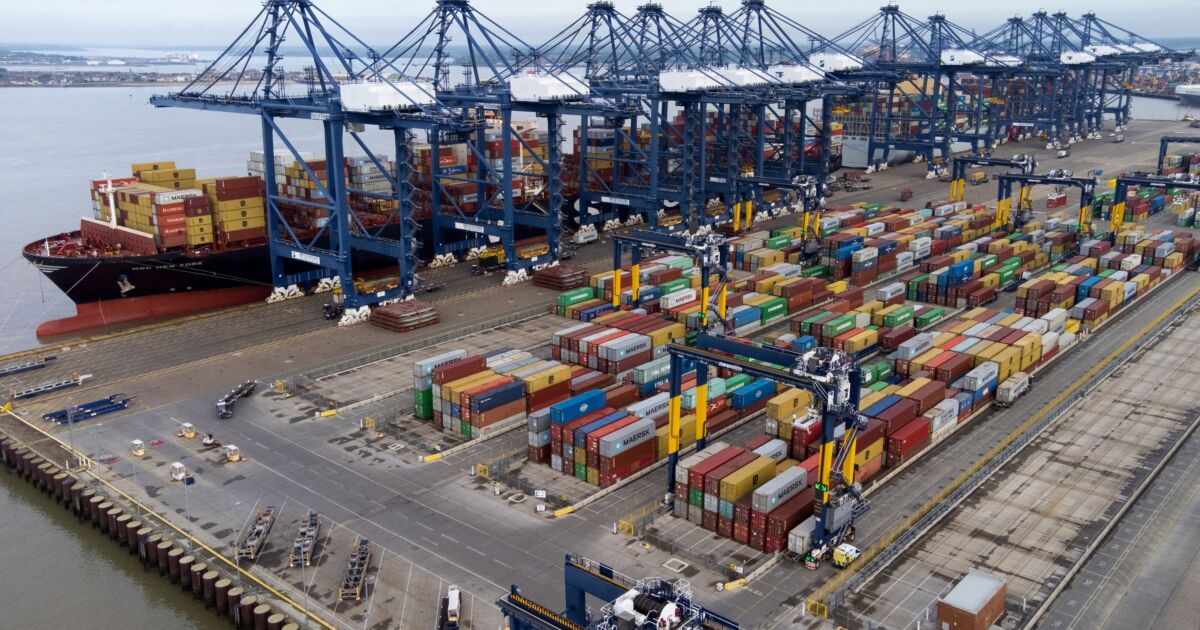

The president's call for more accommodative monetary policy comes as the economy shows signs of slowing. The BEA also released its quarterly gross domestic product report on Wednesday, showing a year-over-year decrease in economic activity of 0.3% — driven in large part by an increase in imports as companies sought to stock up on overseas goods ahead of rising tariff costs. Spending on imported goods reduces GDP.

But Fed officials have been circumspect about adjusting their monetary policy stance in the face of widespread economic uncertainty, much of which is being driven by Trump's tariff proposals.

"It's just too soon to say what the appropriate monetary policy response to these new policies will be," Fed Chair Jerome Powell said earlier this month. "Fast forward a year from now, the uncertainty will be much lower and the effects of the policies will be clear."

Wednesday's report is unlikely to break the Fed out of its holding pattern. Even dovish — meaning inclined to cut rates — members of the Federal Open Market Committee have said they are unlikely to support a rate cut at next week's meeting.

During an interview with Bloomberg TV last week, Fed Gov. Christopher Waller, who has said he is inclined to

"I don't think you're going to see enough happen in the real data in the next couple of months, until you get past July," Waller said. "When you get to the second half of the year, we'll start having better ideas of what's going to happen with the tariff world that the administration is considering, and by then you'll start seeing more in the form of tariff price pass through and also stuff on the real side."

Other Fed officials have been skeptical about just how much the pricing picture has improved in recent months. In

In Wednesday's GDP report, the BEA said that quarter-to-quarter PCE inflation increased 3.6%, up from 2.4% during the fourth quarter of last year. While more prone to swings than annualized data, the quarterly inflation series is viewed by some as an early indication of rising inflationary pressures.

These trends are particularly worrisome, Kugler has said, given the rising near- and medium-term expectations for inflation and the looming pricing impact of tariffs as well as other administrative policy changes.

"I am also monitoring any risks to the outlook, especially upside risks on inflation or downside risks to employment. Still, I think our monetary policy is well positioned for changes in the macroeconomic environment," she said. "Thus, I will support maintaining the current policy rate for as long as these upside risks to inflation continue, while economic activity and employment remain stable."