Moneyfacts has launched a new Consumer Duty audit tool for mortgages to help the industry comply with new guidance.

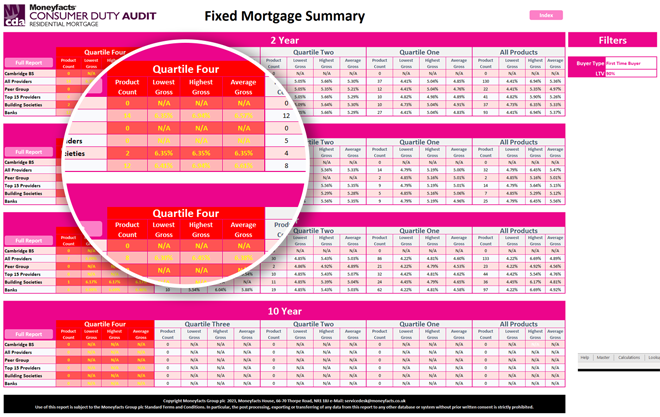

The tool provides a view of residential mortgage products and a summary of the market to enable ongoing fair value benchmarking, filtering and review of the product portfolio.

The aim of Consumer Duty, which was implemented on July 31, is to set higher and clearer standards of consumer protection across financial services.

Moneyfacts founder and executive chairman John Woods says: “Following the unprecedented demand for the Moneyfacts consumer audit tool for savings and conversations we have had with banks and building societies, we know there is already high demand for the mortgages version.”