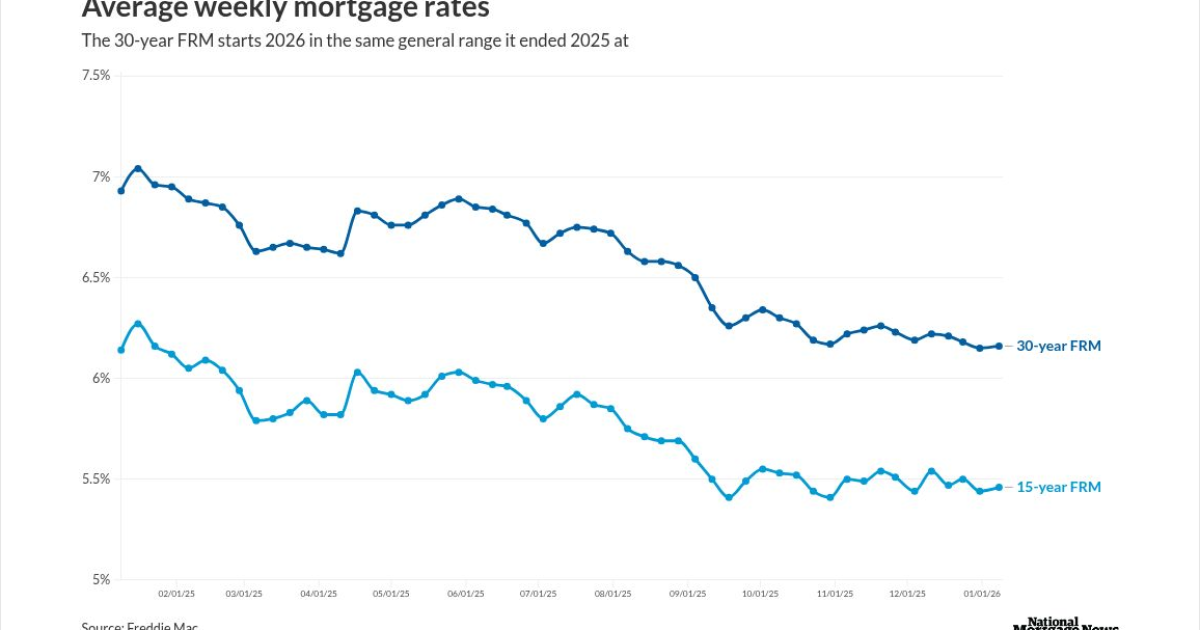

Mortgage rates are starting 2026 marginally higher, according to Freddie Mac, with many observers expecting them to approach and possibly even move below the 6% barrier.

"In the first full week of the new year, mortgage rates remained within a narrow range, hovering close to the 6% mark," said Sam Khater, Freddie Mac's chief economist, in a press release. "The combination of solid economic growth and lower rates has led to improving momentum in for-sale residential demand, with purchase applications up over 20% from a year ago."

Mortgage rate movements this week

The 30-year fixed rate mortgage averaged 6.16% on Jan 8, the Freddie Mac Primary Mortgage Market Survey found. This was a one-basis-point increase

For the other product Freddie Mac tracks, the 15-year FRM, it was 2 basis points higher than on Dec. 31, at 5.46%. But this was 68 basis points lower than the 6.14% it was at one year prior.

This increase reinforces the broader rate trends of recent months, said Samir Dedhia, CEO of One Real Mortgage. But it is not necessarily moving the market.

"What's notable, though, is that even with improved rate conditions, we're seeing softer mortgage demand to start the year," Dedhia said. "Some of that is seasonal, but there's also a clear 'wait and see' attitude from both buyers and homeowners."

Rates have not moved down enough to fundamentally change the affordability equation for potential buyers as home prices are still elevated, Dedhia commented.

How much did the 10-year Treasury yield change this week

The mortgage rate change was in line with the sideways movement in the 10-year Treasury yield.

The 10-year Treasury yield ended 2025 at 4.16%. Between Jan. 6 and Jan. 7 it fell 4 basis points to 4.14% from 4.18%. But by 11 a.m. on Thursday morning, it had increased back to 4.17%. Lender Price data posted on the National Mortgage News website at the same time put the 30-year FRM at 6.32%. While up 1 basis point on the day, it was down by 2 basis points from the prior week.

What's next for mortgage rates?

The market is now in a holding pattern following the Federal Open Market Committee's December short-term rate reduction, Dedhia said.

"For consumers, this moment of relative stability creates opportunity, staying rate-aware and prepared can mean locking in value when the next shift arrives," Dedhia continued.

Mortgage rates are expected to continue their "gradual descent" to 6% by the end of 2026, Kara Ng, senior economist at Zillow Home Loans in a Wednesday evening commentary.

But they will have a tough time breaking underneath 6% "because of the risks of stubborn inflation counterbalancing a slowing labor market," Ng said. "The December Bureau of Labor Statistics employment report, released on Jan. 9, will offer the first clean read of the labor market since the government shutdown."

Rather, Zillow is forecasting this year to be one of "small wins" for housing.

"Affordability is set to gradually improve as modest rises in home values means that incomes can catch up, opening up a wider pool of shoppers able to buy a home," said Ng. This means a typical home could be affordable to the median household by the end of 2026.

The 30-year FRM should be between 5.7% and 6.5%, with a full year average of 6.1%, said Ted Rossman, Bankrate senior industry analyst.

"More certainty about the path of the economy (tariffs, jobs, etc.) could also bring down the spread between 10-year Treasuries and actual mortgage rates paid by consumers," Rossman said. "There has been an unusually high risk premium in recent years."

The end of the qualitative tightening program should also

Rossman is expecting three 25 basis point cuts by the Federal Open Market Committee, versus the current expectations of a single reduction of 25 basis points in the short-term rates.

"I'm basing that on the assumption that the reshaped Fed will lean toward more cuts (not less), but within reason," Rossman said. "And that inflation will remain mostly in check and that the Fed will continue to focus more on supporting a weakening job market."

Mortgage interest rates have relatively stable lately but this is likely to change quickly, Kate Wood, Nerdwallet's lending expert, said in a Tuesday commentary.

"We're about to get several major data drops that should provide a clear gauge of the labor market's health," Wood explained. "If there's significant weakness, mortgage rates are likely to start sliding downward."

What is the immediate challenge for the U.S. economy

Deflation will be the biggest

"Most of the inflation we experienced came from housing, specifically owner's equivalent rent," Navellier said. "That pressure has now disappeared" as home prices are soft nationwide and rents have declined for several months. Other pressures such as oil prices and food costs are also lower.

Improving market conditions may not be enough to support a year of strong growth, said Bright MLS Chief Economist Lisa Sturtevant.

"Lower mortgage rates and more inventory will bring some buyers back into the market," Sturtevant said in a press release. "But for many households, economic concerns will continue to outweigh the benefits of better affordability. As a result, 2026 is likely to be a year of cautious progress rather than a full housing market rebound."

The Mortgage Bankers Association reported on Wednesday that the conforming 30-year FRM was at

This was down by 7 basis points from 6.32% for the prior week.

"Mortgage rates fell to a 16-month low to start 2026, but overall mortgage application activity declined 10% over the holiday period, driven by weaker purchase demand," said Bob Broeksmit, the organization's president and CEO, in a Thursday morning statement.

"MBA expects housing conditions to improve in 2026, with total originations rising 8% to $2.2 trillion," he continued.