Homes with high energy efficiency ratings are worth up to £40,000 more than less efficient properties, and buyers are increasingly willing to pay a ‘green premium’.

That’s according to new research by Halifax, which found that properties with better Energy Performance Certificate (EPC) ratings sold for higher prices in all regions of England and Wales.

Here, Which? explains why energy-efficient homes come with bigger price tags, and offers advice on how you can improve your property’s rating.

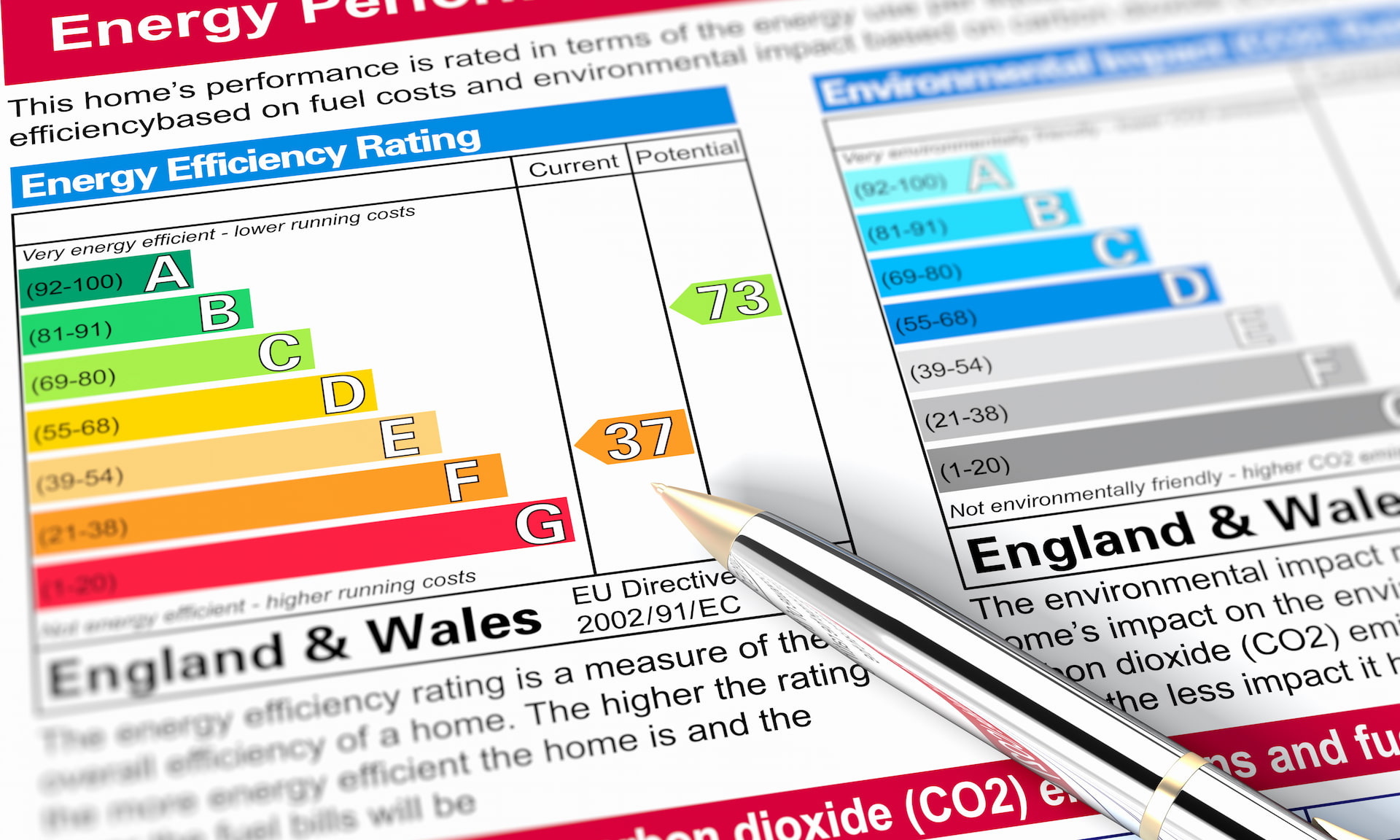

How do EPC ratings work?

An EPC is a certificate that rates how efficient your property is. EPCs are valid for 10 years, and properties sold in England and Wales must have a valid certificate as part of their estate agency listing.

EPCs grade energy efficiency from A-G. In addition to your home’s current rating, the EPC gives its potential rating if you were to make green improvements. The average EPC rating is D.

New-build homes tend to get the highest EPC ratings, as they’re built to modern energy standards, while older properties are more likely to have much lower ratings.

Reforms introduced in 2020 prevent landlords from renting out properties with EPC ratings of F or G.

How does energy efficiency affect value?

Halifax found that energy efficiency can have a big effect on the value of a home, with A-rated properties worth up to £40,000 more than G-rated homes.

Halifax says the average property price difference between an E-rated and a C-rated property is £11,000, demonstrating how bringing your home up to even a middling rating can make a big difference.

The table below shows the average value you can add to a property by upgrading its EPC rating by one band.

| Change in band | Average growth in value |

| G-F | £9,954 |

| F-E | £7,584 |

| E-D | £6,162 |

| D-C | £5,214 |

| C-B | £5,214 |

| B-A | £4,740 |

Are homebuyers becoming greener?

Halifax found that 77% of existing homeowners don’t know the EPC rating of their own property, but that homebuyers are increasingly interested in going green.

Two-thirds of respondents to Halifax’s survey said they would feel proud to live in an environmentally friendly home, while the same proportion said it’s important that their home represents their personal values.

Two in five current homeowners told Halifax that energy efficiency was either a ‘very’ or ‘fairly’ important factor when choosing where to live.

Live more sustainably – get our free Sustainability newsletter to make changes for you and the planet.

Are some areas greener than others?

Halifax found a disparity between some regions of England and Wales when it comes to energy efficiency.

Unsurprisingly, areas with more new-build homes and flats tended to have higher EPC ratings.

Tower Hamlets in East London topped the charts, with average EPC ratings of a high C, followed by Salford in Greater Manchester.

More rural areas with older homes fared worst, with properties in the Isles of Scilly and the Welsh districts of Ceredigion and Gwynedd the least efficient.

How can I make my home more efficient?

Energy-efficient home improvements come in all shapes and sizes, from big jobs such as boiler upgrades and having solar panels installed, to smaller ones, such as preventing draughts.

Some easy steps you can take include replacing your property’s light bulbs with energy-saving bulbs and using a smart thermostat to keep your home warm without using unnecessary energy.

If your property has a recent EPC, you can take a look at its recommendations as a starting point.

Andrew Assam of Halifax says: ‘Homeowners at the lower end of the energy efficiency scale are likely to see the greatest returns on their investments, even from making simple changes like switching to LED bulbs or adding loft insulation. There’s a huge opportunity for more people to get on board with this and reap the rewards.’

Financing improvements with a green mortgage

If you’re thinking of making significant improvements to your home, you might need to access credit to do so.

Before considering options such as credit cards or personal loans, it’s worth seeing if your mortgage lender offers any incentives for green borrowing.

Green mortgages have been on the rise over the last 12 months. Traditionally, these mortgages offer lower rates when you buy an energy-efficient property, but some lenders are now offering deals for existing customers who make energy-efficient improvements.

For example, Nationwide customers can apply to borrow up to £25,000 to make green home improvements at a reduced rate of just 0.75% – considerably cheaper than any loans currently on the market.

Kensington, meanwhile, offers £1,000 cashback to borrowers who improve their property’s EPC rating by at least 10 points in a 12-month period.