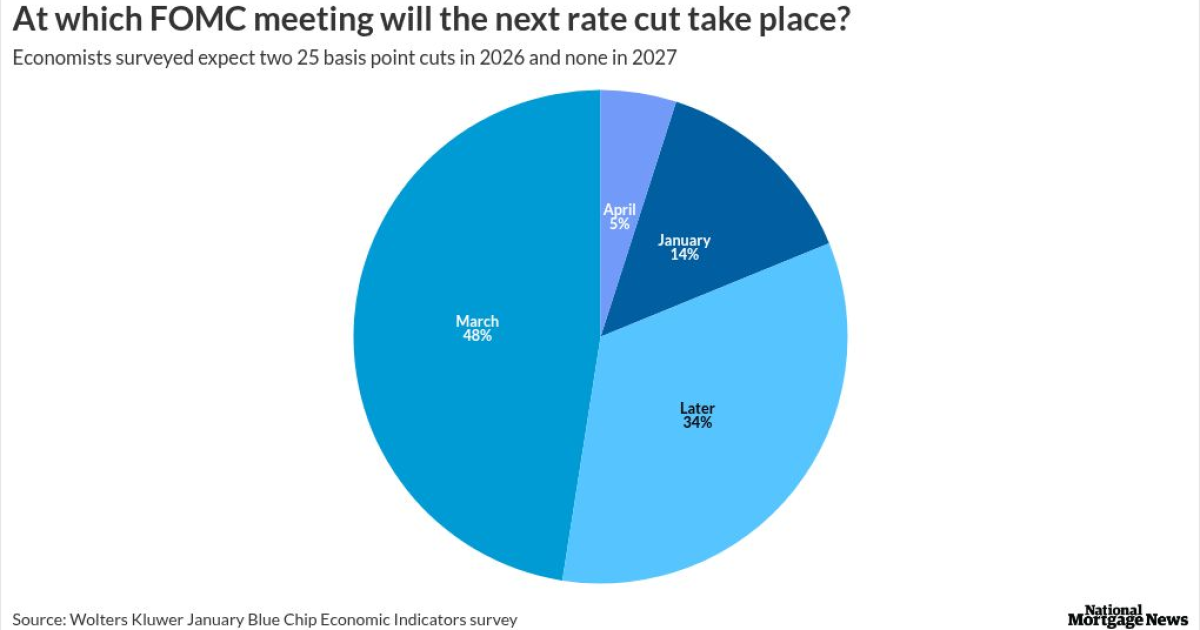

Just 14% of the economists surveyed by Wolters Kluwer expect the Federal Open Market Committee's next short-term rate reduction to take place at its January meeting.

Overall, the Blue Chip Economic Indicators panel consensus is for two cuts during this year to the Fed Funds Rate and none next year, with almost no change expected for longer term rates.

"The FOMC is significantly divided at present on the near-term course for the fed funds rate," the January BCEI report commented. Following

Where mortgage rates are now

However, the survey was taken on Jan. 5 and 6, before last week's announcement by Pres. Trump

In the wake of the announcement, mortgage spreads,

Trackers from Lender Price (which is published on the National Mortgage News website) and Optimal Blue, however, have the rate for Friday at just over the 6% level.

The national average 30-year FRM refinance rate as tracked by Zillow on Monday morning was 6.42%, down 7 basis points on the day. It was down by 9 basis points from last week's average rate of 6.51%.

But this is across all credit score bands and loan-to-value ratios. For a refi borrower at a 740 or higher credit score with 20% or more down, while the rate has broken below 6% on several occasions in the past week, at mid-morning on Monday, it was at 6%, a chart on the Zillow webpage said.

For similarly situated purchase offers, the rate on the Zillow chart was at about 5.8%.

The 10-year Treasury yield closed Friday at 4.17%, down 1 basis point and opened Monday morning at just under 4.2%, although by 10 a.m., it was at 4.18%.

What are economists concerned about

Just as a counterpoint to this month's survey, 87% of the BCEI panelists in the December survey expected the FOMC to reduce rates (as it ended up doing) at that month's meeting.

Just 33% believe the U.S.

Panelists were concerned about inflation, as they saw the data reports from October and November as aberrations which were triggered by disruptions due to the government shutdown.

"Blue Chip forecasters see inflation decelerating over the forecast horizon, but only gradually," with the Personal Consumption Expenditures index remaining "a touch above" the Fed's 2% target during 2026, Wolters Kluwer said in its report.

Still, the longer-term threat is viewed

"On downside risks to the U.S. economy, panelists are increasingly coalescing around employment rather than inflation as the dominant source of downside risk," the report said.

Why the concern over the labor market

For the time being, the U.S. labor market is still bending and not breaking, so the stabilization in the unemployment rate, along with a decline in underemployment, will keep the FOMC on the sidelines for the time being, comments Michael Brown, senior research strategist at forex trader Pepperstone.

Brown does worry the Fed is "falsely reassured" by certain cuts of data, including the underemployment figure, "as under the surface, the labor market hardly looks in great shape."

The job growth is coming from healthcare, which is non-cyclical and non-interest rate sensitive, he said.

While the jobs report was not as strong as the market expected, it was positive enough to likely keep the FOMC from cutting rates in January, said Melissa Cohn, regional vice president of William Raveis Mortgage.

"Bond yields are unchanged on the report and it will not cause rates to go up or down as a result," she said in a Monday morning statement.

Even with mortgage rates in the area of 6%, the lowest in several years, people need to keep an eye on further economic reports to figure out what is going to happen.

"We're back to data-watching," said Cohn. "Good news on the economy is bad news for mortgage rates, and bad news will help push rates down."

How the subpoenas affect impressions of the Fed's independence

Brown sees

"While Trump strops about like a petulant child because he hasn't got what he wants, institutional confidence in the U.S. is again called into question," Brown wrote.

The Fed's independence is under attack and the markets won't stand for it, argues Nigel Green, CEO of financial advisory the deVere Group.

"Investors price assets on the assumption that U.S. monetary policy is set by economic evidence, not by political will," Green said. "When that assumption weakens, risk rises everywhere, immediately and visibly."

If political pressure shapes interest rate decision making, among the effects is rising bond yields to compensate for uncertainty, Green warns.

It could be global as capital flows into Europe, Asia and emerging markets all respond to what the Fed signals are, he continued.

Fed independence "directly shapes mortgage rates for American households, borrowing costs for global corporations, the health of pension funds and the stability of banking systems worldwide," said Green. "Weakening that independence puts all of those at risk simultaneously."

Is deflation the bigger question facing the Fed?

Meanwhile, Louis Navellier, an investment banker, on Friday reiterated his concerns about deflation.

If this were to happen because of falling home prices/rents, oil prices and what is taking place with other countries' economies, "the Fed is going to have to slash key interest rates 100 basis points pretty darn quick," Navellier declared.

In the December FOMC meeting minutes, it signaled one more 25 basis point cut was likely, "but any deflation news will likely cause the Fed to slash key interest rates a lot more in the upcoming months," he continued.