The average credit card user carries a balance of nearly $6,000, as Americans hold

Americans bear a record $1.21 trillion in credit card debt, as the median interest rate hit 25.3%, according to Academy Bank's latest white paper. The trend could affect home loan underwriting and performance.

"With credit card debt at record levels, understanding the realities of high-interest debt has never been more important," said Nick Alphs, president of residential lending at Academy Bank, in a press release Monday.

More than 80% of American adults held at least one credit card in 2024, while nearly half carry a balance. The typical adult also owns 7.1 cards and actively uses 3.7, according to the white paper.

Credit card

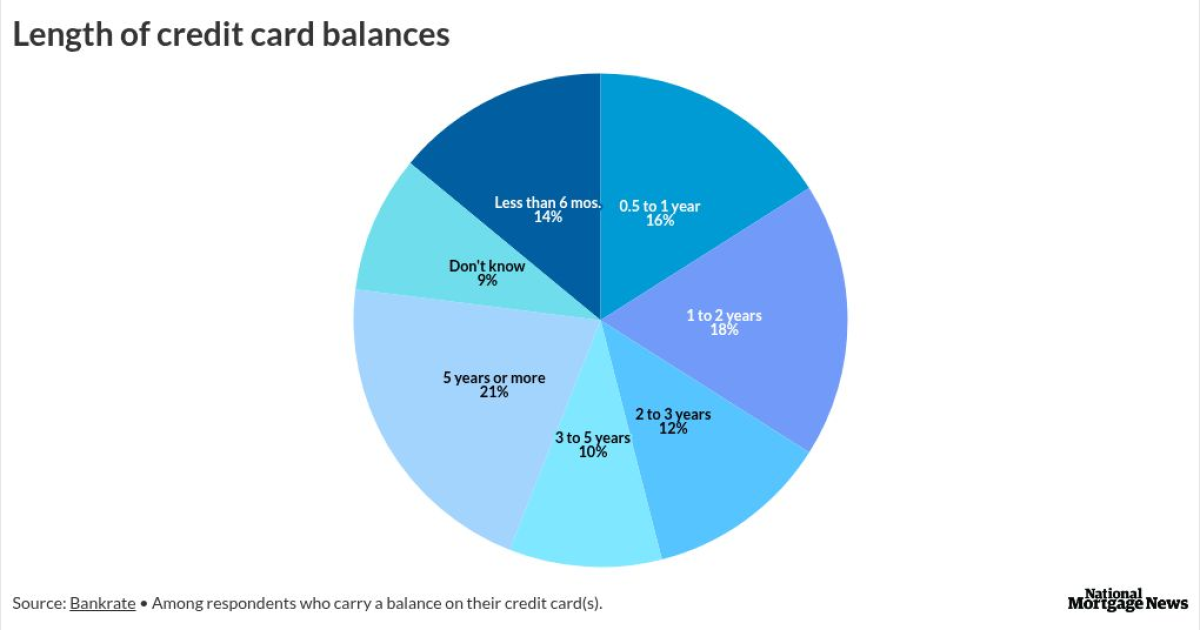

More than 60% of credit card debtors also said they had been in debt for at least a year, up from 53% in 2024, according to a new Bankrate survey.

"There's an industry saying that credit cards are like power tools. As in, really useful or dangerous, depending on how you use them," said Ted Rossman, senior industry analyst at Bankrate, in a press release Monday.

The 53% of credit cardholders who pay in full each month avoid interest and earn benefits like cash back, travel rewards, convenience and buyer protections. But the 47% carrying debt pay an average of about 20% in interest, which can stick with users for a long time, according to Rossman.

The primary debt drivers are basic necessities, such as car and home repairs, medical bills and routine living costs, which account for 73% of credit card balances, Academy Bank found. The number of Americans who cited day-to-day expenses as the main reason for credit card debt climbed to 33%, up from 28% in 2024 and 26% in 2023, Bankrate said.

Debt is not limited to any specific generation either as each saw increases over the past three years. But Gen X posts the highest average balance of nearly $10,000, Academy Bank reported.

President Donald Trump requested Friday in a

"While the most recent call for a 10% rate cap is unlikely to come to fruition, if it does, it could limit access to