The Mortgage Bankers Association has begun to study the feasibility of reducing the government-related mortgage market's traditional three credit-report pull to a single one, putting a new twist on an old proposal.

President and CEO Bob Broeksmit said in a recent blog that the move could fit in with

"A single-report requirement would lead to both higher-quality services and lower costs," MBA President and CEO Bob Broeksmit said in

Broeksmit said the move is worth considering given other consumer finance segments don't use a trimerge and the reasons the mortgage industry has aren't necessarily valid anymore.

"Gaps in coverage or quality that may have existed decades ago appear to have closed," he said.

But there is disagreement on that point.

The bi-merge as a jumping-off point for discussions

The concept the association is looking into is similar to one considered by the GSEs' previous regulator under President Biden, who had examined moving from three to two credit reports as a potential money saver.

Like the MBA, rating agency Standard & Poor's reported that

But others reached a different conclusion.

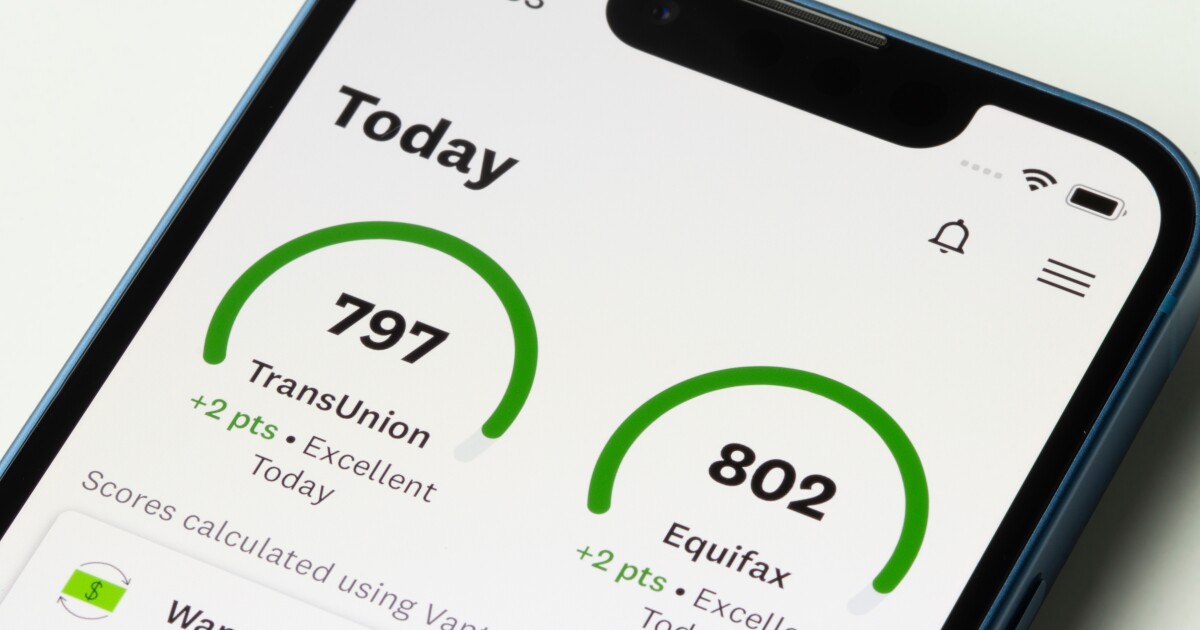

Transunion, a credit report provider, argued that the move

"Trimerge credit reports are the most accurate picture of consumer creditworthiness, making them essential to preserving safety and soundness in the mortgage ecosystem," Transunion said in a statement issued in response to Broeksmit's blog.

How the tri-merge fits in with other credit and closing costs

Given the questions around whether the move to two scores would produce a significant cost benefit, the MBA would have to look into how much there would be to gain from moving to a single score in terms of any costs saved relative to any additional risk.

"Any move away from the current tri-merge policy shifts the underlying data used in mortgage underwriting and could have implications in the broader capital markets," the Consumer Data Industry Association said in a statement responding to the MBA's blog.

However, Broeksmit said, "Early indications from discussions with our members strongly suggest that a single report for mortgages would be feasible without posing undue risk to the GSEs."

In the scheme of the total range of costs related to closing a mortgage, credit reporting and scoring expenses are not as large as items

"Consumer credit reports are fundamental to the homebuying process, helping lenders better assess consumers' likelihood of repaying a mortgage and consumers qualify for the best mortgage rates available," the CDIA said in a statement.

The cost of credit reports are intertwined with those of

"While a tri-merge is required for GSE loans, the GSEs do not use credit scores to make credit underwriting decisions, and there appears to be limited additive value in the data contained in multiple reports," Broeksmit said.