Mortgage activity slowed for the second week in a row, with refinances continuing to slide and purchase sizes grow in the face of rising rates and tightening credit, the Mortgage Bankers Association said.

The MBA’s Market Composite Index, which tracks loan volumes and rates based on surveys of association members, fell a seasonally adjusted 5.4% for the weekly period ending Feb. 11. Compared to the same seven-day period in 2021, total seasonally adjusted activity was 40% lower.

Higher rates continue to dampen interest among potential borrowers, particularly for refinances, with the 30-year average documented among MBA members making the largest weekly jump in almost two years, said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

“Consistent with this period of higher mortgage rates, refinance applications fell 9% last week,” Kan said in a press release. Compared to activity a year ago, refinance numbers have decreased by 54% and were also down 15% since the final week of 2021. The refinance share of weekly activity relative to overall volume also dropped to 52.8%, its lowest level since July 2019.

The Purchase Index decreased as well, albeit less steeply, by 1% on a seasonally adjusted basis from the previous week and came in 7% lower from the same time frame a year ago.

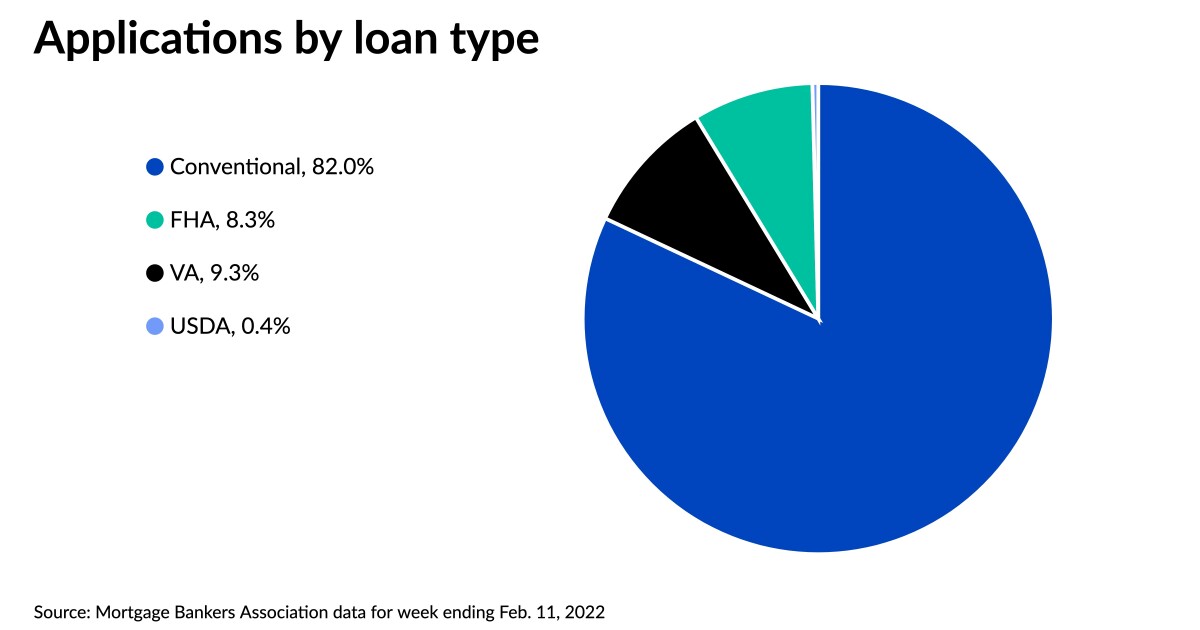

“Purchase applications saw a modest decline over the week, with government purchase applications accounting for most of the decrease,” Kan said. Government-backed loans amounted to only 21.7% of the total purchase volume.

“Prospective buyers still face elevated sales prices in addition to higher mortgage rates,” Kan added.

Due to the lower percentage of federally backed loans, the average size of new purchase applications grew for the sixth consecutive week. The mean purchase loan amount increased by 1.3% to $453,000 and set another record high for the fifth straight week. One week earlier, the average rose to $446,900.

Average loan sizes for refinances, though, edged downward by 0.9% to land at $300,600 compared to $303,400 the previous week. The average loan amount across all new applications was $372,600, a 1.7% week-over-week increase from $366,200.

Purchase-loan amounts have risen in early 2022 even as mortgage credit has lately become harder to obtain, according to the MBA’s analysis. The association also reported this week that its Mortgage Credit Availability Index, or MCAI, slipped by 0.9% in January, an indication of tightening standards. Index values are determined through an analysis of data from ICE Mortgage Technology.

"Credit availability declined to its lowest level since August 2021, even as the economy and job market continued to improve," Kan said, adding further worries for potential home buyers on top of the current prices and rates. The Conventional MCAI dipped 2.5% from December, but the Government MCAI showed an uptick of 0.7%.

Within the Conventional index, conforming mortgage credit availability declined by 4.2% and jumbo by 1.6%. The supply of conforming credit fell to its lowest level since 2013, driven by decreased investor appetite for loan programs catering to borrowers with higher loan-to-value ratios and lower credit-scores. Jumbo credit reversed its direction, declining for the first time after six consecutive months of increases.

“That growth streak ended last month, as investors reduced their willingness to purchase jumbo loans and also raised credit requirements," Kan said.

In the MBA’s weekly survey, the share of adjustable-rate mortgages increased to 5% relative to total mortgage activity, up from 4.5% a week earlier. But the overall share of government applications decreased, with the Government Index also showing a drop in new loan activity.

The share of new Federal Housing Administration-backed mortgages increased to 8.3% from 8% one week prior, but loans backed by the Department of Veterans Affairs dropped to 9.3% of volume compared to 10% seven days earlier. The U.S. Department of Agriculture-sponsored applications share remained at 0.4%.

Mortgage rates rose across all major categories for the second consecutive week, with the 30-year conforming average seeing its largest one-week increase since March 2020, the MBA said. The average rate for loans with conforming balances of $647,200 or less jumped to 4.05% from 3.83%, a 22-basis-point rise. The MBA rate crossed the 4% threshold for the first time since 2019.

The contract average of 30-year fixed-rate jumbo loans exceeding the conforming balance also made a similar steep climb to 3.81% from 3.62% one week earlier.

Average rates for 30-year FHA-backed mortgages crossed the 4% threshold as well, rising to 4.01% from 3.93% in the previous reporting period.

The 15-year fixed-contract mortgage rate averaged 3.37%, up 21 basis points from 3.16% week over week, while the 5/1 adjustable-rate mortgage came in at an average of 3.36% compared to 3.13% seven days earlier.