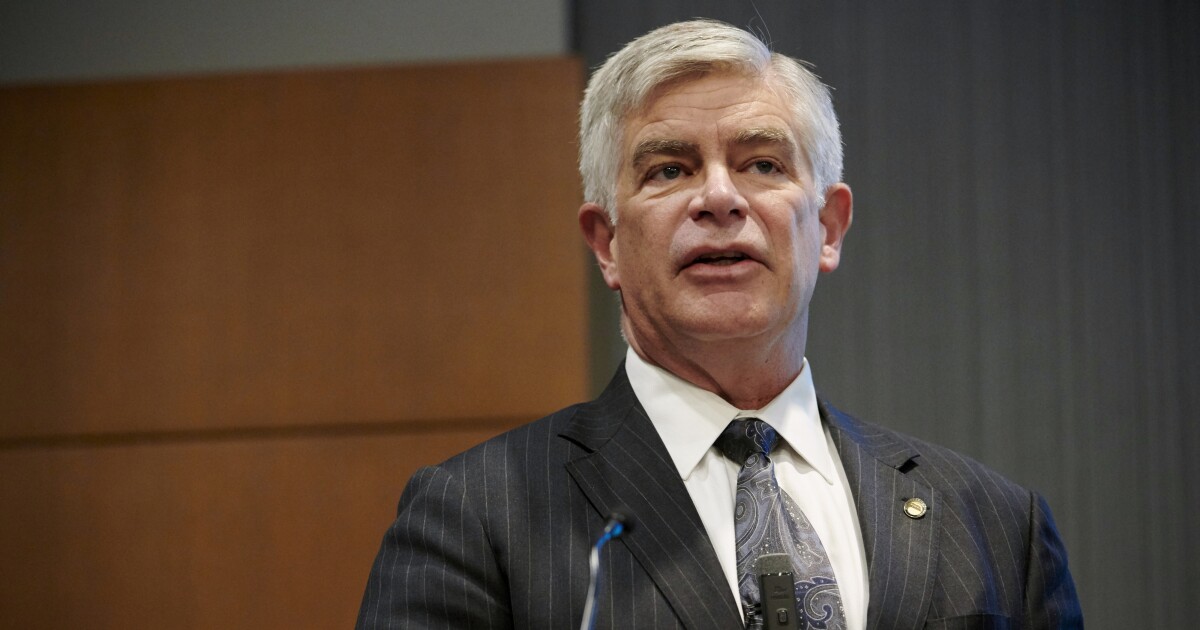

Federal Reserve Bank of Philadelphia President Patrick Harker said higher interest rates are making it more challenging for first-time home buyers by raising borrowing costs and limiting inventory, which is also leading to higher home prices.

Higher rates discourage current owners from listing their homes for sale, which puts a crunch on inventory, Harker said Monday in remarks prepared for a convention in Philadelphia organized by the Mortgage Bankers Association.

"The rise in interest rates not only raised borrowing costs on those looking to purchase a home, but it also contributed to the contraction of inventory," Harker said. "And it is just simple market dynamics that a lack of inventory would elevate prices overall, further lessening the depth of the pool of potential buyers."

While new home sales are "trending upward," those sales cannot fully compensate for the broader housing slowdown, he said.

Harker, who votes on rate decisions this year, also repeated comments he made last week asserting the Fed can hold its benchmark rate steady as long as there is not a sharp turn in the economic data. He reiterated that the US central bank is still doing a lot to fight inflation after raising the benchmark by more than five percentage points since last year, and shrinking its balance sheet.