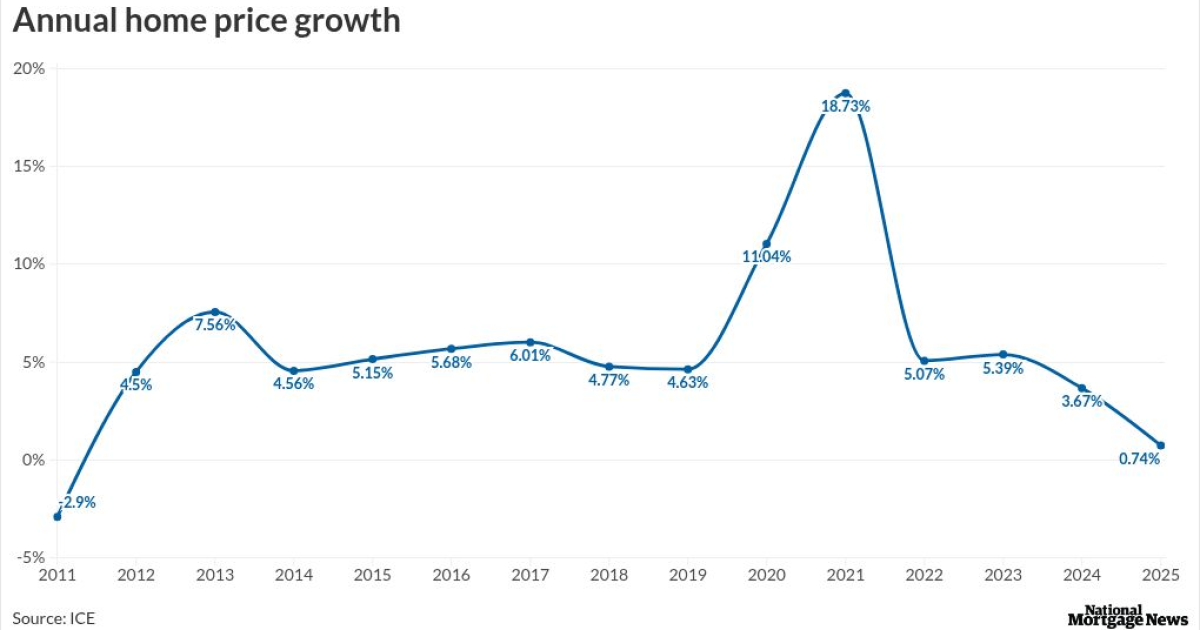

The housing market looks set to stabilize this year as home-price growth slowed to a 14-year low in the final months of 2025, new industry reports said.

Annual home-price appreciation ended last year at 0.7%, the smallest calendar-year increase since 2011, when prices dropped 2.9%, according to Intercontinental Exchange's Home Price Index.

Cotality also reported price growth hit its lowest level in nearly 15 years with a 1% year-over-year climb in November.

Income

At current prices and rates, the purchase of an average-priced home with a 20% down payment on a 30-year loan equals a monthly payment of $2,093, about 28% of the median household income. The latest number is down from $2,256, or 31.1%, at the start of last year, ICE reported.

"Improved affordability and income growth have provided a much needed boost to housing market dynamics, even as regional trends and property types show significant variation," said Andy Walden, head of mortgage and housing market research at ICE, in a press release Tuesday. "The Northeast and Midwest have emerged as clear leaders, while condos continue to face headwinds in most markets."

New Haven, Connecticut, led all markets with 8.6% price growth, followed by Syracuse, New York, and Hartford, Connecticut, at 6.8% and 6.3%, respectively. All but one of the 25 fastest-appreciating markets were in the Northeast and Midwest, ICE's index showed.

Cotality's report found a similar trend, as Wyoming, New Jersey, Nebraska, Illinois and Connecticut made up its top five states for home-price growth in November.

On the downside, though, 35 of the 100 largest U.S. markets saw home prices decrease in 2025, up from 10 the year before and the largest number since 2011, according to ICE.

"Looking ahead to 2026, regional differences will remain pronounced, with demand favoring areas that offer both economic opportunity and relative affordability," said Selma Hepp, Cotality's chief economist, in a press release Tuesday.

What to expect for 2026

Cotality anticipates a

Inventory levels and mortgage rates will be keys to the market in 2026, as a drop in rates could spike demand, but with supply still limited in many regions, buyers may face competition in desirable metros, Cotality's report said.

"If mortgage rates decline as expected, we could see renewed momentum in the spring, spurring increased competition among buyers and potentially driving a re-acceleration of price gains in markets with limited inventory," Hepp said.