A key mortgage rate fell to its lowest point since the end of October and was one basis point higher than its 2025 trough but remained in the same general range it has occupied in the fourth quarter, Freddie Mac reported.

"The average 30-year fixed-rate mortgage decreased further this week," said Sam Khater, Freddie Mac's chief economist, in a press release. "Declining rates offer a timely and welcome gift for aspiring homebuyers."

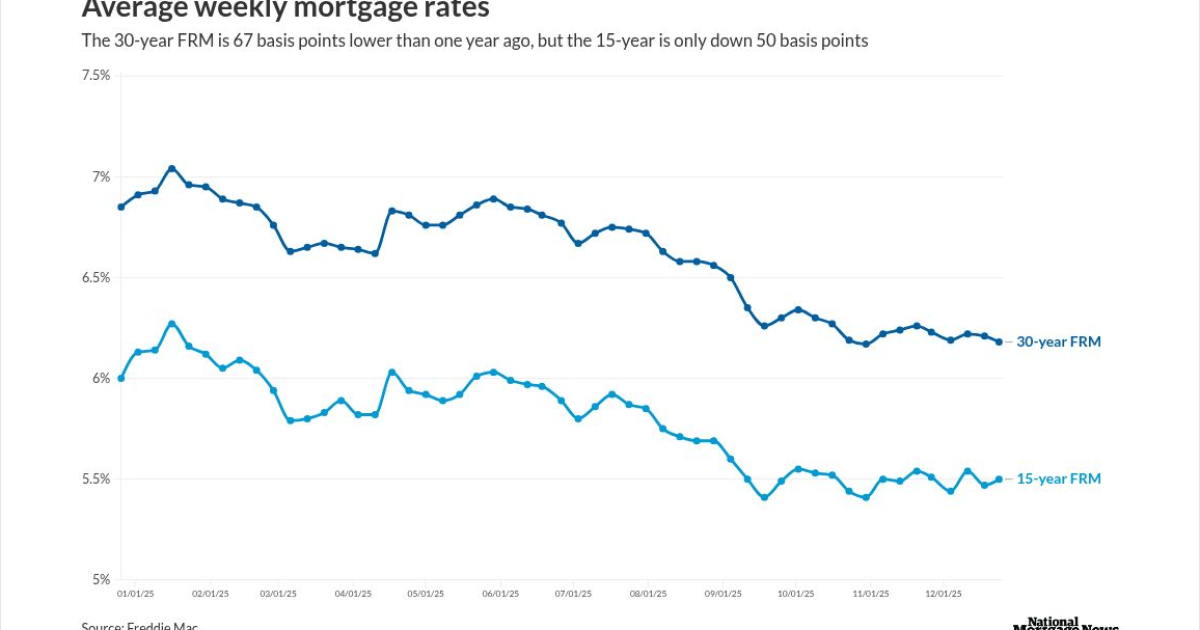

The 30-year FRM was at 6.18% for Dec. 24, a drop of 3 basis points

Since then, the 30-year has been in the same 10 basis point range, another prolonged period in 2025 where mortgage rates have remained essentially flat.

For

Meanwhile the 15-year FRM moved in the opposite direction, rising 3 basis points to 5.5% week-to-week, but it is 50 basis points lower than where it was at this time in 2024, at 6%.

Lender Price data on the National Mortgage News website put the 30-year at 6.36% at 11 a.m. Wednesday, a gain of 2 basis points from six days prior.

The 10-year Treasury yield, one of the benchmarks used to set mortgage rates, was at 4.15% as of 11 a.m. Wednesday morning, down approximately 2 basis points from Thursday' close. Last Thursday, the yield closed at 4.12% but picked right back up to 4.17% on both Monday and Tuesday.

"Mortgage rates are expected to remain range-bound through year-end," said Loandepot's Chief Investment Officer and Head Economist Jeff DerGurahian, in commentary issued Monday.

He said this trend will likely persist until January's employment and

"Markets anticipate at least two Fed rate cuts in 2026, which, combined with easing inflation and soft labor conditions, could help push 30-year fixed rates toward the 5.5% range by midyear," DerGurahian added.

Zillow expects home sales to strengthen next year as mortgage rates decline and affordability improves, it said in

"Even as elevated borrowing costs keep some would-be buyers renting, Zillow expects mortgage rates to trend lower in 2026, gradually improving affordability and helping release some pent-up for-sale demand," it added.

Residential housing investment declined at a 5.1% annual pace for the second and third quarters in

"One of the keys to improving GDP growth moving forward is to shore up residential real estate markets, which remain weak due to high mortgage rates, higher insurance costs, as well as a supply glut in many key markets," Navellier said. "Obviously, multiple Fed rate cuts can help shore up home prices, but for now, weak home prices are raising deflation concerns that the Fed needs to address."