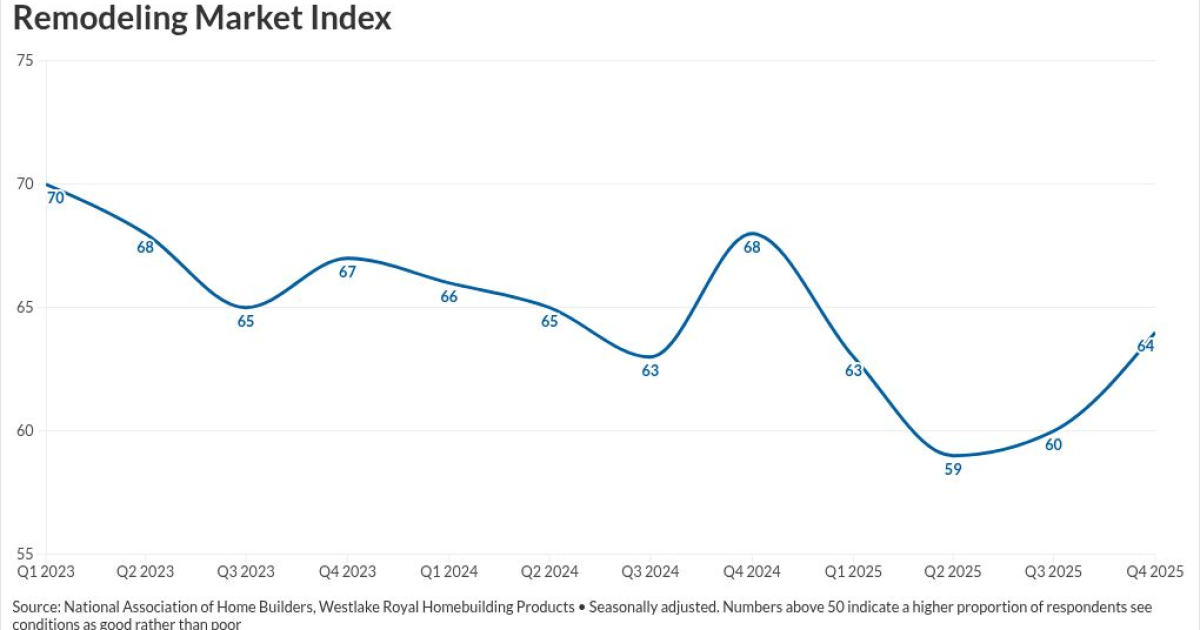

The outlook among home remodel companies sits at its highest in a year, with sentiment toward upcoming business prospects in positive territory in contrast with the homebuilding community.

An index reading above 50 denotes a higher share of respondents view conditions as good rather than poor. While at its highest in a year, the latest numbers still finished below the score of 68 recorded in the fourth quarter of 2024.

"Demand for remodeling is being supported by an aging housing stock, strong homeowner equity and increasing need for aging-in-place improvements," wrote NAHB economist David Lynch in a research post. Sentiment remained strong despite typical seasonal slowdowns in the final months of the year, he added.

Current versus future remodel outlooks

Determined by the average of two component surveys tracking current conditions and future outlook, the remodel market index saw positive trends in both to close out 2025.

Sentiment surrounding present business conditions came in with a score of 71, up from 68 over the third quarter but down on a year-over-year basis from 75. Momentum for renovation and maintenance improved from the prior quarter across all project sizes, with a noticeable uptick for large jobs.

Meanwhile, future indicators, which measure the pace of incoming leads and inquiries and backlogs of existing projects, clocked in at a lower but still favorable mark of 56, rising from 52 in the third quarter. One year ago, the number stood at 61.

The future-indicator score improved in the back half of 2025 after trending noticeably downward earlier in the year. The early-year pullback coincided with

"The major headwinds the industry is experiencing continue to be rising costs and potential customers hesitating due to policy and economic uncertainty," he noted.

Housing researchers have frequently pointed to tailwinds for the home renovation industry over the past few years, emphasizing how older homeowners now prefer

The

Recent analysis from the Harvard Joint Center for Housing Studies estimated home renovation spending to increase to $524 billion by the end of the second quarter, rising 2.4% year over year.

Current remodeling trends stand in

The last time NAHB's homebuilder survey rose above 50 was in April 2024. Respondents last year cited worries over rising material costs and the rate of incentives and price reductions offered to homebuyers as cutting into their outlook.