We are currently in a rising rate environment. UK economists had predicted that Bank of England base rate would top out at around 5.25%, though that prediction looks to be a bit punchy as the UK is now entering a recession with negative GDP figures for the quarter of July to September.

If GDP is negative in the final quarter of the year, we will technically be in a recession. At what point the Bank of England decides that rate rises have had the desired effect of taming inflation is anyone’s guess.

Mortgages Rates

So how have mortgage rates been affected and what is the best advice now – is it to fix or to track base rate?

We have seen fixed rates increase significantly. In August and September, many people rushed to secure fixed mortgages as rates started increasing, with lenders still trying to get through the backlog of work. Getting deals agreed has been difficult as lenders seem to have increased due diligence due to concerns around affordability and market uncertainty.

At the end of 2021 you could fix for 5 years at below 2%. Fast forward to today and 5-year fixed rates are now between 5% and 6%, depending on the level of deposit/equity you have.

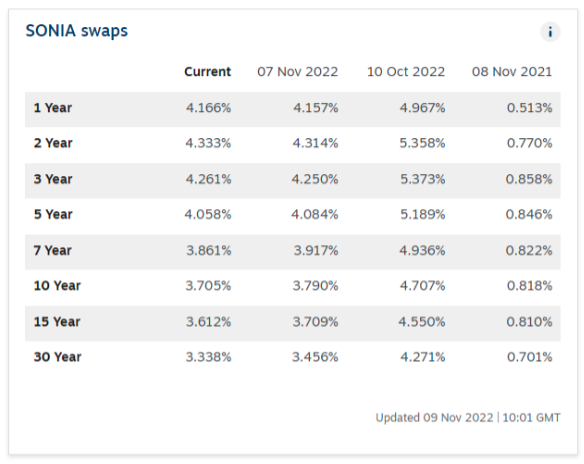

Last week we saw lenders reprice downwards by as much as 1%. If we look at swap rates (rates at which some lenders secure funding from central banks), we can see that 5-year money has dropped by just over 1% from October to November.

Tracker mortgages are currently priced cheaper than fixed-rate money. In fact, base rate could increase by over 1% and one would still be better off on a tracker rate. (This is not advice to take a tracker rate. Each situation is different and a fixed rate gives you certainty of knowing what your payments will be for a defined period – but it is food for thought).

Furthermore, we are seeing lenders bring out tracker rates with no early repayment charges. We think it is important to remember that mortgage lenders need to lend – and they have lots of capital to be loaned out. We will see lenders trying to be innovative in their product offerings, so by offering tracker mortgages with no early repayment charges gives one an option to switch to a fixed rate without penalty, which may make a tracker product more appealing.

Affordability

One area of mortgage lending which has taken a hit is affordability. Due to increasing interest rates, some lenders have increased their affordability stress test rates. This means that although you can afford to pay your mortgage at current rates, lenders will stress test the possibility of higher interest rates and will make sure that you can afford the mortgage at both the current rates and at higher rates.

The other consideration for lenders is the increased cost of living. Lender’s affordability calculators are now factoring in rising mortgage costs, increased energy bills as well as the general increase in cost of items such as food and petrol etc. Although lenders typically lend up to 5 or 5.5 income multiples, their affordability calculators are giving reduced affordability for the above reasons.

Buy-To-Let

Buy-to-let lending is mostly determined by the rent a property will achieve and the rate of the mortgage. With buy-to-let rates increasing to above 6%, the stress test has had two effects.

Firstly, the cost of borrowing money has increased, making the math unworkable (i.e. the rent only just covers the mortgage payment). Secondly, the rent-to-loan calculation has got worse due to the higher rate and the amount one can borrow has greatly reduced.

Buy-to-let new business has been greatly impacted and we believe that we need to see rates around 5% for it to still work for landlords. The cheapest rates on the market today for a 5-year fixed rate are now sub-6%.

The buy-to-let market also needs innovation. One way for lenders to be innovative is to offer a low fixed rate but charge a higher arrangement fee. This allows the lender to use the (lower) interest rate in the ‘rent to loan’ calculation. The mortgage deal remains profitable for the lender due to the increased fee. We expect more of these types of deals to come to market in the coming weeks and months.

Bridging & Development Finance

Development finance has seen no real change in appetite. Funding is available typically up to 60% to 65% loan to GDV. There are still innovative products offering 100% funding (no cash required from the developer) for experienced developers, with profit share of around 60% in favour of the developer. Interest rates have increased, and rates are typically at 8.5% to 10%, plus lenders fees.

Valuations are the main unknown in this market. It is now widely accepted that prices may be 10% lower next year, and we are seeing valuations pricing that in. Any new build sites starting now will be selling in the latter part of 2023, when it is expected we will still be in a recession.

The key to being successful in this market is getting your land price as low as possible. There are deals to be done, and looking at innovative ways to acquire sites will be the key to success. That means doing JV deals with landowners, or agreeing sales on land without planning that are conditional on achieving planning in between exchange and completion.

Bridging lending has increased in the last few months. We are seeing more developers look to take out development exit finance. This type of bridging loan can be secured on partially-complete or completed development sites and allows a developer to borrow up to 80% of the site value. By refinancing a site, you can pay off development finance, release cash for another project and give yourself more time to sale your units. Expect to pay around 8.5% to 10% for bridging finance, depending on the loan-to-value and type of security.

Unregulated bridging loans & property development finance are not regulated by the FCA or by our network Mortgage Intelligence.

Looking Ahead

The market will continue to see innovation as lenders need to lend, it’s what they are in business to do.

We believe that inflation is peaking, the economy is slowing and that people are starting to feel the pinch. We predict that base rate will reach a range of 3.75% (best case) to 4.25%, and that it will remain there for much of 2023.

There are a considerable number of economists predicting that base rate will hit 5.25%, though no one knows for sure as it is all an educated guess. There will likely be macro events that can change all of this in a heartbeat.

We believe that house prices will fall by up to 10%, though a lack of stock will ensure that prices don’t fall off of a cliff. Historically strong areas will see less of a drop, with houses fairing better than flats. We also expect that once the economy starts to show real signs of weakness and unemployment starts to increase, we will see more stimulation from the government to put money back into the markets.

The government have an unenviable task ahead of keeping the economy going whilst not allowing higher inflation to become the norm. We will continue to offer advice on a tailored basis, to be innovative in our approach and to find ways to secure property finance that best meets our clients needs.