At a time when many observers are gloomy about the outlook for commercial real estate, the servicing firm Trimont is vaulting to the top of its industry.

Trimont has a wide-ranging vantage point on the beleaguered sector, having long managed payment collection and other services for nonbank lenders that finance offices, apartment buildings and other CRE properties. The Atlanta-based company will soon have an even better view after striking

The servicing company is "cycle agnostic," Trimont CEO Bill Sexton said in a recent interview, since it doesn't take on the risk that buildings will falter and gets fees for servicing loans in both good times and bad.

Nonetheless, Sexton explained why he is more upbeat about the CRE sector than some others are, though he also acknowledged certain challenges ahead.

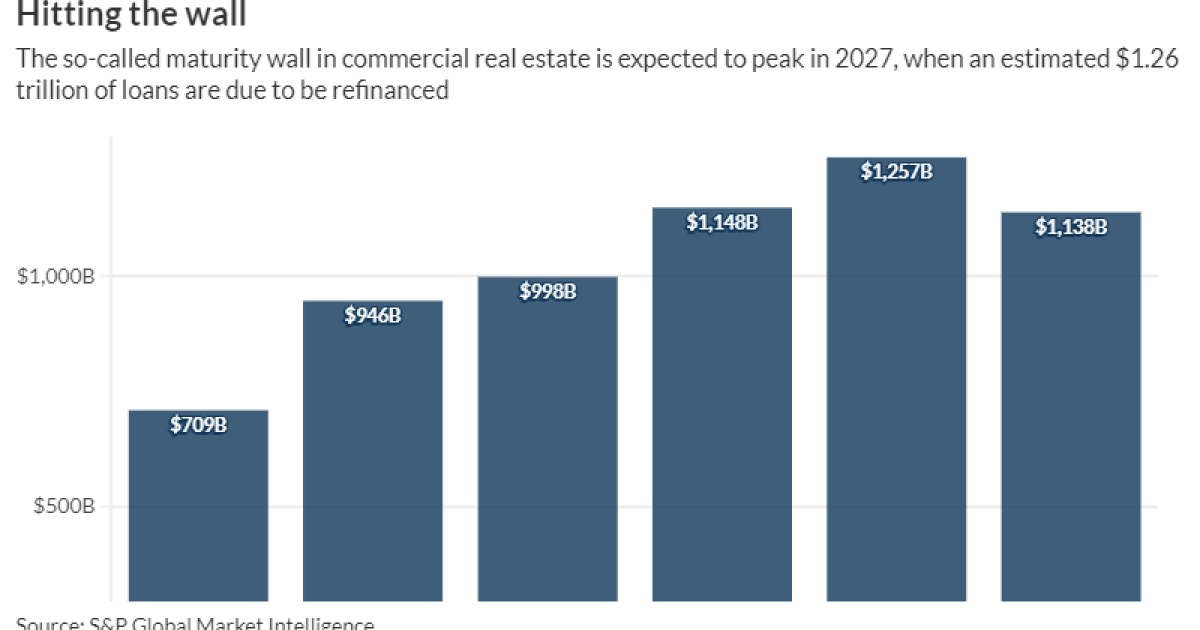

Sexton said that a "daunting" volume of building loans on the books of both banks and nonbanks is due to be refinanced soon and could get pinched by rates that are still higher than they were when the loans were made.

The estimated maturity wall stands at $946 billion this year, $998 billion in 2025, $1.15 trillion in 2026 and $1.26 trillion in 2027, according to a recent analysis by S&P Global Market Intelligence.

"There's clearly a lot of work that needs to be done," Sexton said, noting that a normal market would "find it hard to clear that amount of debt."

Today's market is not normal, at least not yet. Interest rates remain high, even if they're likely to start coming down soon. High inflation over the last few years has hit building owners hard, as maintenance and insurance costs have soared.

The stress is particularly acute in the office market. Less desirable buildings are sitting empty as companies realize they need less office space than they did before COVID.

But not every office building is facing trouble, and the "explosion" of CRE-hungry nonbank lenders since 2008 means there's plenty of money available to reinvent struggling buildings, Sexton said.

"They are very well equipped to back a strategy which is more creative," Sexton said. He mentioned possibilities like making major updates to buildings and even reimagining what kinds of tenants once-thriving offices might be able to attract.

Banks, which in some cases face regulatory scrutiny for large concentrations in CRE lending, may not be the best lenders to help during that period of reimagining, Sexton said. They tend to be "very good at financing stabilized assets," he said, where nonbank lenders have more flexibility to try out new approaches.

The nonbanks' appetite for CRE loans means there's "always somebody out there who's prepared to lend against the sector," Sexton said. Rather than sitting blighted for years, those buildings can benefit from a repurposing so that they can collect rent in the future.

"The real estate industry — and I've been doing this for a very long time — has been very good at adapting to market shifts and repurposing," Sexton said. "We're going through a fairly accelerated version of that right now."

The secular shift from bank lending to nonbank lending is set to accelerate thanks to the much-feared maturity wall. The concern is that some building owners won't find a way out, forcing massive write-downs by banks.

But just because "a loan is due in a year … doesn't mean that the lender and the borrower aren't talking," said Jacques Gordon, a visiting lecturer at MIT's Center for Real Estate and the former global strategist at the CRE-focused LaSalle Investment Management. Those conversations are leading to extensions for some loans and new solutions for others.

"They're keeping the wall from collapsing," Gordon said.

But the idea that the CRE sector will be saved by the vast amount of "dry powder" outside of the banking sector isn't foolproof, he said, pointing to the fact that many previously committed investors pulled their money from the commercial real estate market after the 2008 financial crisis.

Still, there's far more private money now to supplement bank sources "than ever before," Gordon said, providing more cushion in the event that some buildings continue to suffer.

Any additional troubles will mean that more struggling building loans exit the primary servicing arms of Trimont and its competitors, shifting to "special servicing" divisions whose job is to limit investors' losses.

That side of Trimont's business has gotten busier over the last two years, and Sexton said he expects "we'll be busy for the foreseeable future" in working out problems.

But many buildings are doing relatively well, Sexton said.

He expects that as more loans get refinanced, nonbank lenders will likely continue to pick up more clients. There will "always be a place in commercial real estate" for banks, but the shift to nonbanks will provide a further "diversification of the lending market," Sexton said.

And as that happens, Trimont is poised to become the largest servicer in the industry. Buying Wells Fargo's servicing business will give the firm a significant boost. Last year, Trimont had $145 billion in its current primary and master servicing portfolio, according to a Mortgage Bankers Association

Trimont has typically focused on private lending transactions. But under the deal with Wells Fargo, which is expected to be finalized in early 2025, Trimont would gain the megabank's business of managing larger loans that are packaged into securities for investors to buy.

The purchase would give Trimont an 11% market share, the company said. That would be the highest in the industry, surpassing the servicing businesses of the regional banks PNC Financial Services and KeyCorp. It would position the company "very favorably for what we believe is coming in the next phase of this market recapitalization," Sexton said.

Trimont is owned by the investment firm Värde Partners, which bought the servicer in 2015.