One advanced score influential Fannie Mae and Freddie Mac are moving toward produces more elevated numbers than current models for the same loans, according to an preliminary Kroll Bond Rating Agency analysis of

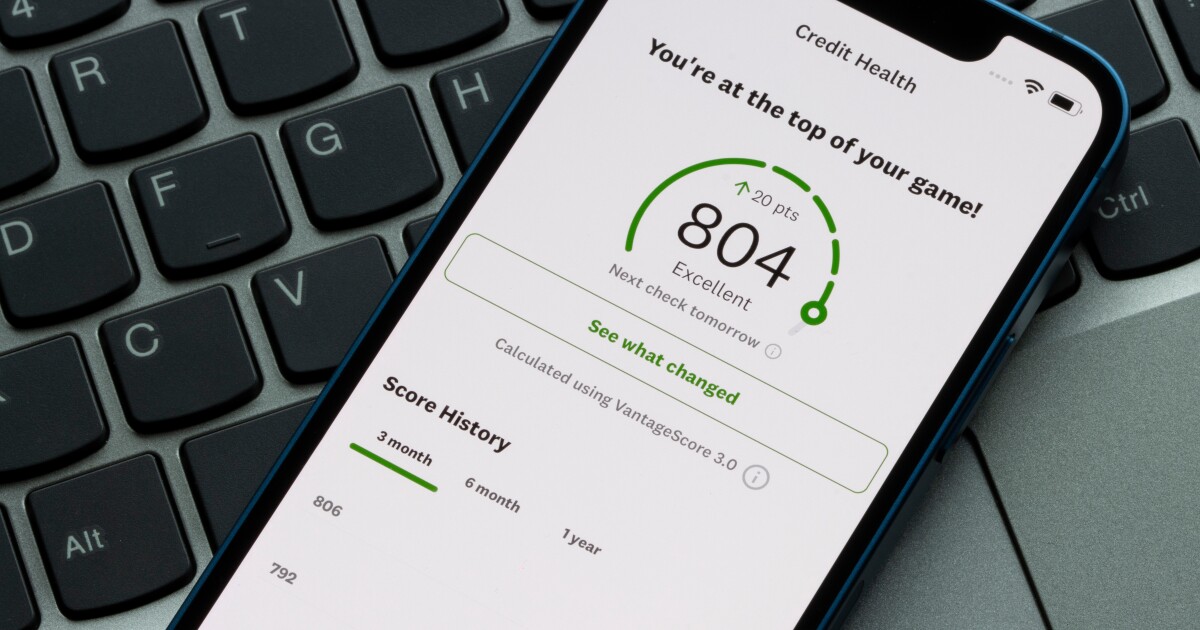

The non-zero weighted average for the 4.0 version of Vantagescore was 769 for loans purchased by government-sponsored enterprises Fannie Mae and Freddie Mac between 2013 and 2021.

The comparable averages using "classic" FICO scores were 753 and 754 for the respective GSEs.

"Across the averages that we looked at, these other calculation methods would yield higher credit scores than the current method," said Jack Kahan, senior managing director and head of global residential mortgage-backed securities at KBRA, in an interview about

Such conclusions, which the report also delves into in more granular ways, could help stakeholders seeking to build a basis for understanding and continuity in the score and credit reporting transition currently set for implementation in the fourth quarter of 2025.

Stakeholders had requested data to analyze because of the responsibility they bear for the Federal Housing Finance Agency's finding that

Kahan emphasized that KBRA was not making a judgment call on whether the findings of the study argued for or against use of the new score and credit report option, but did want to give stakeholders a sense of the objective trends the data sheds light on, which they might use to draw their own conclusion.

In looking at the bi-merge, which could cost less than the current three-report method used in the mortgage industry, the report found there were differences in scores produced under different calculations but they were in the single digits.

To maintain an apples-to-apples comparison, KBRA looked only at Vantagescore 4.0 in comparing current method results to different calculations that might be used in the future.

Among the findings by Kahan, other analysts, quantitative modelers and software engineers involved in the study was that in comparison to the current method, which produced an average score of 765, a future tri-merge average or median bi-merge would be six notches higher at 771. A bi-merge low would on average be 3 notches higher than current at 768. A bi-merge high would be 9 notches higher at 774.

Mortgage companies have been looking at whether the option could make a significant difference in their underwriting or not. FHFA and some analysts have concluded it does not but some credit reporting research finds otherwise.

Lenders want to double check the GSE regulator's assurances on this and other credit reporting and scoring changes because they agree to certain representations and warranties on the mortgages they sell to Fannie and Freddie.

The enterprises look particularly carefully at these pacts if a performance issue surfaces that must be addressed by servicers. Fannie and Freddie may look to force lenders to engage in costly loan buybacks in such circumstances.

Mortgage-backed securities investors, who analyze performance track records, also have been interested in the data. Although Fannie and Freddie guarantee their MBS, there are other aspects of the bonds' performance that modernized scores could impact. The GSEs also share credit risk with other parties.

The study found the share of Fannie loans that were ever nonperforming assets during the period studied was 3.36%. (Some of those loans reperformed.) At Freddie, the ever-nonperforming loan share was 3.31%. As previously stated, the average Vantagescore was higher for these loans than Classic FICO.

KBRA is planning further study of how the advanced and traditional scores correlate with performance, with Kahan emphasizing that they're "one component" in the broader underwriting equation.

The current report also highlights the scores' complexities, such as the fact that the "classic FICO" measure that's historically been in use doesn't just represent a single metric but multiple ones. It points to nuances that exist in details like how different scores treat medical debt and tax liens or credit utilization.

More modernized scores, which have been more frequently used in other contexts, can broaden underwriting by doing things like looking at rent in addition to the debt payment histories classic FICOs consider.

(Rent already can be an additional consideration in underwriting, but incorporating it into scores could increase its weighting in decisions.)

The FHFA and enterprises have only released data from one of the two scores they're transitioning to so far, but say they will subsequently provide information from the other. FICO produces the second modernized metric in the transition, which is its 10 T score.

Classic FICO, 10 T and Vantagescore 4.0 all have the same score range of 300-850.

One example of differences in scores highlighted in the report are minimum requirements to establish one.

Both FICO scores require one account open for more than six months and one reporting to a national credit reporting agency in the last six months. Vantagescore requires a single account with no minimum seasoning.

The election is creating some uncertainty about score modernization's future direction although there is some speculation that its legislative mandate could give it some staying power in either administration.

The context for score modernization could be somewhat different if a second Trump administration made a renewed push to release the GSEs from conservatorship in the manner seen in the former president's first term.

The private mortgage market has dabbled in the use of FICO's advanced scores but often has had to deliver classic metrics along with them if the loans are sold. Some components of the Federal Home Loan Bank system have begun working with Vantagescore.

Other consumer finance sectors have engaged in more frequent use of modernized credit measures.