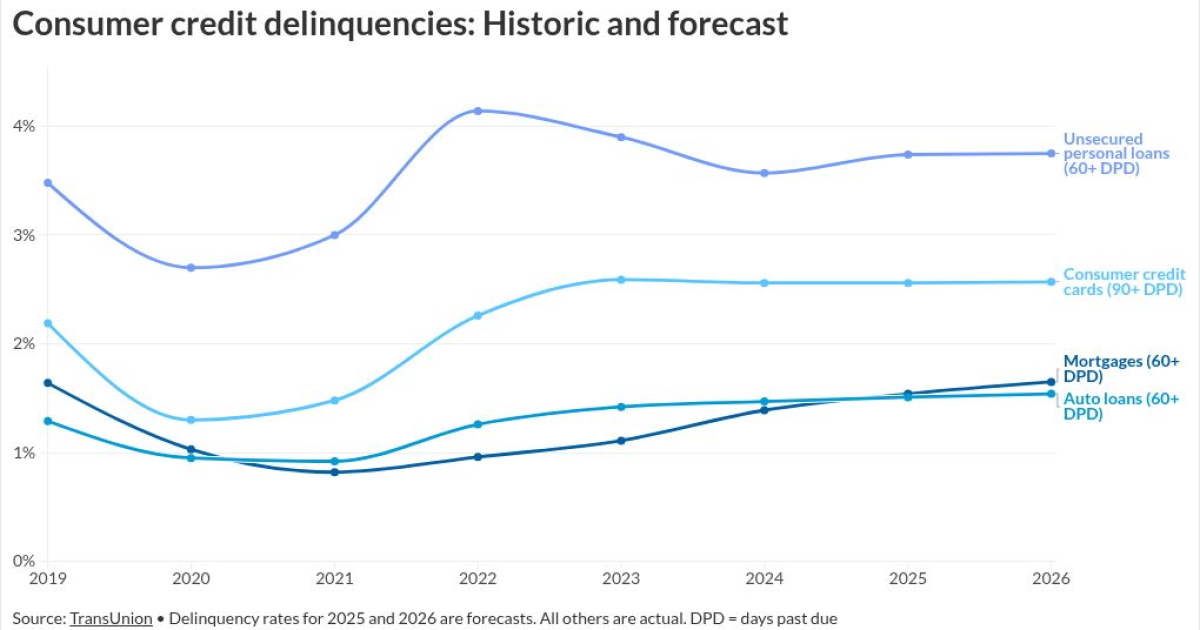

Consumer credit is broadly stable but historically low mortgage delinquencies could drift upward in the coming year, according to Transunion's latest forecast.

The average mortgage delinquency rate that ended 2024 at 1.39% and is on track to reach 1.54% by the end of this year may be 1.65% by the time 2026 is over. Other consumer credit types could experience smaller gains from one to three basis points next year.

"As far as mortgage specifically goes, that's the one area that we're seeing some increase in the delinquencies, but it's still going to be fairly low," said Michele Raneri, vice president and head of U.S. research and consulting, in an interview with National Mortgage News.

The forecast rise in mortgage delinquencies stems from various credit trends the industry should be aware of, including performance challenges in low downpayment, first-time homebuyer loans that could be exacerbated by inflation and

A possible pandemic impact on relative performance

Where mortgages are in post-pandemic cycle also plays a role in why their forecast delinquency rates are on track to inch up more than other forms of consumer credit and

"I think that the thing about mortgage is that it's still low compared to what it was before the pandemic," Raneri said, noting that auto loans' relative rate of normalization compared to that period has differed.

Normalization after the removal of the unusual income stimulus that households received for various loan types during the pandemic has occurred at different rates because there was a variety of responses to it, a recent report from authors at Ghent University and the University of Virginia shows.

"Positive income shocks are, on average, associated with deleveraging. This average, however, masks a sharp bifurcation in financial behavior," authors Nikolaos Koutounidis, Elena Loutskina and Daniel Murphy wrote.

The report on"The Heterogeneous Reactions of Household Debt to Income Shocks" shows that different types of consumers applied auto loan and mortgage leverage in disparate ways in response to the receipt of stimulus.

While financially stable borrowers tended to deleverage, households with affordability constraints tended to take on auto credit while removing card and mortgage debts. Those who had mixed financial profiles, such as high incomes but also lower credit scores, added mortgage leverage.

Current readings on consumer leverage

The one type of consumer leverage tracked in Transunion's forecast, credit cards, shows there is a trend toward slower growth, with balances rising from $1.05 trillion in 2024, to 2025's $1.15 trillion and then $1.18 trillion next year.

The forecast rise in 2023 is the smallest increase since 2013 when the aberrant pandemic period is excluded. The trend likely reflects a mix of consumer moderation in taking on debt but could also represent more lender caution about their ability to repay.

The increase in card debt, as slow as it is, means mortgage lenders could keep seeing more borrowers apply with elevated debt-to-income ratios but the pace at which the rate indicator is rising could be more gradual.

In line with a recent Mortgage Bankers Association report that shows credit has loosened to its highest level since 2022, there does not appear to be a pullback in home lending in response to any of the incremental stress in on loan performance.

However, Raneri said that there are ways that consumer credit lenders in general have been responding to incremental stress in the market without cutting borrowers off.

"They have a lot of levers," she said, noting that these could include higher interest rates or lower limits.

How student and auto loans are adding to mortgage stress

Signals that repayment requirements and other terms for

"We have seen that consumers who have a student loan that is in default have a higher delinquency rate across the board for all products," Raneri said, noting that it could also change the order of borrowers' priorities for repayment.

Also, as the prices for cars as well as homes has gotten higher, it has compounded the strain for borrowers working to pay both their auto loan and mortgage.

"Affordability for automobiles has been on the more difficult side for consumers," Raneri said.